Bitcoin's price action has been markedly less volatile over the weekend, where the Bitcoin price opened at $477.43 on Friday and currently is at $472.80. It seems that futures contracts have contributed to the stability of the Bitcoin price, with minor fluctuations since September 9 when OKCoin launched its futures exchange.

The Russian Finance Ministry recently announced it will ban Bitcoin and other crypto-currencies in 2015. Russia is the third country to attempt to ban Bitcoin, following Ecuador and Bolivia. The motive behind this move is to prevent the crypto-currency from being used to finance terrorism, money laundering and other illegal activity. However, this can be accomplished just as easily as with the Ruble or any other fiat currency. The ban may impede adoption in Russia. This development contrasts somewhat with the Bank of England’s slightly positive stance; a recent report illustrates the disruptive effect it can have on monetary policy, however it could in the future be used as money if wider adoption takes place.

Targeting 'Under-Banked' Nations

In just over 2 weeks, UROEX will open Bitcoin exchanges in Pakistan and Cambodia. UROEX is a Bitcoin exchange that specifically targets under-banked nations, aiming to capitalize on the huge potential that Bitcoin has to provide access to banking services in developing countries. Also, in Mexico Bitso and Pademobile have joined forces to offer a digital wallet for mobile phones, which is SMS based, allowing those without smartphones to benefit. Bitso will now give access to approximately 3 million users of Pademobile. Through this service, payment of Bitcoin is now accepted at every 7-11, a convenience store chain, in Mexico.

TeraExchange has been given the go ahead by the Futures and Commodities Trading Commission for the first regulated platform for Bitcoin derivatives in the US. Also, the Bitcoin spot price index will be made available. TeraExchange developed the platform to meet the increasing demand of international merchants, payment processors, miners and hedge funds for an effective hedging tool.

The chart above shows the 4-hour Bitcoin price action. After breaking through the cloud in the upward direction and remaining above it, the price action has broken through the cloud in the downward direction. A close below the cloud will indicate a downward trend forming. However, the conversion line is above base line indicating bullish momentum. Also, the cloud has turned green so we should see an upward move within the current downward trend.

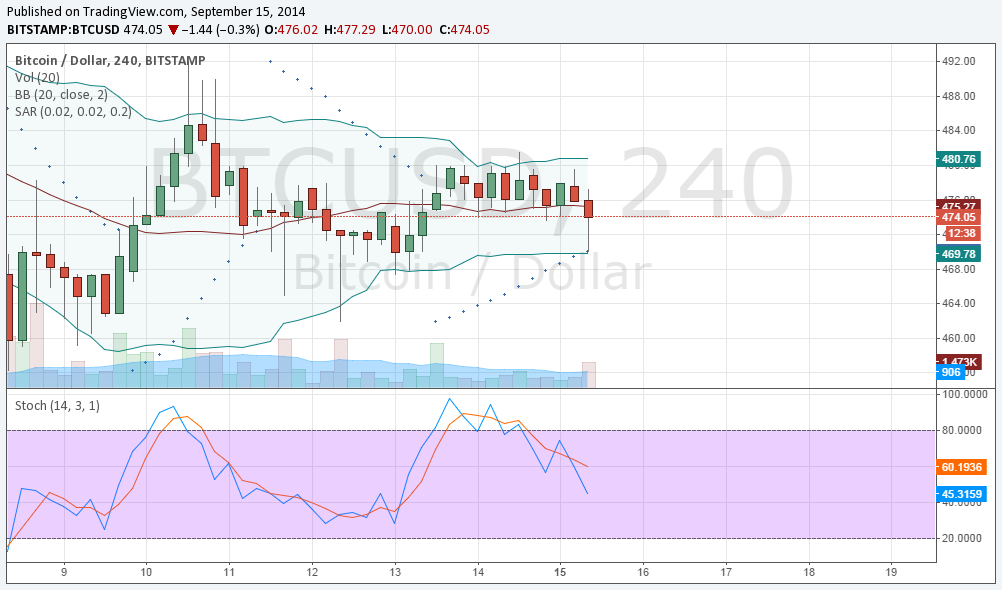

The chart below also shows the price action at the 4-hour timeframe. The parabolic stop and reversal has not yet indicated the start of a downward trend, as the dots are below the price action. On the other hand, the stochastic implies that the price can fall further before entering oversold conditions. Using the Bollinger Bands®, we see that the price could possibly fall as low as $469.78 before bouncing upwards and returning to the middle band at $475.27. Alternatively, if the price moves up, it is expected there will be resistance at $480.76.

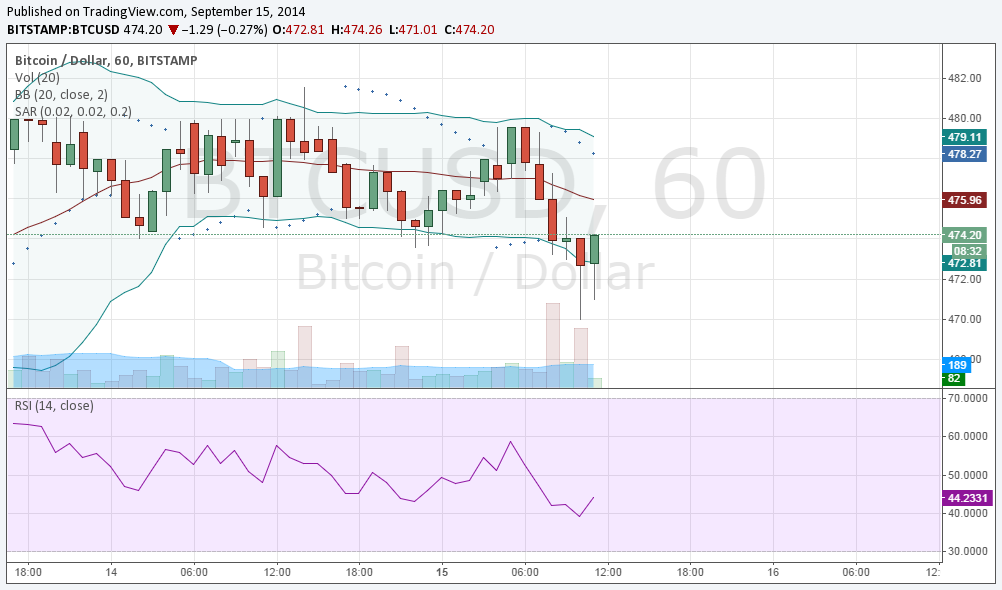

The one-hour chart shows that the price is bouncing off the bottom Bollinger Band® and the price is moving toward the middle of the bands. Also, the relative strength index is increasing but has not yet passed the 50 mark, which if happens, the upward trend will be consolidated and could see the price move to the upper band at $479, before returning to $475.