“Sell in May” might not have been beneficial to those who made decisions based on seasonal probabilities. Yet there’s one asset class that has been taken out to the proverbial woodshed… high-yielding mortgage REITs.

Mortgage REITs do not make money through the purchase of shopping malls, residences or office buildings. They borrow short-term debt to finance the acquisition of longer-term residential and commercial mortgage-backed securities. The profits come from the difference, or spread, between short-term and long-term rates. Mortgage REITs also benefit from the use of leverage.

Unfortunately, the recent chatter about the Federal Reserve tapering their quantitative easing program has hit Mortgage REITs harder than nearly any other type of market-based security. That’s because the Fed currently buys nearly $45 billion in U.S. Treasuries and $40 billion in mortgage-backed bonds every month, yet analysts have suggested that the central bank may reduce the purchase of mortgage-backed bonds first.

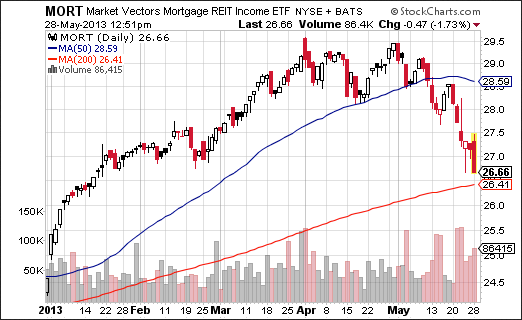

In truth, the chairman of the Federal Reserve, Ben Bernanke, is extremely unlikely to deviate from his current course of easing. That said, his recent “float-a-trial-balloon” commentary on the possibility of cutting back on the bond buying has sent the mortgage-backed security market into a “tizzy.” Both of the two major Mortgage REIT ETFs have dropped considerably from respective 52-week highs; each is threatening to fall below a 200-day long-term trendline.

Some investors and market watchers believe the selling activity is a tremendous overreaction. Nevertheless, if overbought conditions can persist for long periods of time, oversold conditions can persist as well. It follows that a yield-oriented investor who believes that the Fed is mostly blowing hot air to fill its trial balloon might consider picking up technically oversold shares of REM or MORT. Unemotional stop-limit loss orders can protect against the possibility that a newly acquired position turns into a bearish disaster.

By the same token, current investors in REM or MORT need to honor previously entered stop orders, rather than decide that oversold conditions will recover or that the Fed is merely bluffing. Do I believe the Fed is bluffing? Yes I do. Still, one must know when to hold and when to take a big gain, small gain or small loss. Letting one’s convictions take precedent over the ability to control outcomes can lead to devastating and undesirable consequences.

Disclosure Statement: ETF Expert is a web log (”blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Threat To Mortgage REIT ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.