The Turkish lira is weakening again against the dollar again over 3.76, after last week it has already touched 3.88.

Today there was some majors announced: Turkish Central Bank takes a step to provide liquidity, The Central Bank on Monday lowered the upper limit for forex maintenance facility, a move that will provide approximately $1.4 billion in liquidity to Turkey’s financial system.

In a statement, the bank said the upper limit for the forex maintenance facility had been lowered to 55 percent from 60 percent and 5 points reduced all tranches.

It aims to support the country’s foreign exchange reserve management of the banking system and limit adverse effects of excess capital flow volatility on Turkey’s macroeconomic and financial stability

Also, there are rumors about the VISA issue with the US :

Turkey’s lira led gains among emerging-market currencies after Reuters reported the U.S. resumed visa processing for the country on a limited basis.

Lira Gains 1.4% To 3.8341 Per Dollar On Friday’s 2.3% Slump

“Given that the diplomatic spat between Turkey and the U.S. contributed to the lira’s selloff, any signals that would indicate that relationship may gradually normalize will provide the lira with respite,” says Piotr Matys, a currency strategist at Rabobank in London

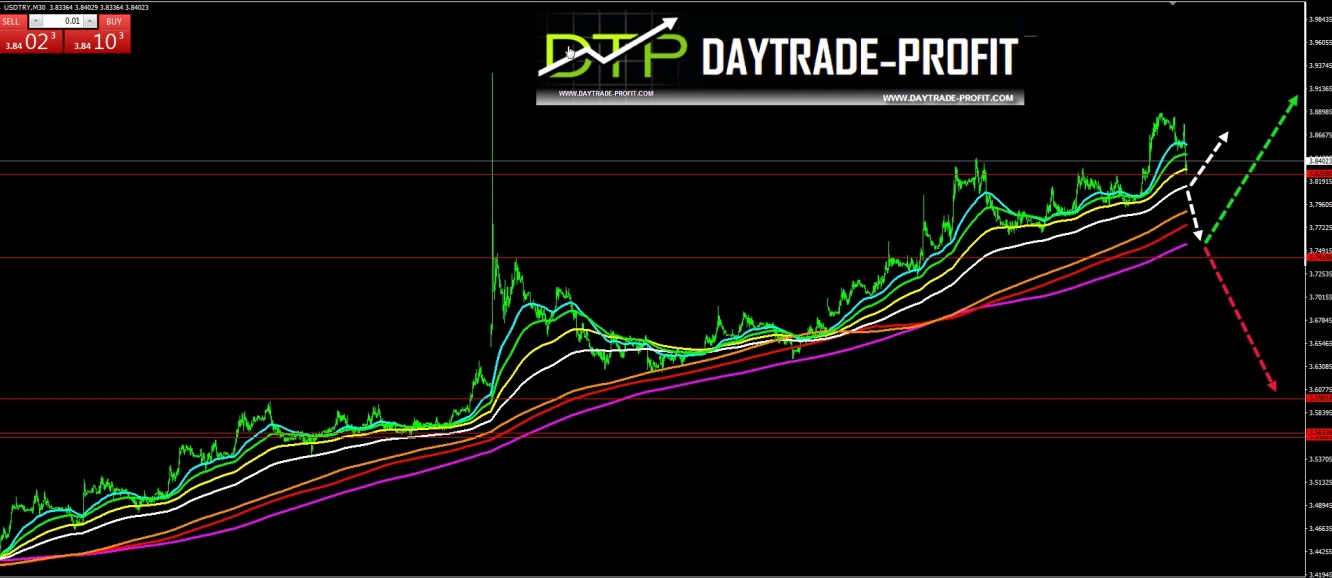

Technical Analysis

Pay attention to the 3.75-6 price level as if the lira closes below this level it will send the Turkish lira to the with 3.56-9+ price area or even to the 3.34-3.36 price level.

While staying above those levels could send the USD to try to 3.82-3 price levels, the long-term trend forecast is still up as long as 3.34 holds.

Break below 3.34-6 on weekly basis will send the Turkish to 3.24-6.

Technical Scenario

Turkish lira going to test 3.51 area

Technical Scenario

The first one: going up till 3.56 + price area and from there going back down to test again 3.41-3 price area

The second scenario is break up 3.56 price area in daily basis closed and going all the way to 3.74 price area and even to new record above 4 to 4.20 price area

The last one is the inability to hold above 3.41 and a new negative price level of 3.26, if not less.

My scenario as you probably know is still in place and we expect a new record for areas of 4.12 +, as long as the 3.39-3.41 level holds.