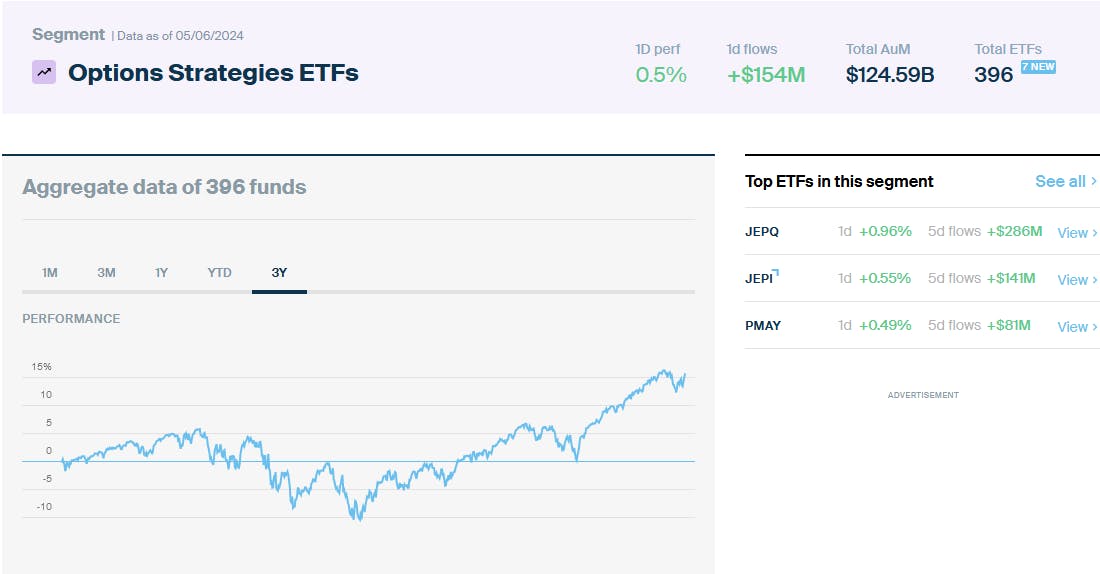

The options-based ETF segment, currently valued at approximately $124.6 billion in assets under management and comprising 396 ETFs, continues to grow rapidly. Notably, on May 6th, 2024, this segment witnessed inflows of $154 million according to ETF Central Data.

For a detailed understanding of the various strategies employed within this sector, refer to our comprehensive four-part series:

- Options Strategies in ETFs, Part 1: A Grand Overview

- Options Strategies in ETFs, Part 2: Covered Call ETFs

- Options Strategies in ETFs, Part 3: Buffer ETFs

- Options Strategies in ETFs, Part 4: Put-Selling and Leverage

But among the providers in this competitive niche, YieldMax stands out not only for its unique single-stock approach but also for its ability to consistently deliver double-digit yields. Here's a deeper look into how the YieldMax ETFs operate and the current options (pun intended) they offer investors.

What are YieldMax ETFs, and how do they work?

YieldMax ETFs offer a unique twist to the traditional covered call strategy, commonly used by retail investors and advisors to generate income from highly traded stocks.

Instead of directly owning the underlying securities and selling calls against them or a reference index like the SPX or NDX, YieldMax employs a "synthetic covered call strategy."

Here's how it works:

Instead of purchasing the stock, YieldMax combines a short put and a long call to create what's known as a synthetic stock position. This method is not only capital efficient but also mirrors owning the actual stock.

The real twist comes with the addition of selling a short call to generate income, which forms the core of the covered call strategy. However, since the ETF doesn't hold the underlying shares, there's nothing to get called away if it does expire in-the-money and gets assigned.

To back these positions and add a layer of security, YieldMax uses Treasuries as collateral. In today's environment of higher interest rates, this also contributes to earning a competitive yield.

The result? YieldMax ETFs provide above-average monthly income and exposure to the returns of the underlying reference asset without physically holding it. However, like all covered call ETFs, the upside is capped, and there is still exposure to downside risk.

Some of the current YieldMax ETFs available

Here's an overview of the most popular covered call ETFs YieldMax currently offers. As you can see, most of these ETFs focus on a single stock, featuring double-digit distribution yields. This isn't a typo – they really do pay that much, but it isn't a free lunch by any means.

The distribution yield is calculated by multiplying the ETF's distribution-per-share by twelve (12) and dividing the resulting amount by the ETF's most recent Net Asset Value (NAV).

Remember, this distribution rate is not the total return you should expect, as the share prices of these ETFs can fall. All figures are accurate as of May 7, 2024.

- YieldMax TSLA Options Income Strategy ETF TSLY+2.44%: 0.99% expense ratio, 53.78% distribution yield

- YieldMax Innovation Option Income Strategy ETF OARK-1.79%: 0.99% expense ratio, 54.26% distribution yield

- YieldMax AAPL Options Income Strategy ETF APLY+0.98%: 0.99% expense ratio, 24.31% distribution yield

- YieldMax NVDA Options Income Strategy ETF NVDY+0.14%: 0.99% expense ratio, 55.67% distribution yield

- YieldMax AMZN Options Income Strategy ETF AMZY-1.18%: 0.99% expense ratio, 50.55% distribution yield

- YieldMax META (NASDAQ:META) Options Income Strategy ETF FBY-1.66%: 0.99% expense ratio, 56.05% distribution yield

- YieldMax GOOGL Options Income Strategy ETF GOOY-1.24%: 0.99% expense ratio, 45.55% distribution yield

- YieldMax COIN Options Income Strategy ETF CONY-0.01%: 0.99% expense ratio, 119.10% distribution yield

- YieldMax NFLX Options Income Strategy ETF NFLY+0.11%: 0.99% expense ratio, 69.54% distribution yield

- YieldMax DIS Options Income Strategy ETF DISO+0.35%: 0.99% expense ratio, 41.75% distribution yield

- YieldMax MSFT Options Income Strategy ETF MSFO -2.22%: 0.99% expense ratio, 32.36% distribution yield

- YieldMax XOM Options Income Strategy ETF XOMO-0.5%: 0.99% expense ratio, 22.80% distribution yield

- YieldMax JPM Options Income Strategy ETF JPMO -0.63%: 0.99% expense ratio, 25.64% distribution yield

- YieldMax AMD (NASDAQ:AMD) Options Income Strategy ETF AMDY +0.06%: 0.99% expense ratio, 36.93% distribution yield

- YieldMax PYPL Options Income Strategy ETF PYPY +1.35%: 0.99% expense ratio, 60.45% distribution yield

- YieldMax SQ Options Income Strategy ETF SQY -0.82%: 0.99% expense ratio, 62.79% distribution yield

- YieldMax MRNA Options Income Strategy ETF MRNY-4.94%: 0.99% expense ratio, 56.27% distribution yield

The distribution yields of these covered call ETFs are exceptionally high, primarily due to the nature of the underlying strategy and the volatility of the reference assets.

Selling options on stocks like Tesla (NASDAQ:TSLA) using a synthetic strategy, for instance, can command high premiums because these stocks are more volatile. When you sell a call option, you collect a premium upfront, which contributes to the fund's income.

This strategy is effectively compensating you for the risk of capping potential gains if the underlying stock rises beyond the strike price of the call option.

As a result, the higher the volatility of the underlying stock, the higher the potential income from selling the option, but it also reflects the increased risk you're taking on by using this strategy.

This content was originally published by our partners at ETF Central.