For the newbies, that means it’s time to embrace the adage that “a picture is worth a thousand words.”

I select a handful of graphics to put important economic and investing news into perspective for you.

And this week, I’ve got a singular focus: Washington, D.C.

Enjoy!

Curb Our Spending? NEVER!

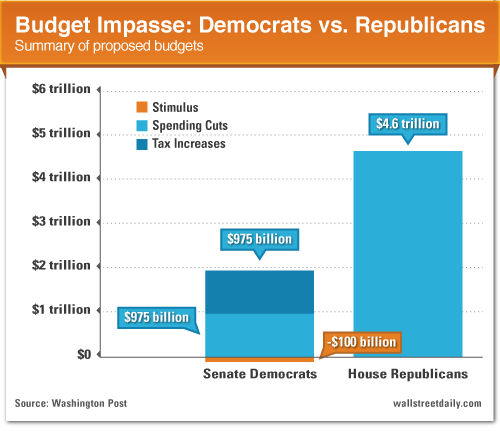

For the first time in four years, Senate Democrats released a budget resolution.

I get why they didn’t really rush. I mean, who needs a budget when you don’t have a spending problem?

Oh yeah. We do have a (huge) spending problem.

Don’t we have a massive debt problem, too?

I can’t remember, because a certain someone (residing at 1600 Pennsylvania Avenue) recently said, “[We] don’t have an immediate crisis in terms of debt. In fact, for the next 10 years, it’s gonna be in a sustainable place.”

No spending problem. No debt problem. Well, then it should come as no surprise that this historic budget resolution increases spending by about 60% over the next decade.

The end result? Get ready for a fiery and drawn-out debate. I say that because the competing budget proposals from Republicans and Democrats are miles apart on how they should address our fiscal problems.

As they duke it out, let’s just hope the market largely ignores them again – much like it did during the Fiscal Cliff debate.

Move Washington, Get Out the Way

I know it might be taboo to talk politics and finance. But at this moment in history, Wall Street and K Street intersect too much to ignore.

And here’s the key message that politicians need to get: The market just wants them to move and (as Ludacris eloquently raps) “get out the way.”

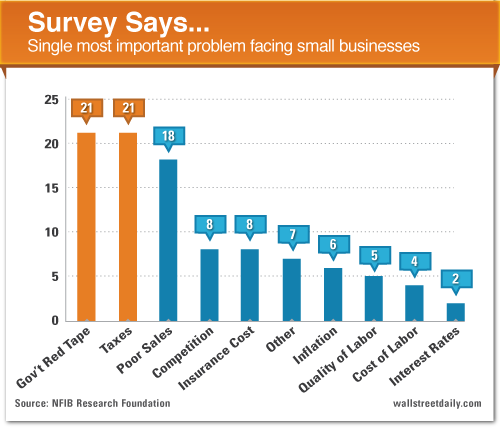

Case in point: The NFIB Small Business Optimism Index for March revealed that the biggest concern facing small businesses is still Washington!

Readings for government regulations and taxes checked in at 21, the same level they rested at one year ago.

Bespoke Investment Group puts the data into perspective best: “For every small business owner who cites poor sales as the number one problem with their business, there are more than two small business owners who cite issues related to Washington as their number one problem.”

And Bespoke adds that “one can only imagine how much better off the U.S. economy would be if politicians just got out of the way.”

Amen! Forget imagining it, though. Here’s hoping that we actually get to witness it happen.

That’s it for this week.

I’m sure I ruffled someone’s feathers, today. So speak up and let me know how despicable I am for daring to mix politics and finance.

In all seriousness, we cherish your feedback and want to know what you think of this weekly column – or any of our recent work at Wall Street Daily.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Two Scariest Government Charts

Published 03/15/2013, 02:37 AM

Updated 05/14/2017, 06:45 AM

The Two Scariest Government Charts

It’s Friday in the Wall Street Daily Nation!

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.