What is with all the crazy extremism? The markets are not crashing and they are not going to the moon either. Yet analysts, media people, newpapers and bloggers are all picking an extreme view and espousing it.

Big names that you respect like Ron Baron are calling for a 30,000 on the Dow Jones Industrial Average in 10 years. Dougie Kass and his ‘Summer of 1987 Feeling’ sees it heading the other way. There are of course many others with extreme views on both shorter and longer timeframes.

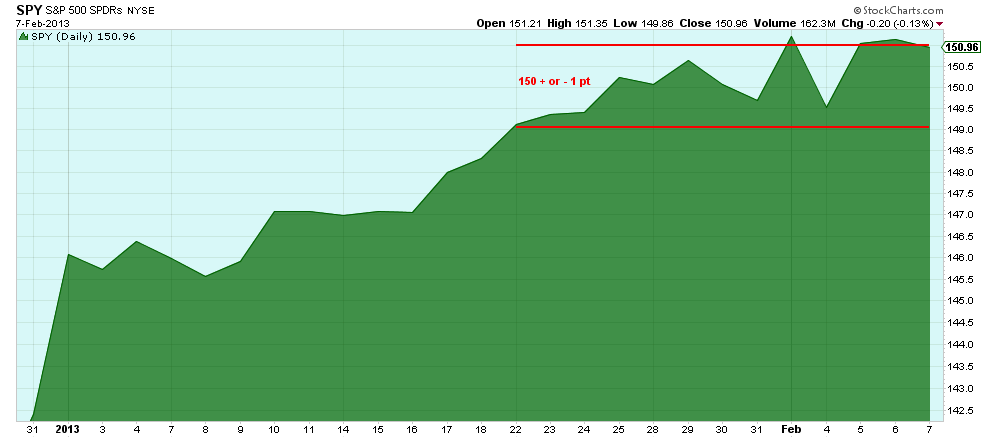

The one thing that I do not see though is a group of people that are just chilling. Waiting for something to happen but recognizing what has been happening the last 3 weeks. Absolutely nothing. The simple chart of the S&P 500 SPDRs, SPY, shows that since it has breached the 149 level January 22nd, it has done nothing but move sideways.

There has been all this extremism about a top being in or new highs coming and the SPY has stayed in a 2 point range the entire two weeks since. That is less than a 1.5% band. Is it really all that surprising that the SPY is consolidating/resting/moving sideways at a level of 150, a nice big fat round number. That the Dow is doing it at 14,000, or the Russell 2000 iShares, (IWM) at 90?

How long will this go on? Until one side or the other gets tired of shouting about doom or prosperity is my guess. And my personal view is that it resolves to the upside (sorry for not using all capitals or bold). You can deal with this by going on a ski vacation or a trip to the Caribbean until that time comes. Or you can adjust your timeframe and be patient, or like us, use essentially forward trades, via call calendars in the options market. Whatever your choice, just stop yelling and recognize that all that is happening is a sideways slog. Until it changes.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The SPY Is Just In A Range

Published 02/10/2013, 01:20 AM

Updated 05/14/2017, 06:45 AM

The SPY Is Just In A Range

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.