As a market analyst who is focused on Cryptocurrencies, many people ask if the crypto-market is a bubble. Yesterday, while amusing my children with actual soap bubbles I managed to gain some unique perspective on how to better answer this question.

The first thing we need to realize about bubbles is that they only exist given the proper conditions. One of my favorite economists on Twitter, who goes by the username @TheBubbleBubble, has been warning about financial bubbles since before 2008 and recently posted this graph showing how bubbles usually form when financial stress is low.

This feeling that the economy is doing great represents the soap in our analogy. As we can see, financial stress is at extreme lows right now.

The amount of cash that's been pumped into the system over the last decade represents a reservoir of water. With soap and water both in abundance, I'd say we have enough solution at this time to create as many bubbles as we need.

The third ingredient of course, is hot air and there's certainly no shortage of analysts out there ready to talk up their asset of choice.

The second thing I noticed is that bubbles are never lonely. A single breath can easily produce 10 or 20 bubbles of different sizes. Not only that, you'll also notice the formation of hundreds of microbubbles known as suds.

Each tiny bubble, similar to a penny stock or a new digital token, will probably never amount to much but has the potential to become a monster.

The funny thing is, you never really know what the growth potential of a specific bubble is just by looking at it. Sometimes you can catch a large bubble with the wand, blow on it, and watch it get even bigger. With the right equipment and enough solution, there really is no limit to how big a bubble can get.

Today's Highlights

Iran in Focus

Ethereum Strikes Back

Japan Bitcoin Trade

Please note: All data, figures & graphs are valid as of January 2nd. All trading carries risk. Only risk capital you're prepared to lose.

Traditional Markets

By the time Wall Street rings them first opening bell of 2018, few will be thinking about Kim Jong Un's upgraded nuclear desk. What more likely be on the minds and TV screens of traders this morning are the protests in Iran.

With the war in Syria seemingly nearing its end, the last thing we need is another conflict in the Middle East. The most direct impact this would be on the price of oil. Since Oil is a highly speculative market, if we do see supply disruptions in the third largest OPEC producer it could send the price even higher.

Oil has been holding well above $60 a barrel and if we go much higher, technical analysts might start to view the upward momentum as a new trend.

Generally speaking, stocks do well when the price of oil is steady. Wild swings have a way of destabilizing other markets.

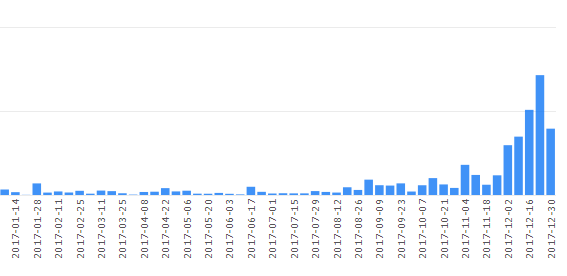

On a side note, it is interesting to see the correlation between economic issues in Iran and a recent rise in Bitcoin volumes in the country. On the week of December 23rd, local bitcoin volumes peaked at 86 BTC.

Even more than the situation in Iran, American investors will be thinking about the new tax laws that went into effect yesterday and how they'll impact various sectors.

Asian markets have opened the year on a positive note, with gains of 1.5% in Chinese Stocks. Europe on the other hand is looking a bit red at the open.

Also, as I'm writing we can see another dip in the US Dollar, which could be significant if the move is sustained.

