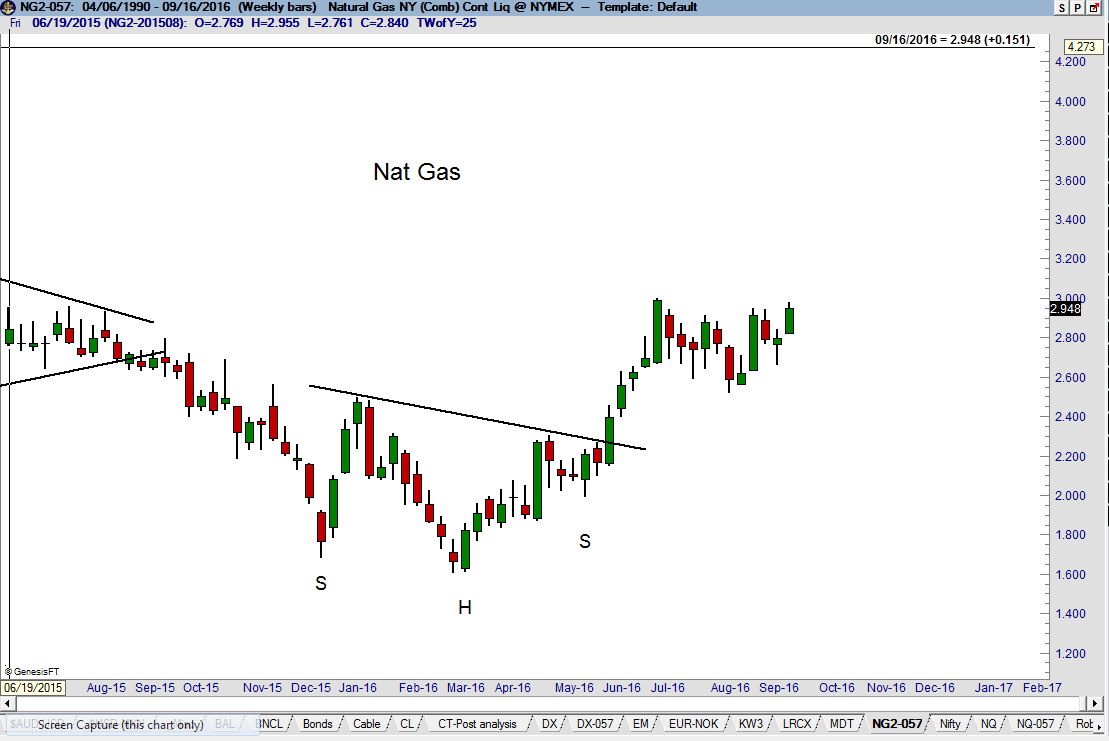

I last covered the natural gas market back on June 20. Natural gas posted a 21-year price low in Mar. 2016 and the bottom took the form of a 7-month natural gas head-and-shoulders bottom on the daily and weekly charts. The target of this H&S at 2.934 was quickly met on Jun. 29.

A case can now be made that the weekly chart is forming a 21-month natural gas head-and-shoulders bottom, as shown below. I have some significant issues with this interpretation. One problem is that the right shoulder is too abbreviated in relationship to the left shoulder. A second problem is that there is no overlap between the two shoulders on the charts of the individual contract months (not shown).

I prefer to view the period since July 1 as simply an 11-week consolidation within a primary bull trend. A decisive close above 3.091 (Nov. contract) would complete this consolidation and establish 3.433 as the next target level.

