The Dow Transportation Index (via the iShares Transportation Average ETF (ARCA:IYT)) has been the talk of the town lately. Tuesday it broke below support and fell into critical territory. Like a runaway train. That is, if you are looking at it on a short term basis. And that is what you will get from the television and most other media sites.

That's because it has been so long since there has been even a 10% correction in the markets and index ranges have been so narrow that market watchers have all grown accustom to to the lack of movement. I’m not sure if a psychologist would call this part of the recency bias or not, but the recent tight range has traders, pundits and prognosticators focusing on a tighter picture. And what happens when an abnormally narrow range fills your normally large screen? Every tick in the market looks like a monster move. As if you are the ant trying to move a leaf instead of the human you are watching.

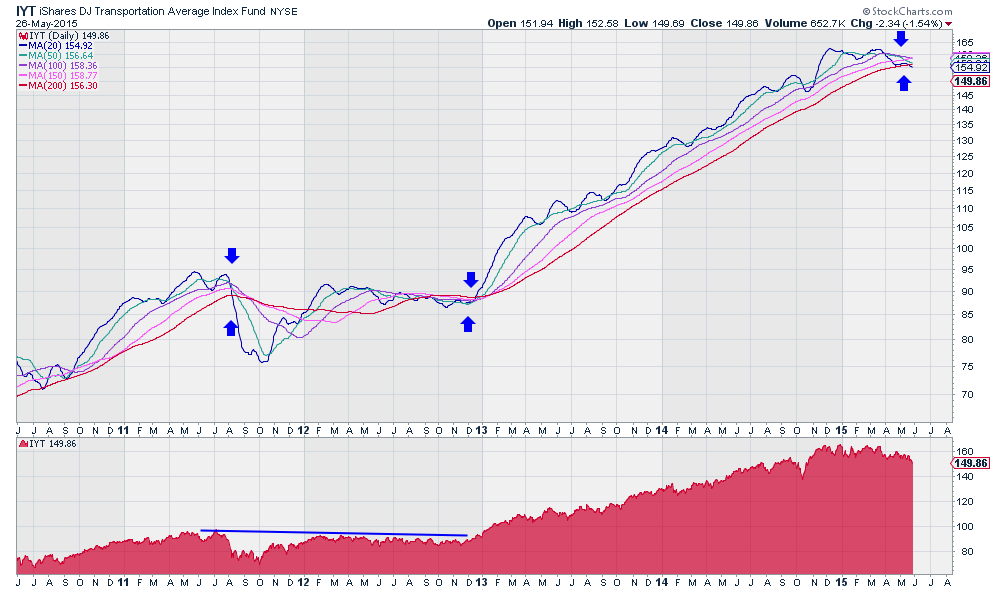

One way to remove this bias is to widen your base. Look at a longer timeframe with more and varied price history. The Transports are down, that's a fact. But it's hardly a crushing blow. They are now less than 9% off of their highs in December.

Another way to change your focus and gain a fresh view is to remove price altogether. The chart above does this in the top panel, showing only the smoothed moving averages at 20, 50, 100, 150 and 200 days. This view brings out an interesting feature. The SMAs might be about to turn down. But they have not yet. Looking far to the left of the chart, when this happened last in July 2011, gives more information. The downturn happened and then the 20 day SMA bottomed quickly and started back higher.

During this correction the Transports fell over 28%. This can be seen in the bottom panel. When they recovered seven months later, the Transports held that level until the SMAs moved to a tight point again. That point launched a 2 year move higher.

What are the takeaways? First, the Transports have not rolled over yet. Watch to see all the SMAs moving lower for the bias to change to a downtrend. Next, those points where the SMAs get very tightly intertwined can be important pivots. But as shown in 2011 and 2012 they can move either way. A turn up would shift the bias higher.

Until then Transports are a sector to avoid, but they're hardly off the rails.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.