You knew it right away when you were growing up. You would ask your parents a question and one of them, usually your dad, would come up with some crazy story as to how peanut butter was first discovered by Native Americans as they crushed the legumes creating walking paths in the undeveloped south when one of them stopped to rub off the mush from their feet and tasted it. Rolling your eyes, you would walk away saying “Oh, Dad”.

So why do you listen to adults who keep telling you that Gold is an inflation hedge, or store of value, or safe haven? Again and again we see these “truths” being shattered. The latest comes from the safe haven crowd. Supposedly the move in the Turkish lira is causing world wide turmoil. And what is Gold doing? Dropping like a stone. Kind of ironic isn’t it? Because, you know, Gold is a stone.

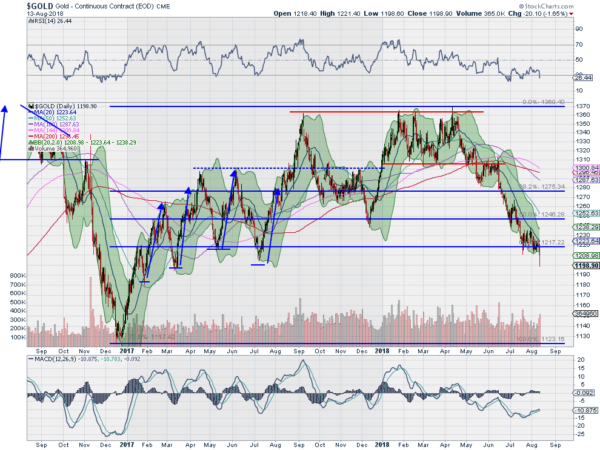

The chart above tells the real story. Since April, Gold has been moving lower. Weren’t we concerned about rising inflation then, I forget. It paused in June and then resumed the path lower into another consolidation in July. This one came at a 61.8% retracement of the move higher from the December 2016 low to the high in April. Then came Monday.

The shiny rock broke down below this consolidation and stopped at a 17 month low. Momentum continues to look bearish as the price drops. It is a bit oversold so a pause or bounce may come into play, but the price action looks more like a trip back to the December 2016 low is in order than a crisis induced buying spree.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.