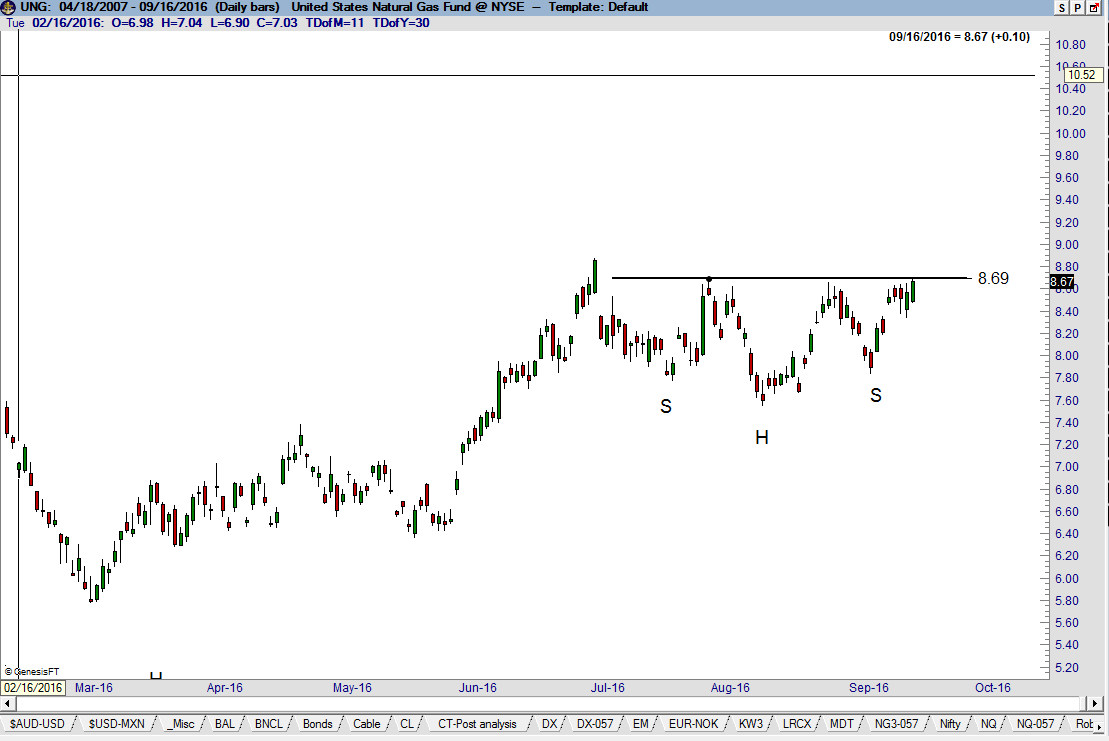

The United States Natural Gas ETF (NYSE:UNG) displays a very clear 10-month H&S bottom.

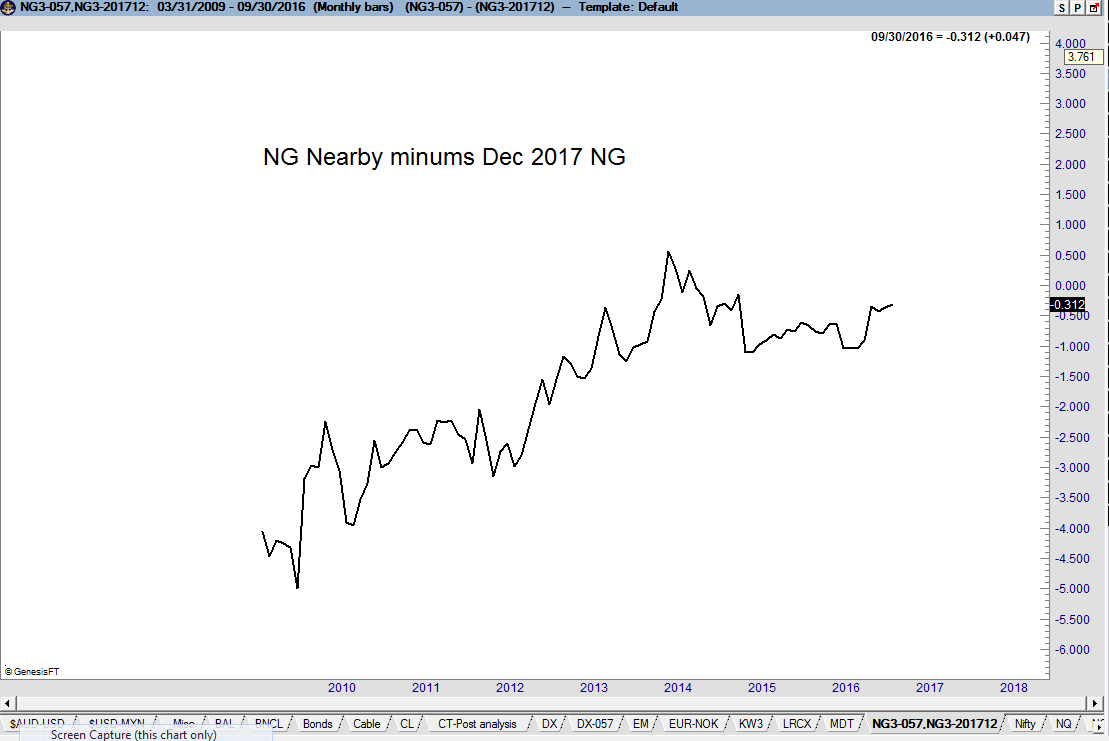

Investors who attempted to buy the natural gas market with UNG lost money continually from Jul. 2008 through May 2012, despite periodic rallies in the underlying product. UNG was a terrible investment vehicle due to the large carrying charge structure of the futures market. However, the huge carrying charges have disappeared in nat gas. As the chart below shows, Dec 2017 contract has gone from nearly five full points carry to the near contract to almost even money. The one-year carrying charge in nat gas (Dec. 2016 to Dec. 2017) is currently only .05. Thus, the carrying charge disincentive to own UNG has all but disappeared, making UNG a legitimate play.

The daily graph of UNG displays a 12-week continuation inverted H&S with a horizontal neckline at 8.69. Using the 3% breakout rule of Edwards and Magee, a close above 8.95 in expanded volume would be a valid breakout in UNG.