by Adam Button

Just how strong will the economy be in 2021? Resilient through recent lockdowns combined with reopening exuberance are leading to upgrade after upgrade. EUR/USD had its first test of the December trendline resistance after breaking above its 100-DMA, while DXY also broke below its 100 DMA, eyeing its own December trendline support.

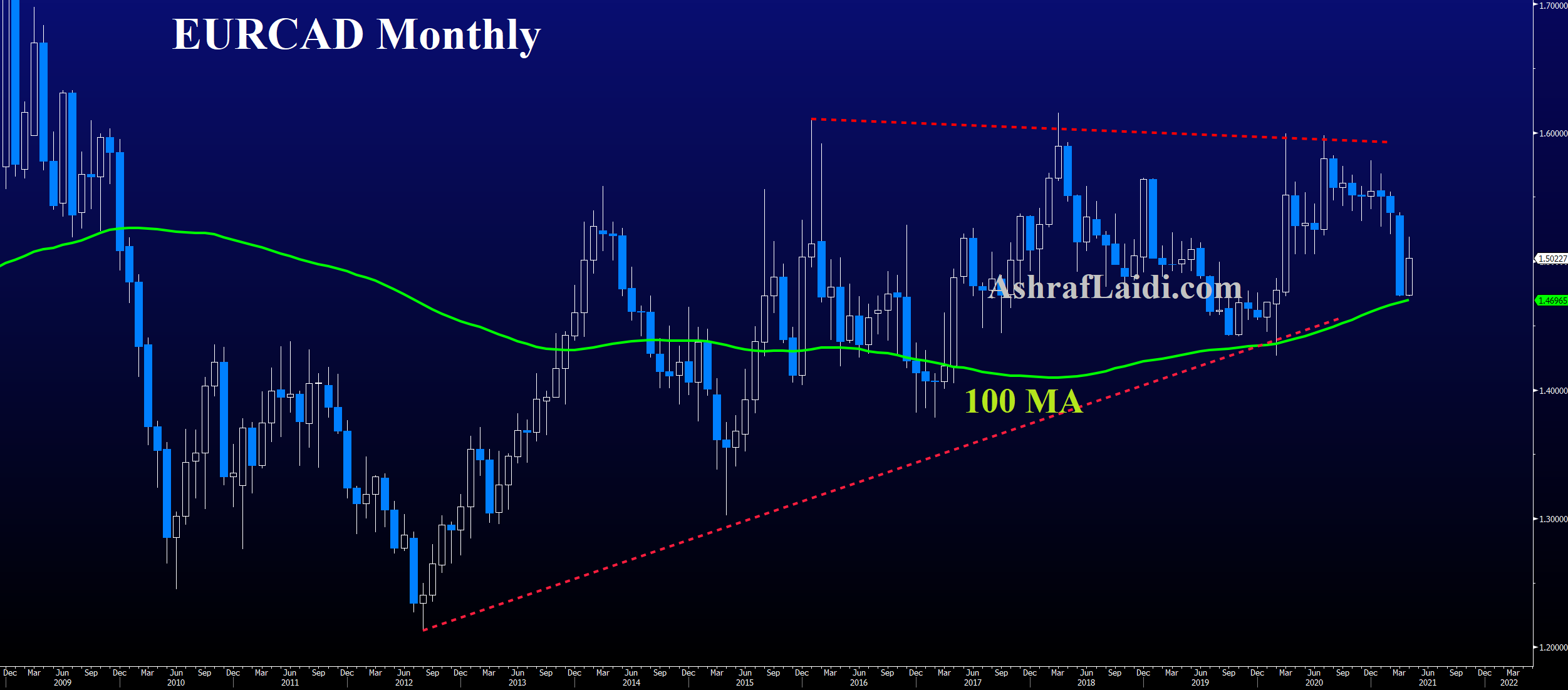

Expect gold to retest and break above its own 100-DMA this week. It will be a busy week with the Fed, Biden's tax plan and more earnings. The CFTC positioning data showed renewed bets on the Canadian dollar. Both EUR and CAD have done well. Here's a monthly chart of EUR/CAD. What do you think? US Durable goods orders are next.

There's no post-pandemic playbook. Economists were in uncharted territory heading into the pandemic and will be sailing blind coming out. Almost every step of the way so far, the returns are better than anticipated.

As the US reopens, the latest signs are impressive. Survey data is the most-forward looking and on Friday the Markit services PMI was at a record high (since 2008) at 63.1 compared to 61.5 expected. It was the same thing in similar surveys elsewhere and nearly all of them cited strong orders and soaring input prices.

Some of the anecdotal reports are so glowing, they were hard to believe at first but now they're widespread.

“Restaurants spent much of the past year trying to win back customers. Now, they are struggling to win back employees,” the WSJ wrote on Sunday.

A similar boom is brewing in the UK, which is just behind the US in vaccines. The BOE's Broadbent highlighted “very rapid “ growth on the weekend. Forecasts are nearing +7% for the year.

The week ahead is very heavy on economic data and earnings, with the FOMC decision as a highlight. It starts with the US durable goods orders report for March at 1230 GMT.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +81K vs +67K prior

GBP +25K vs +26K prior

JPY -60K vs -58K prior

CHF +2K vs +1K prior

CAD +13K vs +2K prior

AUD -2K vs +4K prior

NZD +4K vs +3K prior

What's fascinating about the rise in CAD longs is that it came on Tuesday, ahead of the BOC decision. The loonie fell hard in the day ahead of the decision but someone was clearly wading in on the other side and was quickly proven right. Expect CAD positioning to stretch further in next week's report.