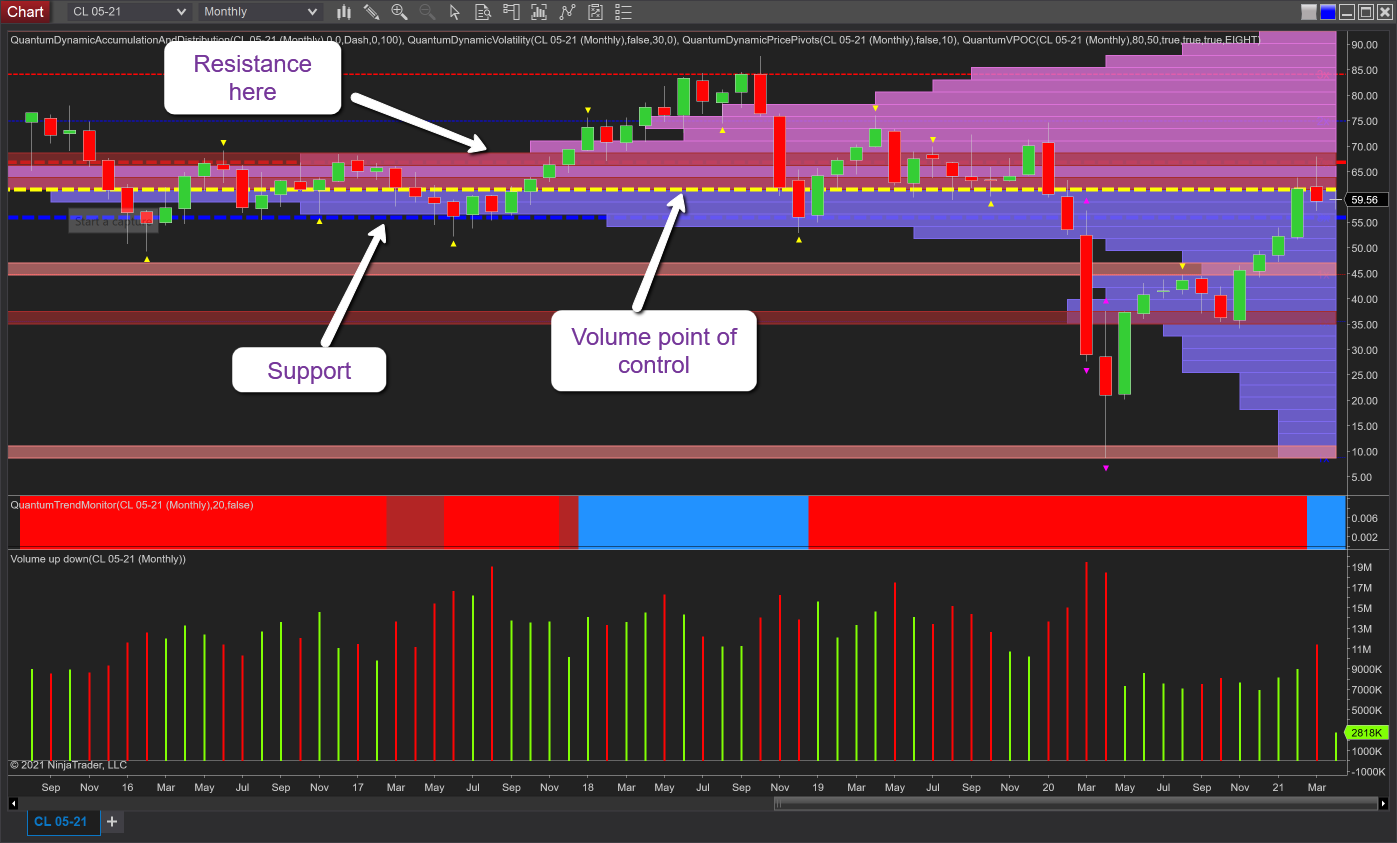

Of all the timeframes and charts for the WTI oil futures contract, it is perhaps the monthly which is the most revealing and one I have referenced many times in my analysis of oil.

The level of resistance which I have constantly highlighted and suggested oil would not breach yet is at $66 per barrel. That's shown on the chart with the red dashed line.

The significance of the monthly chart cannot be underestimated as it carries the weight of time, thereby giving additional importance to these levels. Last month was a classic sign of weakness with the candle closing on a deep wick to the upper body and good volume, having duly tested the resistance level at $66 per barrel.

In addition, and pivotal, is the fact we are trading at the volume point of control just above the $60 per barrel level and shown with the yellow dashed line. This is where we expect congestion to build as it represents the fulcrum of the market where bullish and bearish sentiment is equally balanced and there is, therefore, no trend.

As we have just arrived at this point on the monthly chart, we can expect congestion to build with support in the $57 per barrel region as denoted by the blue dash line which will come into play as the market probes the downside.

In summary, given the technical picture on this timeframe, expect to see the price of oil remain rangebound in this channel for the next few weeks.