ETH Vs XRP

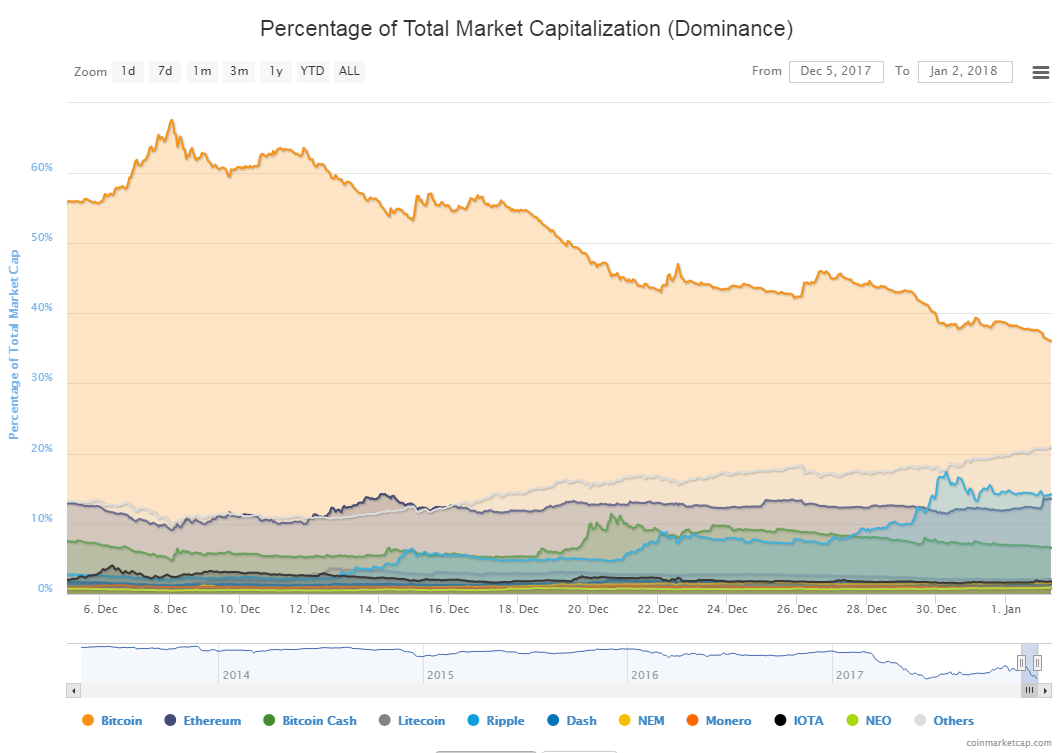

A fierce battle is playing out in the crypto world at the moment between Ethereum and Ripple.

While Bitcoin has been declining in market share, Ripple was on a massive run. The logic is that if bitcoin fails to replace the banking system, the current institutions may just use the Ripple network to integrate blockchain technology, speed up transactions, and lower prices.

On December 29th, the total supply (market cap) of Ripple's XRP tokens surpassed that of Ethereum making it the second most valuable cryptocurrency network.

This morning, Ethereum is fighting back with its own price surge and seeing a fresh new all-time high of $882.

XRP and ETH are now fighting neck and neck for the number two spot. We can probably expect some great memes coming out today.

BTC Japan

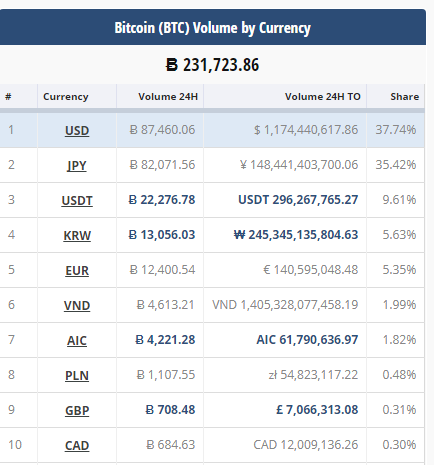

Without a doubt, bitcoin is big in Japan. After gaining legal status in March, Japanese citizens have been trading the new digital asset like crazy.

The Japanese are among the most zealous traders in the world and according to one economist that I spoke with in October 2016, Japan accounted for more than 90% of total Forex volumes at that time.

According to a recent report from Deutsche Bank, a lot of those volumes have now moved to bitcoin. Analysts at the Japanese Investment bank Nomura, one of the world's largest financial institutions in the world, are now projecting that the rise in bitcoin may actually boost the Japanese GDP by as much as 0.3%.

This may not sound like much but it actually represents massive economic growth. Arguably, this factor may have an even greater effect on the economy than the ridiculous amounts of stimulus that have been deployed by the Bank of Japan in recent years.

For now, it seems that Japanese citizens are holding. Meaning, they're not selling the bitcoin to realize their gains but letting them ride. However, the fact that individuals were able to vastly increase their net worth, even if it's just on paper, has encouraged consumers to spend money.

.

As the price of bitcoin looks for a floor, the thing that I want to watch is volumes in Japan. These guys are no dummies, so only if/when they feel confident the price will rise again will they start pouring back into the market.

For now, Japan is only creating about 35% of global BTC volumes. Far from the 68% they were doing on November 26th. A rise in Japanese volumes together with a notable spike on bitcoin could be a great signal to re-enter the market.

Let's have a fantastic day ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.