Very few people understand the tremendous hidden value in every silver coin in the world. Unfortunately, most precious metals investors do not realize the critical factor in acquiring and holding the physical silver investment. The majority of gold and silver analysts provide forecasts for precious metals based on the negative symptoms taking place in the economy and market (debt, derivatives, fiat money, etc), and not the fundamental factor… ENERGY.

In my newest video, Tremendous Hidden Value In Every Silver Coin, I explain in detail why physical silver investment is superior to the $15.4 trillion of U.S. M2 Money Supply.

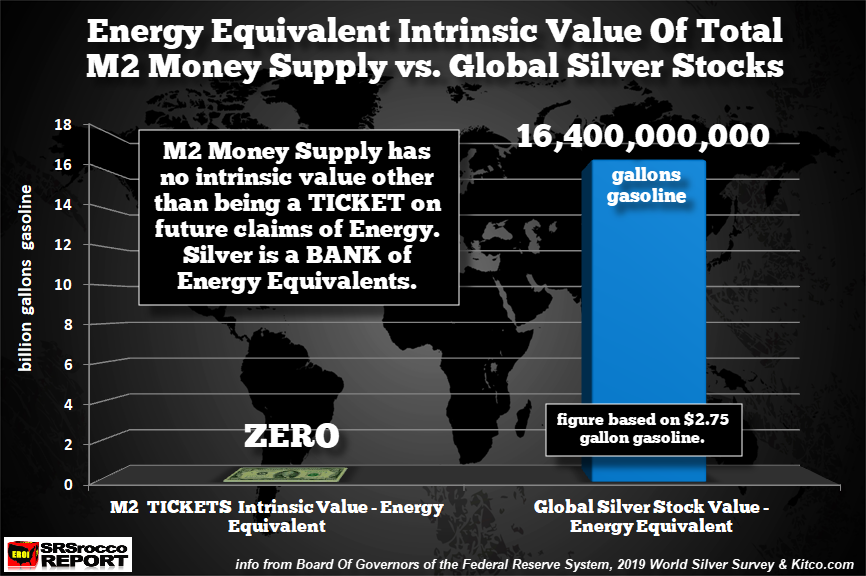

The overwhelming majority of precious metals and financial analysts do not understand why Silver is Money and a store of value. It all has to do with the “Energy Equivalent Value” in silver (and gold) versus Fiat money and the M2 Money Supply.

Since the 2008 Financial Crisis, the U.S. M2 Money Supply has more than doubled to $15.4 trillion versus on $45 billion for all the Global Above-Ground Silver Stocks. Silver is an excellent store of value because it performs as a BANK of ENERGY EQUIVALENT VALUE:

Fiat money does not hold this same trait because the intrinsic value of a Federal Reserve Note is its production cost: 13 cents. Silver is currently priced at $18 due to the $15-$16 cost per ounce to produce the metal. While some in the precious metals community may not agree with my “Cost of Production” analysis on the value of silver, the facts speak for themselves. Sure, the silver price may rise above its production cost due to more demand, but rarely will the silver price fall below its production cost for an extended period of time.

Regardless, the hidden value of silver is explained more in detail in the video, which I highly recommend watching. The chart below shows the Energy Equivalent Value of all Global Silver Stocks versus the M2 Money Supply:

Again, to understand the dynamics of Silver as a store of value versus the $15.4 trillion of U.S. Money Supply, please watch the video above.