Investing.com’s stocks of the week

The most surprising change the New Year brought with it in the financial markets is the dollar weakness. Normally, a change in the currency’s direction is relative to a country’s monetary policy. Even the rising treasury yields) currently underway should be supportive of the dollar. But in this instance, the projections of higher interest rates are being offset by the government’s changing attitude towards free trade and the dollar.

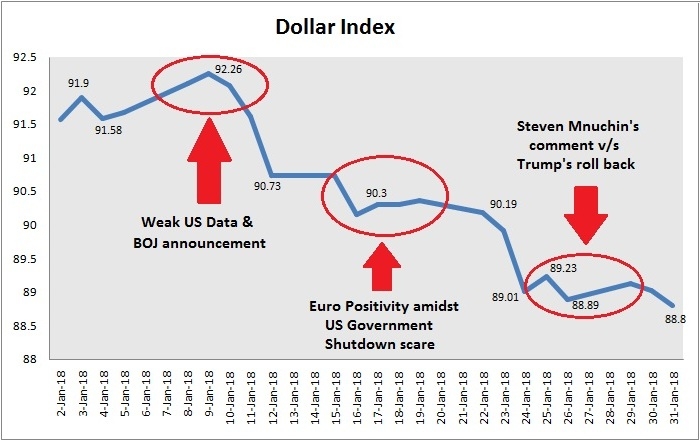

Compared to the 2017 beginning levels, the dollar index has fallen by 13.5%, out of which 3.5% was in this month alone, to 89.02 levels - its lowest in three years. The year began with intensified political noise around the government shutdown at the Trump White House. Amidst the ECB and the Bank of Japan sharing their positive outlook towards their economies while not making any certain changes in their policy, the dollar extended its fall.

The dollar fall exaggerated post Mr. Mnuchin’s remarks supporting a weaker dollar, however, the stern note by the IMF on the same reversed the scenario. President Donald Trump came into picture to turn around the situation by stating that the dollar will strengthen as the US economy grows and that his Treasury Secretary's comments favoring a weak dollar were misunderstood.

The Dollar Index hence revived from its three year low levels and is currently eyeing sustainability above 90 levels. Market participants were probably waiting for Trump’s State of the Union speech due today; however, with him jawboning on trade rather than the dollar, the pair barely had any reaction.

To bounce back the dollar requires a fundamental catalyst, which in near sight could only be the FOMC meeting tomorrow. The FOMC meeting will be Janet Yellen’s last. Even though no changes are expected to interest rates, everyone believes that Yellen’s final FOMC statement will be upbeat and some economists even expect the Fed to upgrade its balance of risks and inflation statement.