The big story in small-caps so far in 2016 remains the revival of small-cap value’s leadership over small-cap growth. But the third quarter is an interesting story in its own right.

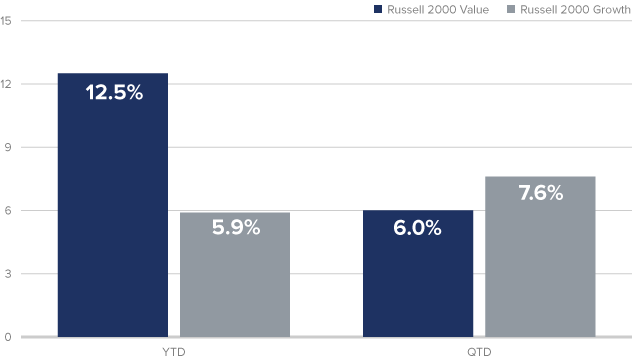

With a little more than two weeks to go, we’re seeing ongoing strength for small-cap stocks. The Russell 2000, Russell 2000 Value (NYSE:IWN) and Russell 2000 Growth (NYSE:IWO) all showed healthy advances both year-to-date and from the end of June through the end of August (and into mid-September as well). Year-to-date through 9/15/16, the Russell 2000 Value Index was up 12.5% versus 5.9% for the Russell 2000 Growth.

Small-Cap Value Leads YTD, Trails Growth QTD

Russell 2000 Value and Growth Returns, 12/31/15-9/15/16 and 6/30/16-9/15/16

One of the most intriguing developments in small-cap this quarter is the margin separating growth and value. From 6/30/16-9/15/16, the Russell 2000 Value increased by 6.0% while the Russell 2000 Growth advanced 7.6%.

So far, then, the quarter appears to be a catch-up period for many small-caps that did not fully participate in the initial phase of the rally off the 2/11/16 low for the Russell 2000. This has meant higher third-quarter returns for micro-caps, growth companies, and lower-quality businesses (as measured by earnings, profitability, and returns on invested capital).

Are we concerned, then, that the third-quarter moves mean a resumption of the unfortunate pattern that marked 2011-2015, in which most small-cap investors gravitated to safety and/or high yield at one extreme and speculative growth at the other?

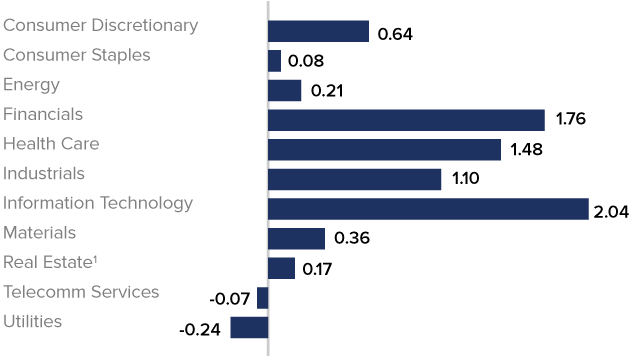

We are not. In sharp contrast to other periods, such as 2015, small-cap sector strength has been widespread in the quarter (and in 2016 as a whole). From 6/30/16- 9/15/16, the Information Technology, Financials, Health Care, and Industrials sectors made the greatest contributions to third-quarter-to-date returns, and only two sectors—Telecommunication Services and Utilities—were negative.

Widespread Small-Cap Sector Strength QTD

Sector Contributions to Russell 2000 Returns, 6/30/16-9/12/16

1Real Estate, formally part of Financials, became a separate GICS sector in 3Q16.

It’s important to remember that this strength has come across a broad range of industries within these four sectors—and that each is among the most diverse in the equity universe.

Expanding breadth and ongoing positive returns through much of the asset class are welcome developments, even if higher-quality small-caps spent much of the summer in the back seat.

To be sure, the summer months were placid—as they have often been—which we think helped certain smaller, lower-quality companies to come close, pull even, or move ahead of their larger, higher-quality small-cap counterparts.

But volatility (as measured by the VIX) has been picking up of late. And we think there’s a good chance we’ll see even more market gyrations in the next few months, with two Fed meetings on tap before the end of the year, the election in November, and ongoing uncertainty about the global economy.

In other words, we don’t think we’ve seen the last of the interesting moves within small-caps by any measure.

Stay tuned…