, I encouraged you to embrace the possibility that the U.S. economy might actually be gaining momentum.

I know. It’s not exactly a popular stance.

But lo and behold, in the short time that’s passed since then, even more evidence emerged in support of such a contrarian viewpoint.

Let me share it with you – and explain why it matters.

Then, I’m singling out the two earnings reports to focus on this week. Each promises to provide critical intelligence regarding how much of a positive surprise we can expect for U.S. GDP growth in 2013.

Without further ado…

Out With the Old

I previously predicted that the economy is overdue for a boost, as consumers and businesses begin replacing old “stuff” like cars, appliances, heavy equipment and furniture.

Guess what? The latest data suggests that the replacement cycle is upon us!

On Monday, the Commerce Department reported that durable goods orders increased 4.6%. Once again, economists’ forecasts look sillier than weathermen’s. (The median forecast of 76 economists surveyed by Bloomberg called for a mere 2% increase.)

Lest you think the monthly uptick is an anomaly, the increase capped the first four-month gain in durable goods since 1992. So it’s legit.

Or as Barclays PLC (BCS) economist, Peter Newland, told Bloomberg, demand is “back on track.” I’d say so.

And the more it picks up, the more likely that U.S. GDP is going to come in higher than expected. (Remember, economists only expect 2% growth this year.)

No Lack of Earnings Surprises, Either

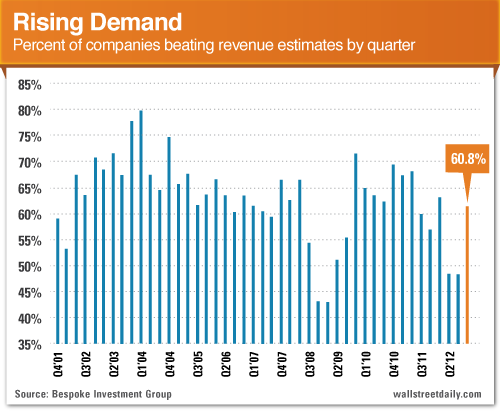

As you know, the earnings reporting season is in full swing. And the latest stats confirm that an uptick in demand is materializing across multiple sectors, not just durable goods.

Case in point: The earnings “beat rate” (the percentage of companies topping analysts’ earnings estimates) increased from 59% to 63.9% in the last week.

Even better, the revenue “beat rate” (the percentage of companies topping analysts’ sales estimates) now rests at 60.8%.

That’s a country mile higher than last quarter’s revenue beat rate of 48.2%, and the surest sign that demand is picking up across the board.

Keep An Eye on Pickups and Tablets

If the trend of better-than-expected reports continues, I bet you dollars to donuts that economists will be revising their GDP growth forecasts to the upside.

The two companies I’ll be watching closely this week are Ford (F), which reports before the opening bell today, and Amazon (AMZN), which reports after the bell today.

As I told you last week, small business owners account for the majority of pickup truck purchases. And small businesses are an undeniable driver of U.S. economic growth. So any further signs of strength from Ford bode well for the economy.

Meanwhile, Amazon’s status as the King of Online Retail makes its results a strong proxy for consumer spending habits, which is another key driver of economic growth.

Bottom line: Analysts and economists remain too downbeat on the economy. That’s no longer just a contrarian hunch. The latest data proves it, as more and more reports keep coming in well ahead of expectations.

I recommend tracking the situation in the coming weeks. Why? Because stronger GDP growth only increases the prospects for stock prices.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Two Most Critical Earnings Reports This Week

Published 01/29/2013, 06:51 AM

Updated 05/14/2017, 06:45 AM

The Two Most Critical Earnings Reports This Week

Last week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.