As an exercise to in relaying our view on the best stocks in the PIIGS equity markets to our clients, we screened the non-financial stocks of these countries that are listed on the Stoxx 600 Index. As our cash return on invested capital framework for European stocks is not yet in place, I used a similar approach but based on figures already available in the Bloomberg Terminal. Remember that our cash return on invested capital framework is built on many specific changes to the accounting data and thus requires a lot of work, something we have not built for European equities yet.

PIIGS stocks with biggest potential are dominated by utilities

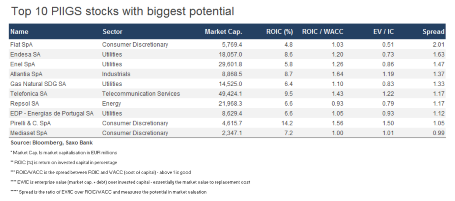

Our approach is the ROIC/WACC to EV/IC framework which states that there is an approximately 1:1 linear relationship between the profit spread (ROIC/WACC) and the value spread (enterprise value to invested capital). Based on this assumption, I ran an analysis of the 41 non-financial PIIGS stocks in the Stoxx 600 and the table below shows the stocks with the highest potential.

Fiat (F) has the greatest potential as its enterprise value is currently half of the replacement cost (invested capital) of the business. The catalyst for Fiat is the stabilisation and the return to economic growth in the eurozone. What makes car manufacturers such as Fiat interesting is the implicit leverage on the balance sheet which amplifies returns if things go right.

Another striking observation is that the top 10 list is populated by four utilities. The driver here is not so much their profitability as the fact that on average they only cover their cost of capital by 20 percent. The real driver of their share price potential is their low enterprise value to replacement cost and part of that story has been the expectations of lower long-term profitability which have hurt their share prices (see chart for Eurostoxx 600 Utilities Index since 2011). If you believe improving economic conditions in Europe will take off in 2013 then these utilities could see a rebound in valuation pushing them more in line with their actual profitability spread.

Top 10 PIIGS stocks on quality are dominated by Spanish stocks.

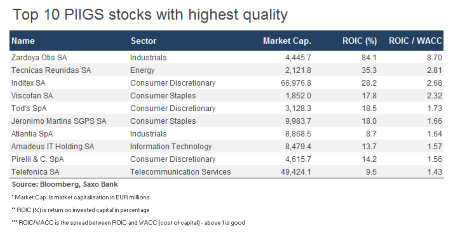

If you are less interested in turnaround and mean reversion cases (which those stocks in the "biggest potential table" are all about) then the next table (below) with the top 10 stocks on quality may be more for you. It provides the 10 PIIGS stocks with the highest profitability spread without taking valuation into consideration. An interesting observation here is that Spanish stocks dominate the table with names such as Zardoya Otis, Tecnicas Reunidas, Inditex, Viscofan, Amadeus IT Holding and Telefonica.

These stocks should be able to continue to grow and will likely perform well in 2013 if they can keep their profit spreads steady.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Top PIIGS Stocks On Share Price Potential And On Quality

Published 01/27/2013, 05:30 AM

Updated 03/19/2019, 04:00 AM

The Top PIIGS Stocks On Share Price Potential And On Quality

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.