Not only is gold rising in price into the Indian seasonal buying, but it is happening just as world emerging markets are getting hammered. A double whammy of sorts. And things were so promising just four months ago. Is it time to worry? Will it continue? Take a look.

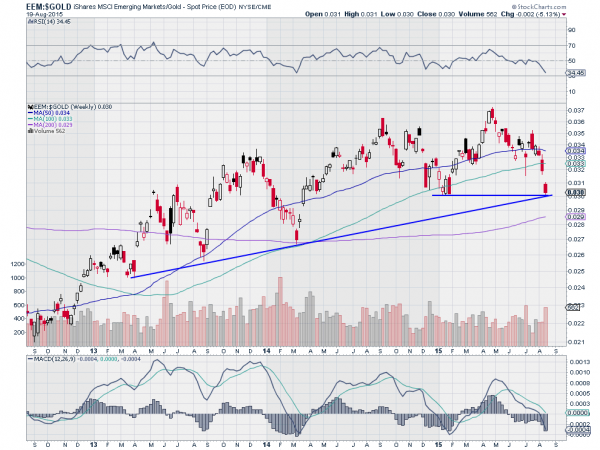

The chart below shows the price of the iShares MSCI Emerging Markets ETF (NYSE:EEM) measured against gold prices on a weekly basis. Notice that is shows a solid uptrend since early 2013. A progression of four higher highs and higher lows moved forward until the peak in April.

But since then, the ratio has been moving lower. Into the end of this week it is at a critical level from two perspectives. The first is that it is at support at the January low. The second is that it is also at the rising trend support.

The first puts the uptrend in jeopardy, but the second will confirm a breakdown should it fail too. With the RSI falling and in the bearish zone and the MACD falling the outlook does not look good for those in emerging markets looking to buy gold anytime soon.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.