There’s no doubt that 2015 was a roller-coaster ride for oil and gas investors.

But how hard, exactly, was the sector hit by low gas prices?

The results aren’t pretty...

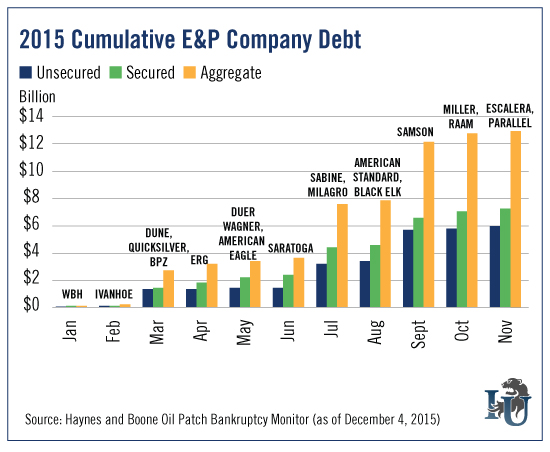

This week’s chart looks at the cumulative debt accrued by exploration and production companies in 2015 and lists the companies that went belly-up this year.

As you can see, cheap oil has taken a toll...

Not only has it led to $13 billion in fresh (and expensive) debt, but in the fourth quarter alone nine U.S. oil and gas companies - each with more than $2 billion in debt - filed for bankruptcy. That’s the highest quarterly number of oil and gas bankruptcies since the Great Recession.

Throughout the entire year, 41 oil and gas companies filed for bankruptcy and 70,000 oil jobs were lost. Companies in the oil and gas sector accounted for about 25% of global defaults.

It’s no wonder. The EIA estimates a breakeven price range between $30 and $75 in North American oil plays. At current $35-per-barrel prices, many companies find it difficult to cut costs to maintain production.

For 2016, the EIA has issued a crude target price of $54 per barrel.

But according to Resource Strategist Sean Brodrick, that number isn’t realistic. To hit $54 per barrel, Sean says oil demand has to surge - and that’s not likely. “The EIA is expecting global oil demand to grow 1.4 million barrels per day in 2016,” he says, “but that’s not enough to soak up excess supply.”

And that surplus will keep prices low. Which is why we’re taking the EIA’s forecast with a grain of salt. It also helps to consider that, this time last year, the EIA predicted crude would average $75 per barrel oil.

We all know how that shook out.

Meanwhile, Sean said oil prices would stay under $50 a barrel in 2015. And, needless to say, he was spot-on.

Looking ahead, Sean expects oil to remain at $40 per barrel for 2016, and $45 per barrel for 2017.

That’s not much of an improvement over current prices. If Sean’s $40 prediction is right, many oil and gas companies will struggle to break even and will continue to rack up debt.

But there is hope.

Sean says, “Amazingly, there are companies that can make money at these prices. Technology is improving fast, meaning they can lift oil at lower and lower costs. But you must be very selective.”