Retail investors are pressing for stricter derivatives regulation in the financial services industry. Yet many of the same investors engage in derivatives trades that would make even an institutional structured products specialist uncomfortable.

Here is a good example - a product known by its ticker symbol as TVIX. It's issued by VelocityShares and is actually an exchange traded note traded on NYSE Arca. TVIX targets to replicate 2x the VIX futures performance (it's a leveraged note on futures contracts on options implied volatility - a "double" derivative). Here is the description:

VelocityShares Daily 2x VIX Short Term ETN is an exchange-traded note issued in the USA. The Note will provide investors with a cash payment at the scheduled maturity or early redemption based on 2X the performance of the underlying index, the SP 500 VIX Short-Term Futures Index less the Investor Fee.

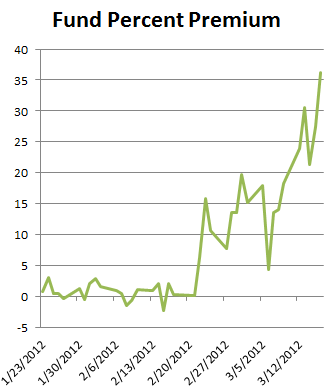

As VIX came crashing down this year, people thought it may be a good idea to be short vol. It wasn't enough just being short though - they wanted to be 2x short US equity implied vol via TVIX. As more people kept piling in, it became what's known as a "crowded trade". Some people were short the ETN and long the VIX futures against it, trying to arb out the discrepancies between TVIX price and NAV. But before the weekend, someone decided to cover their short. And that's when the ETN began to rally, while VIX futures went lower. This continued into today.

In the last 5 days the VIX futures are down about 3%. According to the description above, TVIX should be down 2x or 6%. Yet TVIX is up over 7%.

The short squeeze has pushed the price up so much that TVIX now trades at over 36% above its net asset value.

It is now nearly impossible to short TVIX since there are none to borrow - thus limited ability to arbitrage out the dislocation. By lunch time yesterday TVIX was up over 1% for the day, while VIX futures were down 5%. So the next time you feel like shorting some vol, try using futures directly, or stick with SPY options. This is not for the faint-hearted and the fact that it is exchange traded (vs. OTC) doesn't make it a whole lot "safer".

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The TVIX Short Squeeze

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.