Here is a thought experiment: what if the US economy entered a recession next month? Would it be too early for a recession? How would it compare to previous recessions? And what stories would we tell to explain why the recession happened?

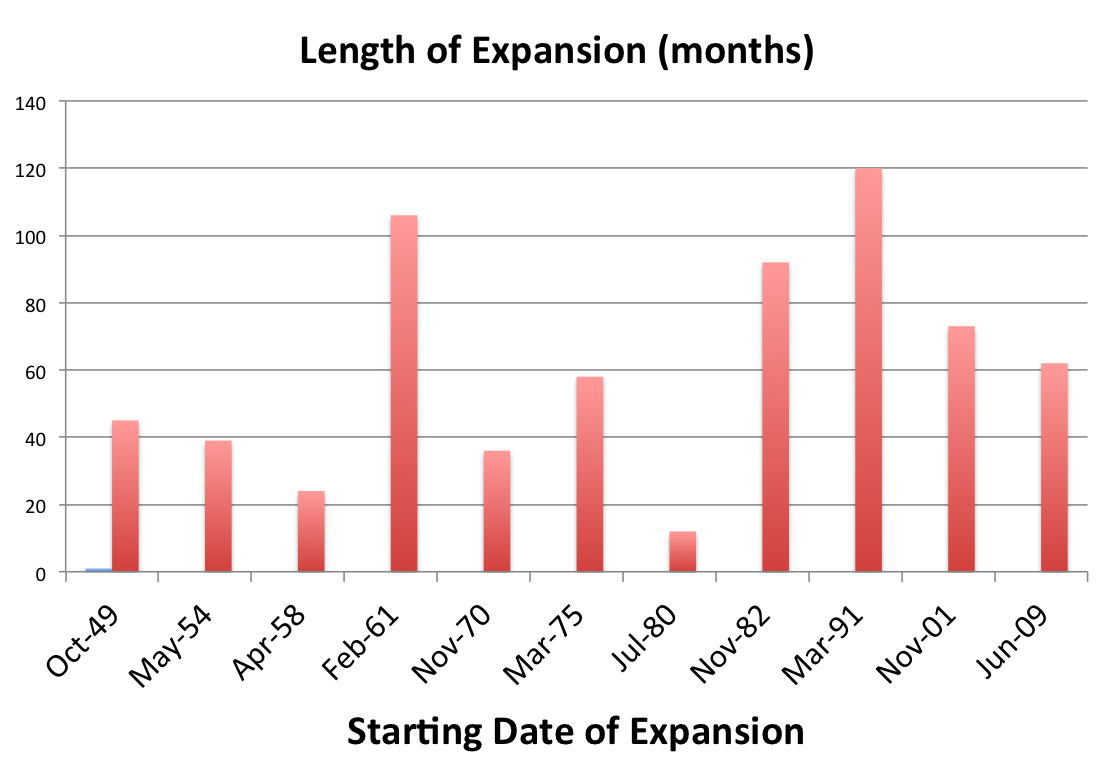

Let's start counting months using the two phases of the business cycle as defined by the NBER business cycle dating committee. How long is the current expansion? The current expansion started in June 2009, which makes it already 62 months. Compared to all the previous post-WWII expansions it is already above average (60.5 months).

What would be more unusual is the way the economy would look as it entered a recession. There are no indications of the economy running out of slack (inflation, wage growth). It would also be very hard to find large financial excesses as we saw at the end of the 90s (the stock market reached price-earning ratios that are a lot higher than what we see today) or something similar to the large increase in investment in real estate in addition to highly overvalued housing prices that we saw in the years prior to the December 2007 recession. We could of course argue that the recession happened because of geopolitical uncertainty but any historical analysis of political events over the last decades would suggest that what we are seeing today (so far, keeps fingers crossed) is not that unusual.

