Investing.com’s stocks of the week

Market movers today

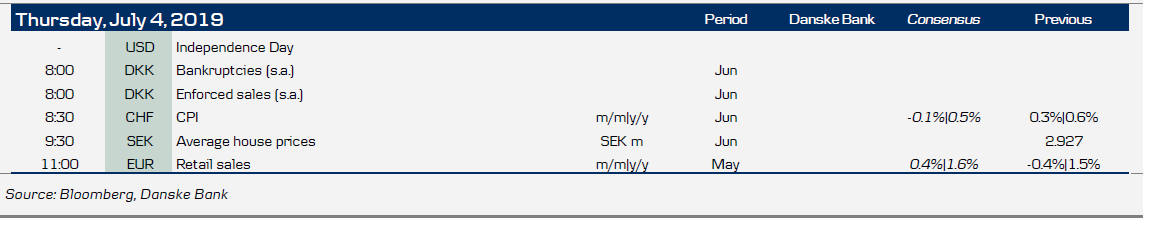

- We are looking at a quiet day on the release front with the US markets closed for the 4 July celebrations.

- In the Eurozone, we get retail sales which are expected to edge up slightly. While investments have been facing headwinds amid the trade uncertainty, retail sales have remained fairly steady.

- The tensions between Iran and US is rising after Trump warned Iran yesterday about stepping up its uranium enrichment. Iran has called for EU economic guarantees by 7 July or else it will proceed with the nuclear programme.

Selected market news

The European government bond markets continue to see spread compression between the core-EU markets and the Periphery. 10Y Greece is now close to breaking through 2% ahead of the general election in Greece on Sunday. The combination of the nomination of IMF's Largarde to be head of the ECB, soft economic data, fiscal discipline in Italy as well as the hunt for yield combined with expectations of more upgrades of e.g., Greece from rating agencies is supporting the rally in the periphery.

The positive sentiment in Europe is also supporting US Treasuries from the long end, where the 2-10Y curve has flattened in recent days. Rate cuts have been priced into the 2Y segment and thus the long end has to rally ahead of the US labour market report released on Friday.

US equity markets continue to rise ahead of the 4 th of July holiday, but the move has not been followed in Asia this morning, where we have seen a mixed picture in the equity markets.

In the Scandi markets we see a significant increase in prepayments of 2% 30Y callables in the Danish market see more in the link above. The Riksbank did not change much in their policy at yesterday's meeting see more in the 'Selected reading' links above.

There are limited data releases today and the US markets are closed. Hence, we expect to see modest activity in the markets.

In Denmark, today brings figures for bankruptcies and forced home sales in June. The number of forced home sales has generally been falling in recent years but remains higher than prior to the financial crisis. In contrast, the number of bankruptcies has been rising in the past few years. However, this can also be seen as a healthy sign, as it indicates greater competition between Danish companies.

Key figures and events