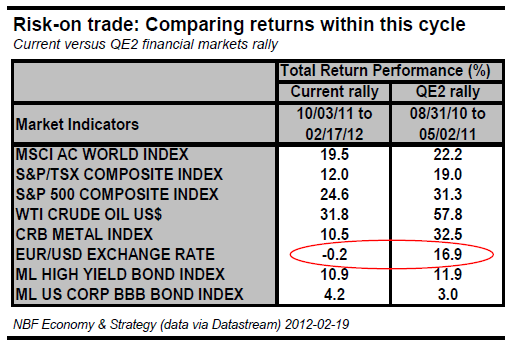

It seems that the risk-on play is back in force. Many of the reflation trades show significant increases. Global equity markets are on the rise, high-yield and BBB corporate bonds are rallying and commodity prices are gaining momentum, all much as a result of central banks around the world opening the monetary spigots for 2012.

Some trades, however, are far from matching the general market advances. The euro, though gaining some ground from its bottom of late 2011, has underperformed both other risk-on trades and its own rise in the Fed-induced QE2 rally that began in the second half of 2010.

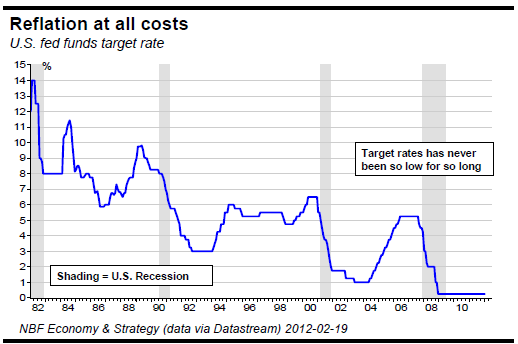

Reflation at all costs

Central banks are aggressively promoting an easymoney environment for 2012 and beyond. As the joke goes, central banks seem to be focusing once again on their core business, printing money and buying debt.

The ECB has its main policy rate back down to 1% and has carried out an atypical 1% Long-Term Refinancing Operation (LTRO) in which it lent banks €489 billion for three years. A second round of LTRO, which reduces medium-term financing risk for the European banking system, is set for February 29. Meanwhile the Bank of Japan, after two decades of price impotency, has declared war on deflation by setting a 1% inflation target. In addition to continuing its zero-interest policy, it will expand its asset purchase program by about ¥10 trillion to ¥65 trillion, earmarked for purchase of Japanese government bonds.

In February the People’s Bank of China reduced its bank reserve requirement another half point. It faces a deceleration of economic growth together with what seems to be sticky consumer price inflation. With global growth decelerating in 2012, we expect that Chinese inflation will also soften, eventually prompting further easing in pursuit of Beijing’s target of 8% GDP growth. Beijing has also been taking steps to reverse an anticipated fiscal drag and avoid a liquidity crunch for local government. It has ordered commercial banks to roll over about $300 billion in local-government debt maturing this year. This move is consistent with Beijing’s tendency to micromanage the economy. We expect more stimulus to be announced in the coming months.

And of course, the U.S. Federal Reserve has stated that it expects to hold interest rates at current levels “through late 2014.”

The minutes of the most recent FOMC meeting note that a few members thought economic conditions “could warrant the initiation of additional securities purchases before long” – in other words, QE3 remains an option. In addition, Operation Twist, the Fed plan launched last September to buy $400 billion in bonds maturing in 6 to 30 years and sell maturities of 3 years or less, will continue to influence the bond market until at least June.

In sum, central banks are putting their cards on the table and their hands spell “reflation.” Their signi policy shifts are aimed primarily at reducing the risk of crisis and supporting economic growth. At the same time, ultra-low rates force the hand of investors and consumers, making risk more attractive to the former and spending more attractive to the latter. So far, it seems that central bankers have made progress in stirring up animal spirits. How long will it last?

Europe stabilizing?

Europe remains a thorn on the side of many investors. With its economy currently in recession, many are worried about potential spillover to emerging Asia that, in many people’s minds, would lead financial markets to a repeat of 2008. While acknowledging the risk, we suggest that the impact of Europe on Asian economies has been minor so far. In addition, the doomsday risk has been reduced by significant improvements in Europe’s political and financial system over the past three months. First, the IMF, the ECB and the European Commission have made progress on a plan with Greece to once again avoid default on Greek debt. As a result many institutions exposed to CDS counterparty risk will live to fight another day. At least as important are the steps taken, as a result of ECB initiatives, to shore up balance sheets in the European financial system and reduce the probability of liquidity problems in the near future. More specifically, the ECB’s LTRO invites banks to borrow money from the ECB’s discount window, giving many institutions significant breathing room that they lacked before this operation. In sum, the situation is better today than it was a few months ago.

