I put forth a thesis late last year that the US dollar would continue to strengthen for a long time and I have stuck by it. Many of you have probably thought I was nuts at least once or twice as it pulled back from a high over 100 in March and has now consolidated for 8 months. But a long term trend remains in tact until it is proven wrong. An uptrend that consolidates is still an uptrend until it breaks support and heads lower.

As recently as the beginning of October I wrote about why I still like the US dollar here. There are two main points to make from a macro perspective. First the long term chart has many signs of a prolonged uptrend discussed in that article. And the major trading pairs, the euro and the yen show weak long term charts. But the monetary policies of the countries involved also reinforce the case. The US is about to embark on monetary tightening while Japan, Europe and China are all either in a loose monetary mode or leaning that way.

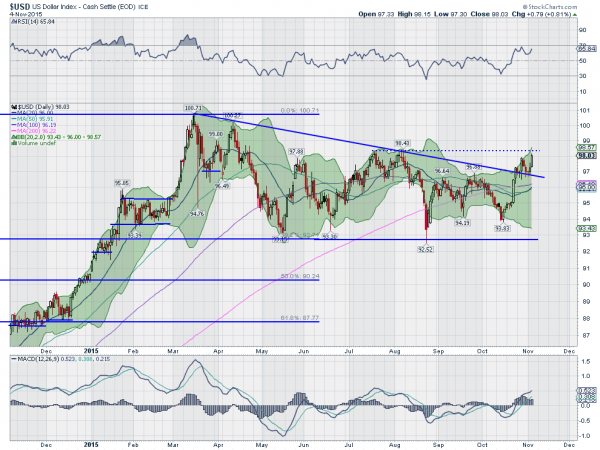

With that long term backdrop the intermediate term becomes more important in telling when things may change. And the daily chart of the dollar index below gives some signs it may be happening very shortly.

The chart is dominated by a descending triangle with support at 92.75. The falling trend resistance was breached last week on the move over 97. This happened about half way into the triangle. The index came back to retest the breakout line before a bounce Tuesday and then seeing follow through action Wednesday. This pattern targets a move to 105.

There is some potential resistance along the way. The first is the August top at 98.40 and then the prior high at 100.71. The momentum indicators support more upside. The RSI is bullish and turning back higher while the MACD is rising. The Bollinger Bands® are opening higher as well. A move over 98.40 will likely get bought. I am already long the Dollar Index via calls on the ETF ($UUP). What do you think?

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.