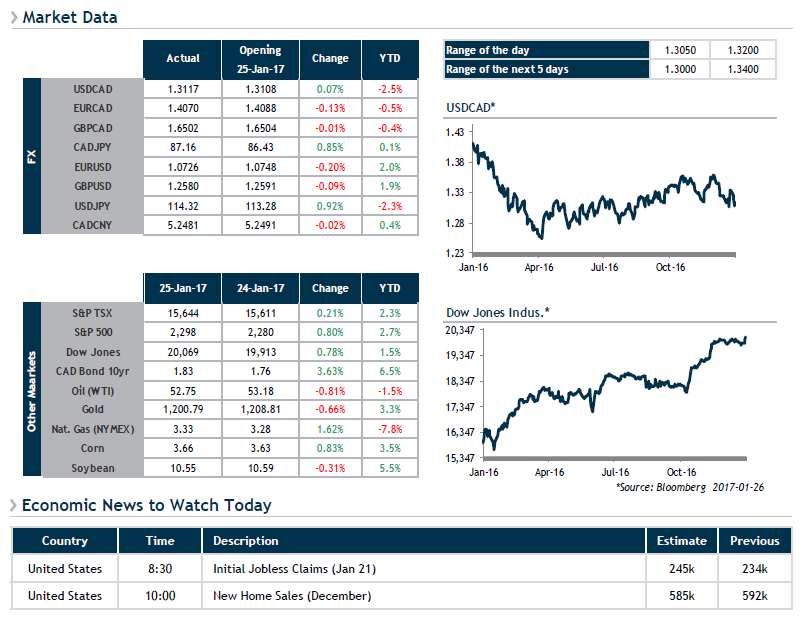

Since Donald Trump was elected, the Dow Jones Index is up 9.5% and broke through the symbolic 20,000- point mark early yesterday. Investors continue to buy shares in multiple sectors, particularly banking and cyclical sectors, as the Trump administration intends to step up infrastructure spending while cutting regulations and the tax burden on U.S. residents. These measures will no doubt stimulate inflation and economic growth. The 13% increase in copper prices in the last quarter is definitely a good indicator. These strengths that are driving stock markets to historic highs have also made it so that the U.S. Federal Reserve will no doubt follow its game plan and raise its key rate two or three times in 2017. In short, the U.S.

dollar, which has lost momentum since the start of the year, should remain strong even though Trump considers it an obstacle to growth and exports. This morning, we’ll be keeping an eye on U.S New Home Sales for December and Initial Jobless Claims to gauge the current state of the U.S. job market. The economic calendar remains very sparse in Canada.