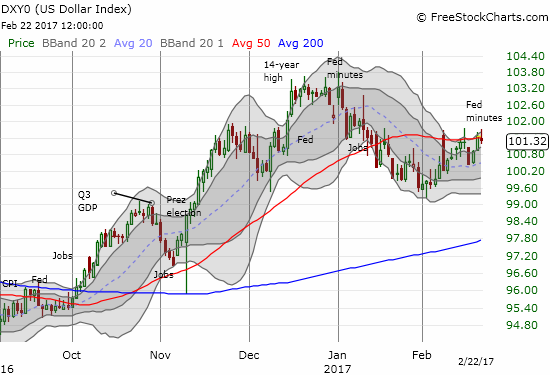

Perhaps the shift was not large enough. Perhaps it was the magnetism of the 50-day moving average (DMA).

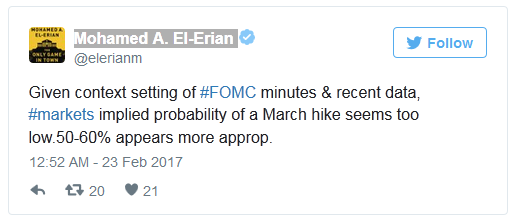

After the Federal Reserve released the minutes from its last meeting on monetary policy, the U.S. dollar index (DXY0) promptly weakened. The dollar closed the day marginally lower yesterday after trading for a small gain in the morning. Yet, the odds for the timing of the next rate hike shifted from June to May.

The U.S. dollar index (DXY0) has closed just once above its 50DMA since January 13th. The dollar has churned just below this critical resistance for the past two weeks. The Fed minutes did nothing to resolve the stalemate.

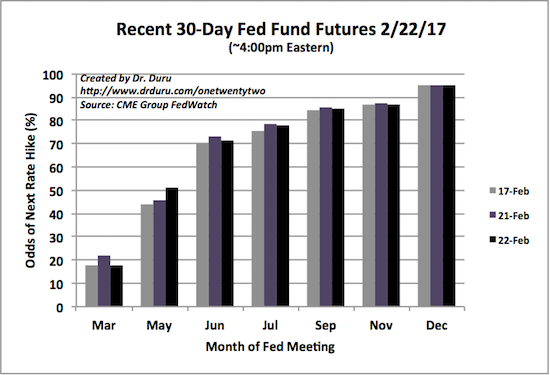

The odds of for a Fed rate hike in May shifted from 45.9% to 51.1%. The odds for the next rate hike to occur in June have recently hovered around 70%.

The odds for a rate hike in May increased from 45.9% to 51.1%. A reading above 50% means more likely than not. In this case, the chance for the timing of a rate hike are just slightly in favor of May. The move is relatively small, but, in my mind, the crossing of the threshold looms large.

All else being equal, the shift should have given the U.S. dollar a boost. The currency market clearly does not (yet?) agree with me. I will be watching closely going forward for new developments in the correlation between the 30-day Fed fund futures.

The euro (via Guggenheim CurrencyShares Euro ETF (NYSE:FXE)) may be the most important driver of the dollar index’s next move; the euro is about 52% on the U.S. dollar index. EUR/USD has trended down since its last peak in early February. On Monday, the euro broke down below 50DMA support for the second time in a week.

The euro bounced nearly perfectly off round number support at 1.05 as part of the dollar’s weakening into the close. Perhaps traders cared more about playing with this 1.05 level than anything else.

The euro’s double breakdown below 50DMA support puts the low from January into play. Will the downtrend carry enough momentum to push the issue in a straight line?

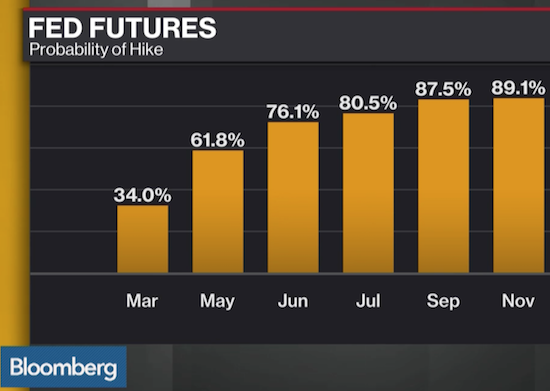

Note: Bloomberg has been reporting very different odds from the CME FedWatch tool. I have yet to get a response from Bloomberg explaining what’s going on.

I am calculating different odds than Bloomberg but at least they expect the next hike in May as I now do.

Full disclosure: short EUR/USD