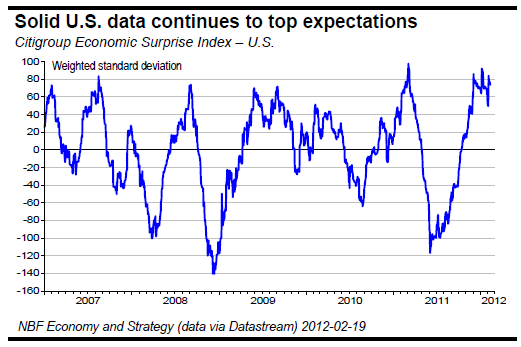

U.S. economy stealing the spotlight

Over the past few months the U.S. economy has shown signs of significant improvement. As the U.S. economic surprise index suggests, the indicators have been consistently beating expectations.

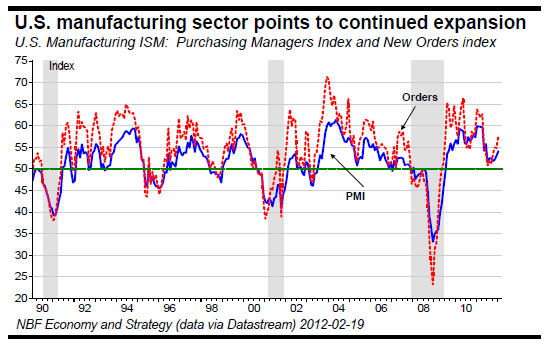

The improvement shows in several areas. The ISM PMI manufacturing index has rebounded from its 2011 decline. The advance is led by renewed strength in new orders, a sign that manufacturing will continue to perform well this year (chart).

Automotive sales and production have advanced in recent months. A contribution from this industry is essential for the economy to remain on a path of sustainable expansion.

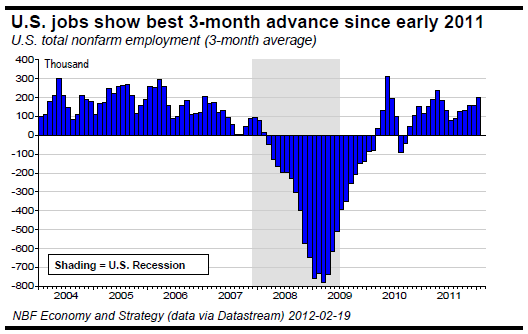

That path is becoming clearer as U.S. labour market indicators bring more good news. Payroll numbers continue to show the best results since early 2011. Gains have averaged 200,000 jobs a month over the last three months, a run not seen since last April when the economy was crimped by shock waves from the Japanese tsunami and by escalating worries about European sovereign debt.

Meanwhile, initial unemployment claims continue to decrease, signalling further improvement in the labour market.

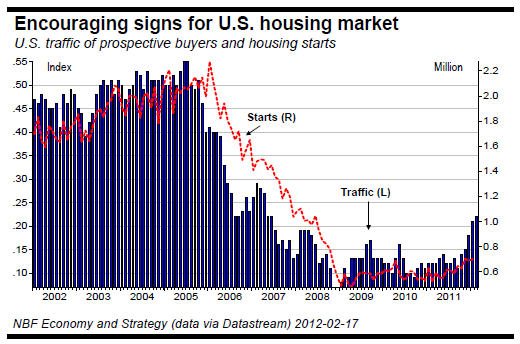

With payrolls rising, we expect the housing market to pick up. Early signs are promising. Inventory has declined markedly, with fewer existing homes for sale than at any time since 2005. Prospective-buyer traffic is on the rise, another omen of turnaround (chart).

Risks are nevertheless substantial

Though the global economic and political news has been good of late, this is no time to set the cruise control. The risks are not small. First and foremost, we continue to expect the economy of the euro zone to weaken in the first half of 2012. The turn to fiscal austerity offers little hope of a strong rebound over the next couple of years. As a result the euro-zone earnings outlook remains lacklustre, especially for Greece, Ireland, Italy, Portugal and Spain. Financial stress in the zone could stay relatively high for some time.

Elections could become an important headwind for financial markets in the coming months if populist rhetoric brings new waves of volatility. Elections in France and Germany will provide a sounding board for challenges to the programs put in place to protect the euro zone. U.S. elections in November also hold their share of uncertainties for equity investors. Valuations could take a hit from an increase in taxation of dividends as proposed in some Washington circles. The prospect of more stringent regulation – the Volcker rule, for example – also argues for some degree of caution.

