Once a Major Megaphone Starts, the Price Never Wants to Leave

IWM Started its Topping Megaphone in Late November 2013

N:IWM began forming a megaphone top across roughly 112.50 in late November 2013. Now it’s back at that level, setting up a move to the megaphone bottom before returning to exactly where it is now.

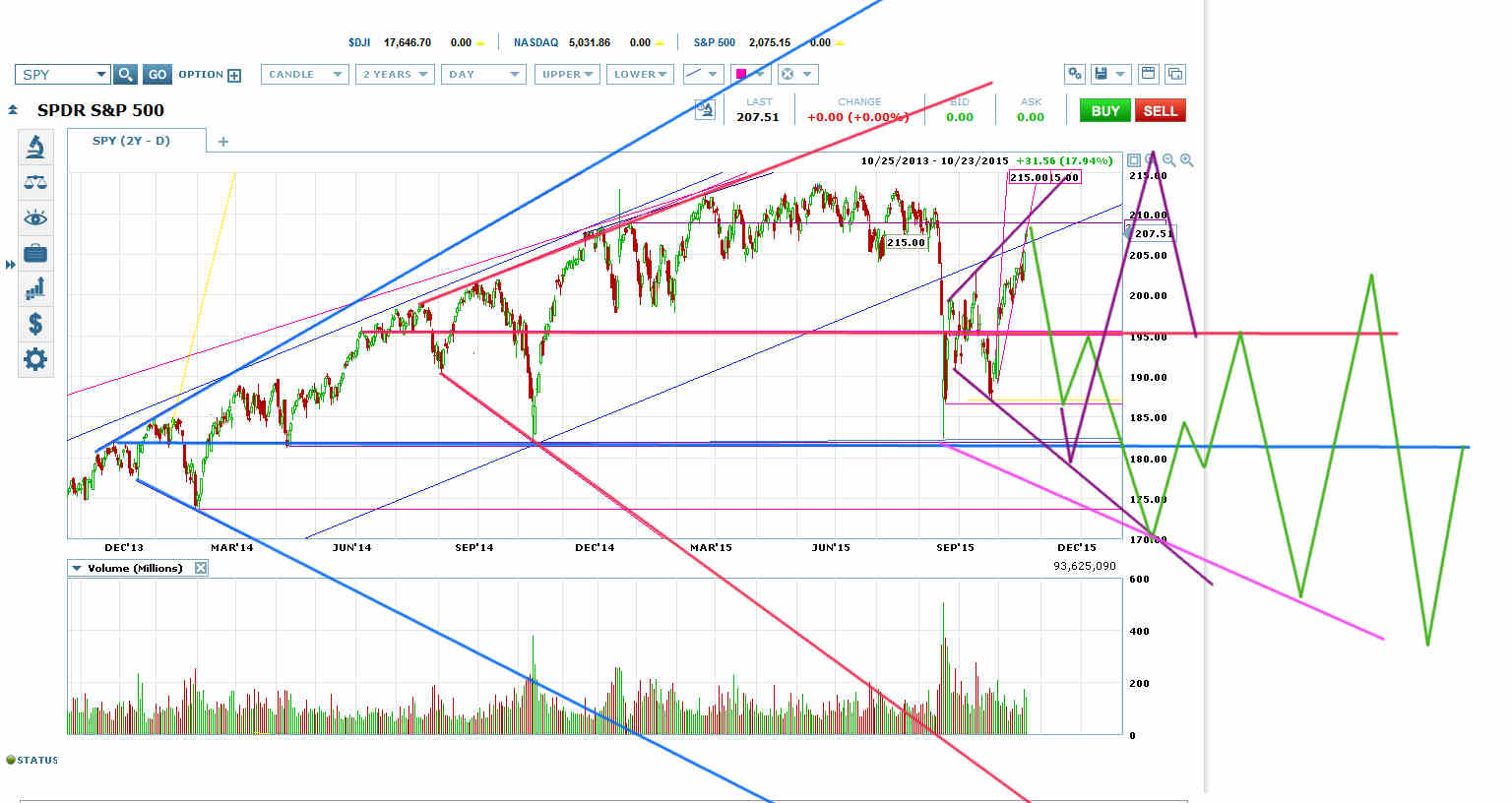

SPY Started Forming the Blue Megaphone in Mid-November 2013 and the Red Topping Megaphone Within It in June 2014

N:SPY started forming the blue megaphone in mid-November 2013 and the red topping megaphone within it in June 2014.

Right now ES is forming a new megaphone (purple) across the red megaphone VWAP at 1950. Sooner rather than later, ES will return to the blue megaphone VWAP–likely for a new megaphone across it (green scenario).

When ES finally gets going below its blue megaphone VWAP, it should spend roughly the same amount of time below it as it spent above it.

But it could take a very long time to get going. Oil and the dollar are likely not going anywhere soon.

USDX Started Forming the Red Megaphone in May 1987

The dollar started forming the red bottoming megaphone in May 1987. Now it’s back at VWAP again. Its next target would usually be the megaphone top, but it could move sideways here for years before returning to the top.

After Taking All of the 1990s to Bottom, Oil Repriced to the Blue Megaphone VWAP – Now It Should Spend Roughly as Much Time Below that Level as it Spent Above it

Oil should spend roughly as much time below its blue megaphone VWAP as it spent above it, and the low for the move down out of the 2011 high is probably not in yet.

Then oil will likely spend some time moving sideways across its blue megaphone VWAP.