When I last wrote about the Turkish lira in mid-January, USD/TRY had pulled back sharply off a parabolic run-up. The iShares MSCI Turkey (NYSE:TUR) was also at the beginning of a dramatic bottoming pattern that was later confirmed with a close above its 50-day moving average (DMA).

The iShares MSCI Turkey (TUR) carved out a bottom in January but recently got rejected by downward trending resistance at its 200DMA.

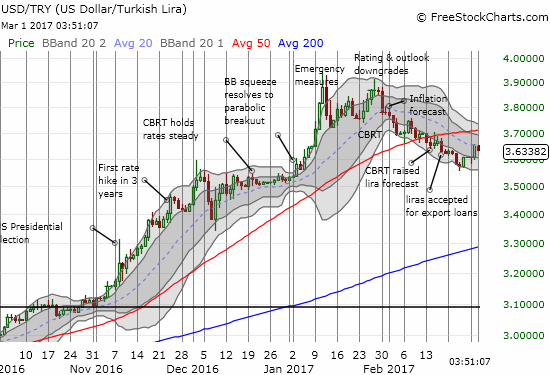

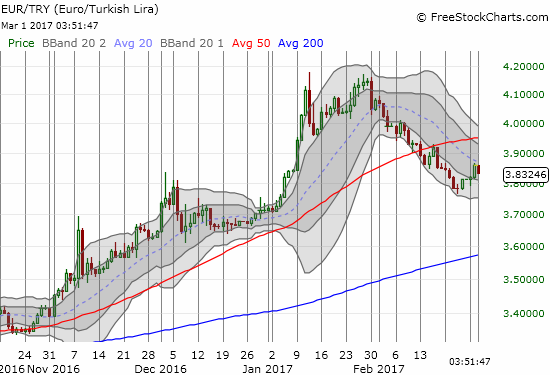

When the Central Bank of the Republic of Turkey (CBRT) rolled out its next round on monetary policy, the Turkish lira weakened sharply. It looked like the start of the next leg of major weakness. However, the momentum came to an immediate end just under the previous high for USD/TRY. From there, the Turkish lira rallied quite consistently…until Tuesday (February 28th). On that day, USD/TRY and EUR/TRY broke out from their respective downward trending channels defined by the lower-Bollinger Bands (BBs). This move potentially signals the next turn of events and an end to the counter-trend rally in the Turkish lira.

The Turkish lira’s comeback rode a fortuitous mix of catalysts following initial disappoint with the CBRT’s last announcement on monetary policy.

After the CBRT hiked rates on January 24th, the lira did not respond as expected. Instead of strengthening, it immediately sold off. The CBRT Bank increased its overnight lending rate by 75 basis points to 9.25%, moved its “late liquidity rate” upward to 11% from 10%, but left its main one-week repo interest rate unchanged at 8%. At the time, this combination did not appear sufficient to traders who reportedly wanted more. From Reuters:

“‘It’s not enough,’ said Jakob Christensen, head of emerging markets research at Danske Bank in Copenhagen.

‘This is a weak, half-hearted response. The central bank is clearly not independent enough to do what it takes. It is trying to do some back door tightening with the late liquidity window but we would have liked to have seen more on all the rates.’…

‘This was a grudging hike – more of the same, with smoke and mirrors from the CBRT (central bank),’ Timothy Ash of BlueBay Asset Management said in an emailed note.

‘By keeping its base/borrowing rates unchanged, the CBRT will be able to sell a message to its political masters and its more orthodox constituency that rates are not actually going higher…

But the nagging concern from I think most economists/market participants is that the CBRT is not really willing to do whatever it takes to stabilise the lira or indeed rein in inflation.'”

The pressure was high given expectations for decisive moves from the CBRT. From Reuters ahead of the monetary policy decision:

“Fifteen out of 18 economists polled by Reuters expect the central bank to increase its benchmark repo rate, with nine of them forecasting an increase of 50 basis points. But it may take a lot more to put a floor under the lira – UBS said recently that increases of 200 basis points may be needed to anchor the currency in the next month or two.”

The fresh weakness in the Turkish lira came to a sudden end. The markets seemed to squeeze some optimism out of stringing a few events together. The lira strength (USD/TRY weakness) took another eight trading days to begin in earnest after the CBRT’s monetary policy decision.

First, there was the contrarian impact of rating agencies downgrading Turkey. On January 27th, Standard & Poor’s (S&P) reduced Turkey’s outlook from stable to negative. Shortly after that, Fitch joined the rest of its peers in downgrading Turkey’s sovereign bond status to junk. Perhaps traders anticipated these actions would eventually force the CBRT to get serious about hiking rates. The Turkish lira reached its weakest point that same day (see chart of USD/TRY above).

After the ratings cuts, the CBRT increased its year-end inflation forecast from 6.5% to 8.0%. Theoretically, this hike in inflation expectations should translate into higher interest rates along the way: “If no permanent and serious improvements are seen regarding inflation expectations in the foreseeable future, it seems tightening will continue” (central bank Governor Murat Cetinkaya). USD/TRY fell and confirmed the previous day’s 50DMA breakdown. The next follow-through downward occurred after the CBRT announced that it would accept Turkish liras at a higher exchange rate to pay for export loans.

Now, the momentum downward is waning. USD/TRY is back to the same level it traded with the update of the inflation forecast. The pair sits right on the downward trending 20DMA (blue dashed line). Assuming that downtrend fails to contain USD/TRY, I anticipate a test of 50DMA as resistance will eventually yield to a new breakout above the 50DMA. As a result of my expectations, I have become more focused on building a long in USD/TRY and accumulating a very small and temporary hedge in short EUR/TRY.

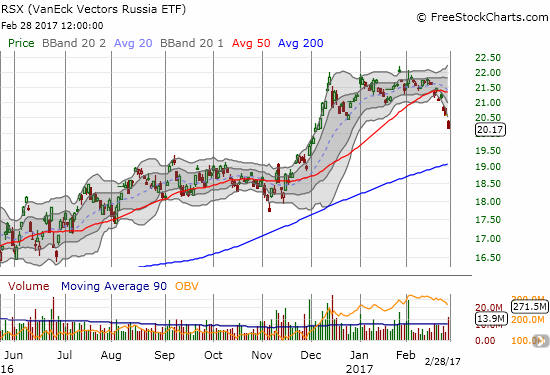

The Turkish lira’s comeback has apparently slammed into a bout of weakness in emerging markets. The past three days of weakness in the lira and in TUR coincide with three days of weakness in the iShares MSCI Emerging Markets (NYSE:EEM) that have taken EEM off a 21-month high. The breakdown in the VanEck Vectors Russia ETF (NYSE:RSX) displays this weakness in particularly bearish form.

If investors and traders are suddenly pulling away from emerging and more speculative markets, USD/TRY could not only rally further but even accelerate into higher levels. I have also gone long the Direxion Daily Russia Bear 3X ETF (NYSE:RUSS) as a play on the bearish turn of events for RSX.

Be careful out there!

Full disclosure: long USD/TRY, short EUR/TRY, long RUSS