Twitter (NYSE: TWTR) has become part of the fabric of human society.

Its 300 million users have made it one of the most important media channels in the world. Whether you’re interested in memes or Middle Eastern conflicts, Twitter has the latest updates.

That’s why rumors of a Twitter buyout have caused such a stir in the tech and financial industries. It turns out that under the hood, the company has hit a plateau in ad revenue. Now the top brass is looking to sell.

A number of suitors have launched short-lived bids for the company, including Alphabet (NASDAQ:GOOGL), Disney (NYSE:DIS), Microsoft (Nasdaq: NASDAQ:MSFT) and Salesforce (NYSE:CRM). However, none of these proposals have come to fruition.

But this article isn’t about how to profit from a Twitter buyout. The latest news is already priced into Twitter stock. And its effects on the price of a massive buyer like Alphabet would be negligible. Instead, we’re looking for the next Twitter...

There’s a new generation of social media platforms. And they’re rapidly gaining on hegemons like Twitter and Facebook.

Right now, these companies are too young or too small to have their own ticker symbols. But that shouldn’t stop you from knowing the ins and outs of these new social media moguls.

Snapchat

There’s been a lot of hubbub about the social media habits of “post-millennial” teenagers. In particular, their distaste for Facebook has confounded analysts. This screen-addicted young generation isn’t “Liking” statuses and updating profile pictures.

So what are they doing?

They’re “snapping.” That’s the verb form of Snapchat. It’s a social network for sharing short-lived photos, videos, notes and illustrations. (Snapchat posts, or “snaps,” are automatically deleted after a single viewing or a set amount of time.)

The app was launched by a group of Stanford undergrads. It spread like wildfire among high school and college students. Snapchat now has 16.5 million daily users, and it’s valued at $20 billion.

Unfortunately, Snapchat is privately held at the moment. But there are plenty of rumors of an IPO coming as soon as 2017. CEO Evan Spiegel has confirmed the company’s plans for an IPO, though he remains vague about the timeframe.

The recent hire of investment banker Imran Khan, architect of the Alibaba IPO, implies that it’s not far off.

This high-quality picture and video-sharing sharing service has seen explosive growth across many demographics. It has become the new standard for social media photography. And it’s outperforming rivals like Flickr and Imgur by a massive margin.

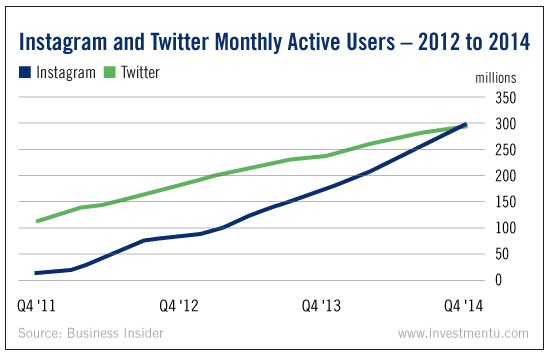

In fact, Instagram overtook Twitter in active monthly users at the end of 2014.

The photo-sharing service is owned by Facebook, so you can’t invest directly in it. But here’s the thing - Instagram is growing considerably faster than Facebook itself. Soon, Facebook may be more than a social network. It is morphing into a holding company for social networks.

Instagram’s user base is likely to eclipse Facebook’s flagship product in the future. So by buying Facebook shares, you’re indirectly investing in Instagram’s bright future.

This one is a bit unusual compared to other social networks. It’s a bit less... social. Pinterest is a service that allows users to curate online bulletin boards for themselves. Users “pin” articles, pictures and other media for later retrieval.

It’s a bit quieter and more individualistic than the other social networks described in this article. But like Instagram and Snapchat, it has achieved staggering growth. Pinterest currently has more than 100 million monthly active pinners. And it’s valued at $11 billion.

Another distinctive feature of Pinterest is its demographics. Almost three-quarters of pinners are female. This gives Pinterest a slight advantage over more broad-based networks in selling targeted ads.

And recently, Pinterest’s leadership has been pushing for more monetization through ad sales. Many commentators have speculated that this is a signal that the private startup is about to go public.

If the Twitter buyout ever goes through, it would mark a turning point in the history of social media. The first generation of social titans is starting to age. Kids don’t think Facebook is cool anymore, and Twitter is struggling to pay its bills.

It won’t be long before a new generation of social media moguls rises up to dethrone them. And as an investor, you’ll want to be ready to buy in when the time comes.