- President Obama in Tuesday’s State of the Union address.

I’m all for leaders inspiring optimism. But not when it entails lying to my face! Is the United States stronger from an economic standpoint? Compared to 2008, absolutely. Out of the woods and on solid footing? Not even close!

The President continued to say that there’s still an “unfinished task” ahead of us. Instead of calling that a lie, too, I’ll give him the benefit of the doubt and say it was merely an understatement of epic proportions…

Consider:

Although the official unemployment rate is exactly the same as it was when President Obama first took office (7.8%), the labor participation rate keeps trending lower, and currently rests at 58.6%.

I’m sorry. But when over 40% of all working-age Americans aren’t working, that’s not good for our economy. Investing in education might be a long-term solution. In the here and now, though, we simply need to create more jobs. And not just in the healthcare sector.

And it's serious when 1 in 4 children are on food stamps - or when 1 in 13 Americans are collecting disability. Or, when the median household income falls for four consecutive years.

I could go on with a laundry list of statistics testifying to this persistently sad state of our economic affairs. But that’s not my intention today. Instead, I want to share the biggest threat facing our nation and, in turn, our investments.

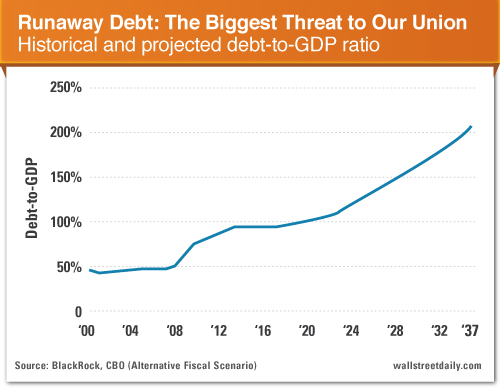

And I can do it with a single chart.

When President Obama first took office, the U.S. debt-to-GDP ratio checked in under 50%. It’s now nearing 100%, according to BlackRock’s calculations. Other calculations peg the current ratio much higher.

But that’s beside the point. What matters most is that by all calculations, if our government continues on its current trajectory, we’re going to be in rarefied air with Japan. And not in a good way.

Forget about blaming any President or political party for the problem. First, we need to get politicians to realize that it’s actually a problem.

Minority Leader of the House, Nancy Pelosi, recently said we have a “budget deficit problem.” Then, House Minority Whip, Steny Hoyer, said it’s really just a “paying-for problem.”

Come again? For those of us who confront the reality of home economics with every paycheck, it’s a spending problem. Plain and simple. And denial is the first indication that there is a problem.

Bottom line: The “state of our union” might be stronger. But much more progress is necessary. Otherwise, it’s going to get much weaker… fast!

Straight up, it’s time for politicians to stop talking about debts and deficits, and to start doing something about eliminating them. They remain the biggest threat to our democracy and investments.

So don’t be afraid to speak up and let them know that the time to act is long overdue. After all, this is a democracy.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The State Of The Union In One Chart

Published 02/14/2013, 06:15 AM

Updated 05/14/2017, 06:45 AM

The State Of The Union In One Chart

“So, together, we have cleared away the rubble of crisis, and we can say with renewed confidence that the state of our union is stronger.”

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.