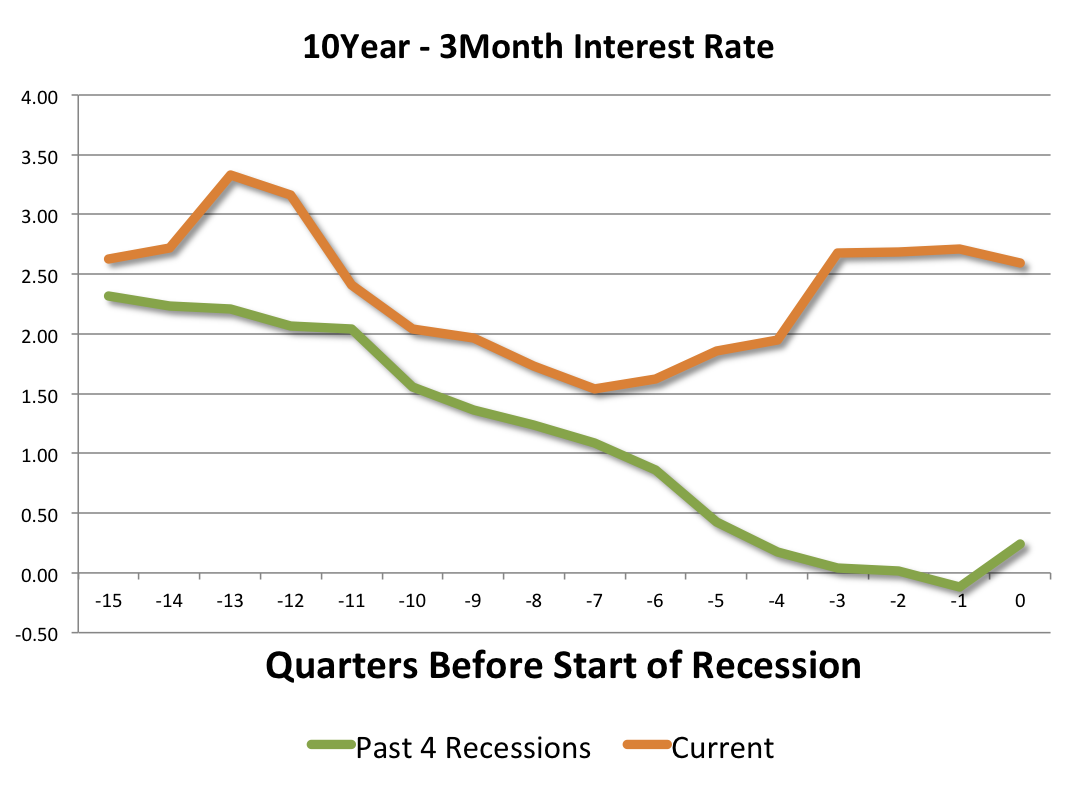

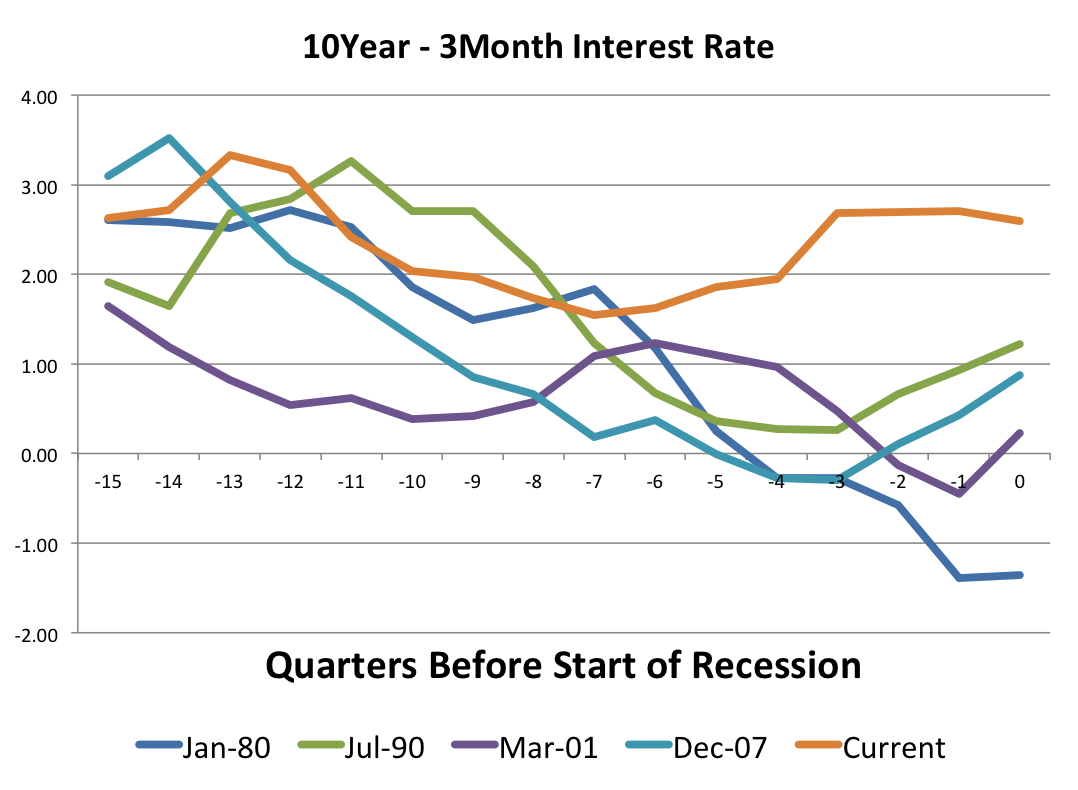

And if a recession started today, one pattern that would also be very different is the stance of monetary policy. If we measure it by the difference between long-term and short-term rates we typically see that this difference displays a strong and consistent downward trend as we approach a recession, something that we have not seen at all in recent months (or years). Here is a quick comparison of the difference between 10 year and 3 month interest rates for the average of the last four recessions compared to what the data would look like for a recession starting today.