Also, energy price inflation is becoming less and less manageable as geopolitical risk drives up the price of crude. Brent is up 31% since October 2011 and is now trading above $120 a barrel, far beyond our comfort zone. This is costly for industrial producers and taxing for consumers at a time when the global growth outlook is relatively fragile. Liquidity injections from central banks are important, but we would be much more comfortable about the global growth prospect if Brent crude were to fall below $110.

Are markets overbought?

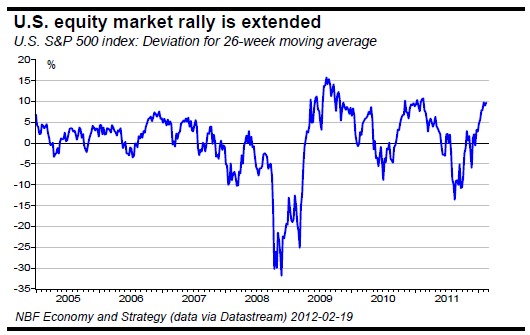

There is a case to be made for reducing exposure to equities, especially U.S. equities. Most of the gains we expected from equity markets in 2012 are already in hand. The S&P 500 is now trading above our yearend fair-value target of 1350. Investors might be willing to pay larger multiples for equities, but the most we can see as reasonable is another 5% by year end. Extended readings of momentum also suggest that U.S. equity markets may be set for a pause.

Bottom line: If the S&P 500 moves above 13.5 times forward earnings, we suggest clients move exposure back toward neutral. The risk here is underestimating the lift from monetary easing, which could drive a stronger-than-anticipated multiple expansion this year. The S&P/TSX composite has underperformed the major U.S. indexes since the beginning of the rally. As a result it is less extended and, unlike the S&P 500, has yet to reach our year-end target (12,720). If world growth matches our expectations and industrial commodity prices advance further, Canadian markets are likely to benefit.

Canadian earnings season

The Canadian Q4 earnings season is well under way, with more than 45% of the S&P/TSX Composite companies reporting so far. At this writing the results are uninspiring. EPS growth shows a negative surprise of 6.3%, with eight of the 10 sectors coming in below estimates (though 55% of companies reporting have beat expectations).

Top-line growth is also coming in lukewarm – a positive surprise of 1.6% so far, but with only 50% of companies beating estimates. Most companies in the Materials sector have missed sales expectations. So at this writing the Q4 reporting season is on track to disappoint, especially after the large negative revisions that preceded the reporting season.

Canadian earnings outlook for 2012

The prospects for 2012 earnings are fair. We see growth of 8% for 2012 over 2011. This single-digit outlook is predicated on limited expansion of profit margins over the year. If margins peak as we expect, sales growth will be the main driver of earnings over the next 12 months.

Asset allocation

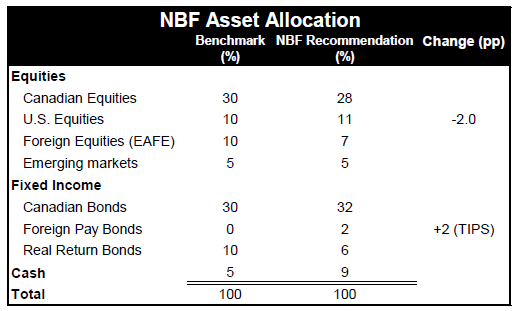

Equity markets have increased their year-to-date advances in the past month. The risk-on trade has gained lift from the renewed willingness of many central banks to ease. It should be kept in mind, however, that the prompt for easing is a slowdown in global growth. Europe, the world’s weakest link, will weigh on the world economy for some time. In addition there is the challenge of debt problems in the developed world and the uncertainty surrounding it. We don’t know yet how much the European recession will affect Asian economies, the real risk to our growth scenario. This month’s expansion of equity prices has made holding U.S. equities less attractive, at least for the time being. We have not changed our 2012 target of 1350-1400 for the S&P 500. Consequently, we are decreasing our U.S. equity exposure by 2 percentage points, to 11% (benchmark is 10%), in favour of short-term U.S. Treasury Inflation Protected Securities (TIPS). We expect headline inflation to be pushed up above the current breakeven rate by the recent surge in gasoline prices. This change in allocation boosts our real return bond holdings to 8%. All else is unchanged this month.

Our year-end target for the S&P/TSX Composite is 12,720, implying a trailing multiple of just over 13 times our EPS forecast of 960. Our sector allocation is unchanged this month.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Spigots Open, the Bulls Return

Published 02/28/2012, 06:44 AM

Updated 05/14/2017, 06:45 AM

The Spigots Open, the Bulls Return

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.