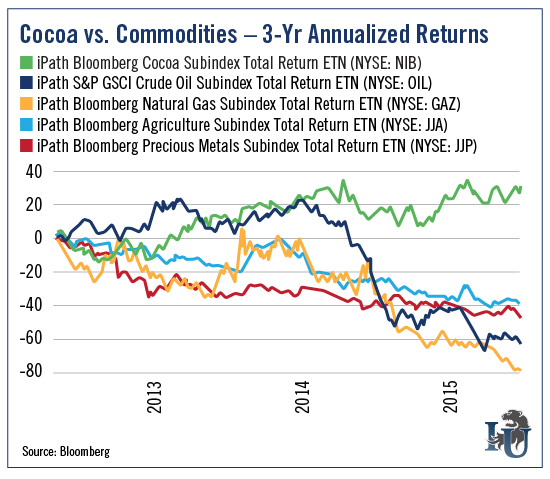

Crude Oil prices have tanked over the past year. Gold is at a five-year low, down 44% from a high in late 2011. Silver is down 71% over the same period.

Commodities as a whole are in the red by double digits for the year.

But as this week’s chart shows, one exception is standing tall...

In the last three years, it’s rewarded investors with annualized gains of around 10%. And it’s one of only two commodities - the other is cotton - that’s in the black year to date.

So what’s this incredible commodity?

Sweet, sweet cocoa.

Over two-thirds of the world’s cocoa is produced in West Africa. Côte d’Ivoire (Ivory Coast) is the largest producer, growing a third of the world’s cocoa.

However, there are concerns about the sustainability of current production levels.

Cocoa crops need plenty of rainfall to yield enough beans. But cocoa-growing regions are experiencing a dryer season than usual. Rainfall is generally expected in September, but instead began in October this year.

The expectation for lower yields is affecting the rise in prices.

Another problem is that most cocoa farmers are very poor. This makes it difficult for them to expand their plots or use better quality fertilizers and pesticides.

And to make things worse, farmers have to worry about extortion. Corrupt soldiers set up illegal road blocks between growing areas and selling ports. The cost to the sector each year is an estimated $19.5 million.

In an effort to deal with these problems, the government of Côte d’Ivoire began a number of reforms back in 2012. The farm-gate price - the price when cocoa leaves the farm - is now set at guaranteed minimums by the government. Buyers that do not respect these prices can have their licenses withdrawn and be criminally prosecuted.

Since the policy has been in place, cocoa prices have been rising steadily.

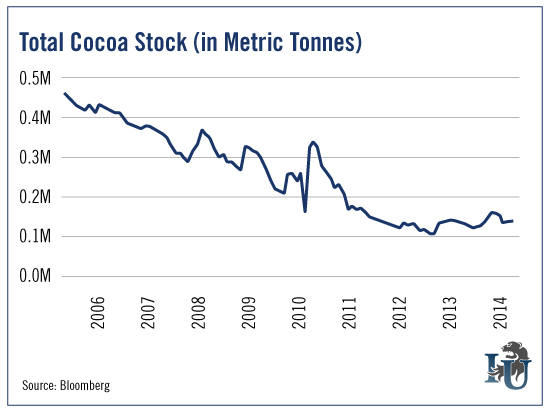

Meanwhile, cocoa stocks in licensed warehouses in the U.S. and Europe are shrinking.

This is while demand is forecasted to grow by 30% by 2020.

With decreasing stocks and increasing grinding activity, global and local buyers have little choice but to pay up. That’s why purchases have grown 118% in Ghana - the world’s second-largest cocoa producer - so far this crop year.

So what can you do to profit on this opportunity?

The simplest way to play the uptrend is through the iPath Bloomberg Cocoa Subindex Total Return Exp 24 June 2038 (N:NIB). It tracks futures contracts on cocoa and has provided a 13% return for investors so far this year.

It’s also worth noting that, as we officially enter the holiday season, we’re in the prime period for chocolate.

As Emerging Trends Strategist Matthew Carr recently noted, “this is the start of a very strong, sugary season for candy makers... Because following Halloween we have Christmas, Valentine’s Day and then Easter.”

Not surprisingly, shares of the Bloomberg Cocoa ETN are up more than 7% since just the start of October.