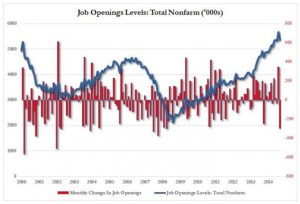

Employment – the JOLTs report revealed that in August, the number of job openings tumbled by the biggest monthly drop since March of ’09, year over year trend: advancing

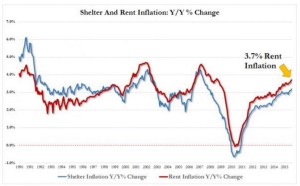

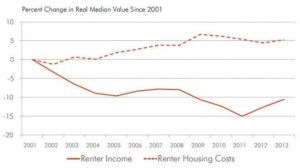

Housing – average rents are up 3.7% YoY, rising double the pace of core inflation, and at the highest pace since ’07, year over year trend: advancing

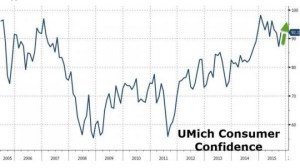

Confidence – University of Michigan Consumer Sentiment rose from 89.0 to 92.1, bouncing after 3 straight months lower, year over year trend: advancing

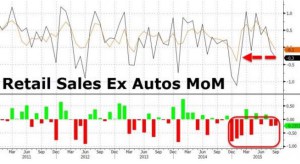

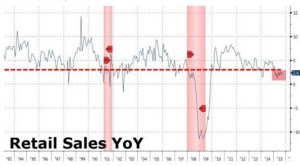

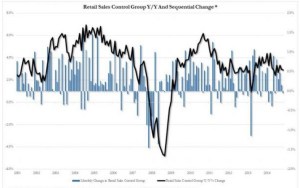

Retail Sales – retail sales (ex Autos) dropped 0.3% in September, the 2nd drop in a row, the biggest drop since January. and its 7th miss in the last 10 months, year over year trend: recessionary

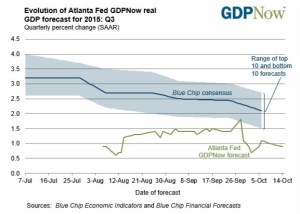

Q3 GDP Forecast – 0.9%, year over year trend: receding

Employment

The JOLTs report (Yellen’s favorite employment metric) revealed that in August, the number of job openings tumbled by 298k to 5.37 million, the biggest monthly drop since the 301k drop in March of 2009.

Housing

Average rents are up 3.7% YoY, rising not only double the pace of core inflation, but at the highest pace since ’07.

The real (inflation adjusted) story is that most American rent and their inflation-adjusted income has not kept up with inflation-adjusted renter housing costs.

Confidence

University of Michigan Consumer Sentiment rose from 89.0 to 92.1, bouncing after 3 straight months lower.Both current situation and futures expectations rose. The Fed’s Bill Dudley previously noted this consumer confidence data is a must-watch for The Fed in its rate-hike decision-making.

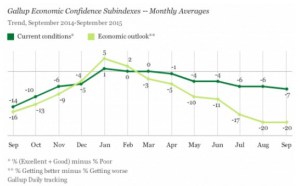

However, Gallup’s economic confidence surveys continued their downtrends.

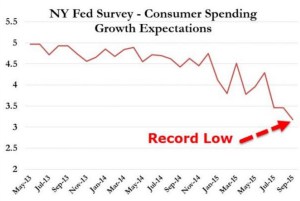

…and the NY Fed’s Consumer Expectations Survey of household spending growth expectations have plunged.

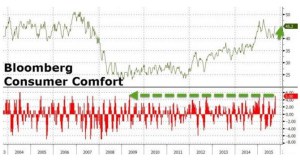

So how comfortable are consumers? The last 4 weeks have seen Bloomberg’s Consumer Comfort index rise at the fastest pace since the move from the March ’09 low… the driver, women, whose comfort rose from 41.6 to 43.0 (as men dropped from 48.2 to 47.6).

Retail Sales

Retail Sales (ex Autos) dropped 0.3% in September, the 2nd drop in a row, the biggest drop since January, and its 7th miss in the last 10 months.

…the year over year trend remains recessionary,

…and the control group saw its first monthly drop since February.

Q3 GDP Forecast

The FED’s GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of ’15 was 0.9% as of Oct. 14 (down from 1.0% on October 9).

The change reflects weaker consumer spending and retail sales, which was offset by better inventory investment to GDP growth.

To learn more, visit Federal Reserve Bank of Atlanta’s website.

