When I was in high school, the only publication dedicated to covering the marijuana industry was High Times. Or the liner notes of a Cypress Hill album.

Pot smokers were “dopes” and outcasts.

But times have changed.

Roughly 60% of Americans believe weed should be legalized. And pot smokers are seen as entrepreneurs and industry leaders.

Now almost every single news and financial outlet covers the marijuana industry with vigor. And the reason is clear.

The industry is expected to grow more than 733% over the next decade.

So any stock remotely associated with cannabis and legalization is soaring. The number of OTC cannabis stocks continues to grow.

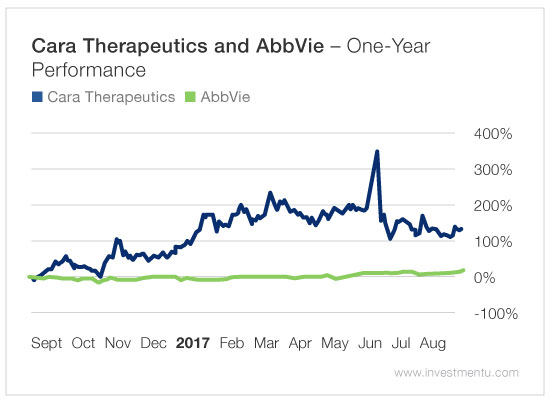

And in the past year, biotechs with a cannabis connection outperformed the markets. Some, like Cara Therapeutics (NASDAQ:CARA), are up more than 134% in the past year alone.

The end of the eight-decade-long cannabis prohibition is triggering some exciting investments. Even better, there are medicinal and recreational markets. And that gives investors two flavors to pursue and profit from.

Growing Green Movement

We must look at marijuana as an agricultural product or soft commodity.

In 2016, legal marijuana sales in Colorado crossed the $1 billion threshold. That’s a major milestone for a state on the leading edge of the legalization movement.

In turn, Colorado brought in close to $200 million in taxes, licenses and fees related to marijuana sales in 2016.

That’s not too shabby.

But let’s be honest... Colorado is small potatoes.

Colorado is one of the fastest-growing states in the country. But its population is a mere 5.5 million. That doesn’t put it in the top 20.

The real money is in California.

Los Angeles is the U.S.’s largest legal marijuana market. Not only is Los Angeles County more populous than 42 states, but its medicinal marijuana industry has already surpassed $1 billion. And that’s been running since 1996.

But in November, California gave recreational marijuana use the green light. And it was just one of several states to do so.

In fact, four states legalized recreational use in November, bringing the total to eight states and the District of Columbia. And this year, 11 more states are considering bills, including decriminalization measures in Texas and New York.

Those — and Florida, too — are the major markets to keep an eye on.

Last year, the legal U.S. marijuana market was worth roughly $6 billion.

But recreational approval in California alone will triple the market.

California is the most important state in terms of product consumption because of its size. More than 12% of the entire U.S. population lives there.

And this is one of the big reasons that by 2021, the legal U.S. pot industry is expected to be worth $20.2 billion. From there, it’s expected to more than double to $50 billion by 2026. So momentum rapidly escalates.

From Recreational To Industrial

Right now, 1 in 5 Americans lives in a state where weed is legal.

And as the pot industry grows 733% in the next 10 years, we’ll see a shift from small operations to large-scale ones.

For investors with lower risk tolerances who don’t want to miss out, that’s good news.

Your options aren’t just OTC or penny stocks.

For example, Scotts Miracle-Gro (NYSE:SMG) is popular with cannabis investors. And it’s done well.

Sales increased 27% in the first quarter.

And over the past year and a half, shares of Scotts are up more than 40%.

As marijuana goes mainstream, expect agricultural machinery companies like AGCO (NYSE:AGCO) to benefit. And expect a renewed boon for irrigation equipment companies like Valmont Industries (NYSE:VMI) and Lindsay Corporation (NYSE:LNN).

Valmont has the added benefit of being an infrastructure, as well as an energy and mining, play. So a renewed focus on infrastructure and a large-scale pot revolution could be a windfall for it.

Plus, investors can’t ignore tobacco companies.

The rise of e-cigarettes and vaping is buoying cigarette manufacturers. Now combine that with legal weed. That’s a potential gold mine.

Over the next 20 years, projections are that Big Tobacco will control one-fifth of the cannabis industry, with marijuana sales adding more than 20% to its revenue.

The pot industry provides plenty of opportunities for investors. But not all of them have to be high-risk penny stocks. There are plenty of solid, low-risk plays out there.

Good investing,

Matthew