Asset Allocation Summary

Major Asset Class Allocations – 5% Stocks, 75% Bonds, 20% Cash

Int’l Developed Stock Allocations – 1.25%– Italy/Germany

Int’l Emerging Stock Allocations – 1.25%– Mexico/Indonesia

Int’l Emerging – BRIC Stock Allocations – 2.5%– Brazil/Russia

US Bond Allocation – 62.5%

Int’l Developed Bond Allocation – 2.5%

Int’l Emerging Bond Allocation – 10%

Asset Class Trends (for new allocation commitments)

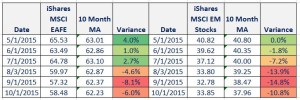

Int’l Developed Stock Trend – bearish

Int’l Emerging Stock Trend – bearish

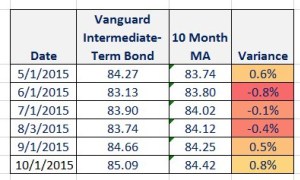

US Bond Trend – neutral (previously bearish)

Int’l Developed Bond Trend – neutral (previously bearish)

Int’l Emerging Bond Trend – bearish

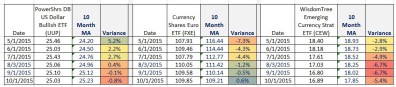

US Dollar– neutral

Euro– neutral

Emerging Markets Currencies– bearish

OVERALL RECOMMENDATION – hold existing allocations / no new allocation commitments

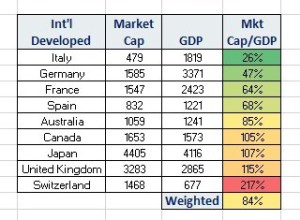

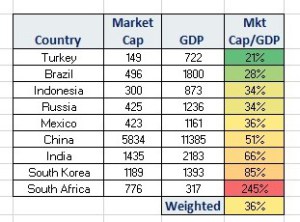

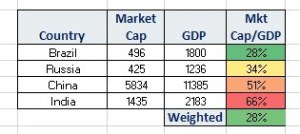

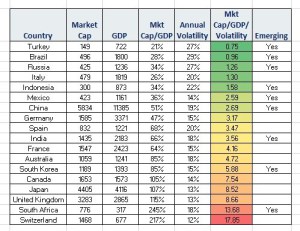

Country Stock Fundamentals – Market Cap/GDP ratios (October)

Int’l Emerging – BRIC offers the best opportunity based on their weighted Mkt Cap/GDP value to overall GDP weights across the globe.

Int’l Developed

Int’l Emerging

Int’l Emerging – BRIC

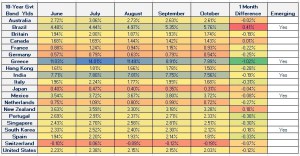

Yields

Bond yields are falling across almost all economies.

The one major exception is Brazil, which is experiencing both political and economic turmoil.

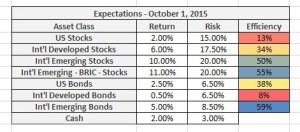

Dynamic Asset Class Expectations

Shiller’s 10 Yr. CAPE Ratio translates into a 2% 10 Yr. expected return on US stocks.

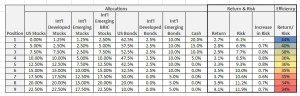

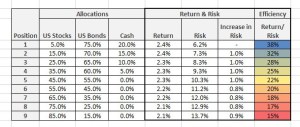

Dynamic Asset Allocation

Based on efficiency, the most attractive mix is position 1.

US + International Allocations

US Only Allocations

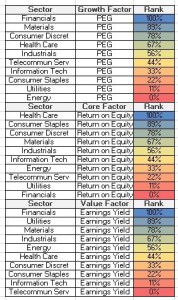

US Stock Sector – Fundamentals

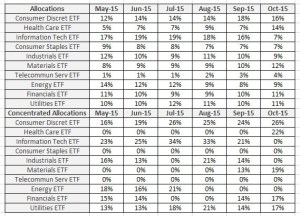

US Stock Sector – Allocations

To see a back-test of the approach and how it works:link

International Stock Allocations

When we look at Market Cap/GDP/Volatility (October), our most attractive countries are mostly emerging.

Trends – Trade Execution – Utilizing Monthly Price Trends (and US Volatility)

The following cyclical tables get to the heart of timing and when the trend in prices is optimal (bull) for buying.

US Stocks and Bonds

Stocks topped in July.

Bearish price / volatility trend is currently in place.

For bonds, the trend is neutral.

International Stocks

The trend for Developed and Emerging remains bearish.

International Bonds

Developed bonds have turned neutral and Emerging remain bearish.

Currencies

The US dollar is neutral, the euro is neutral and Emerging Markets currency remains bearish.

Disclaimer: This is neither an offer to sell nor the solicitation of an offer to purchase any interest in or any other investments discussed. The ETFs identified in the report are utilized as asset class and currency proxies and are not intended as recommendations to buy or sell. This publication is for informational purposes only; it is not intended to be a solicitation, offering, or recommendation of any product, security, transaction, or service. It should not in any way be interpreted as investment, financial, tax, or legal advice. All data herein was obtained from publicly available information and/or sources, internally developed data, and other sources believed to be reliable. Except as otherwise stated, Mr. Grennon has not sought to independently verify information obtained from public or third party sources and makes no representations or warranties of any kind, express or implied, regarding the accuracy, completeness, or reliability of such information. Hypothetical and forward looking statements should not be taken as an indication or guarantee of any future performance, analysis, forecast, or prediction.