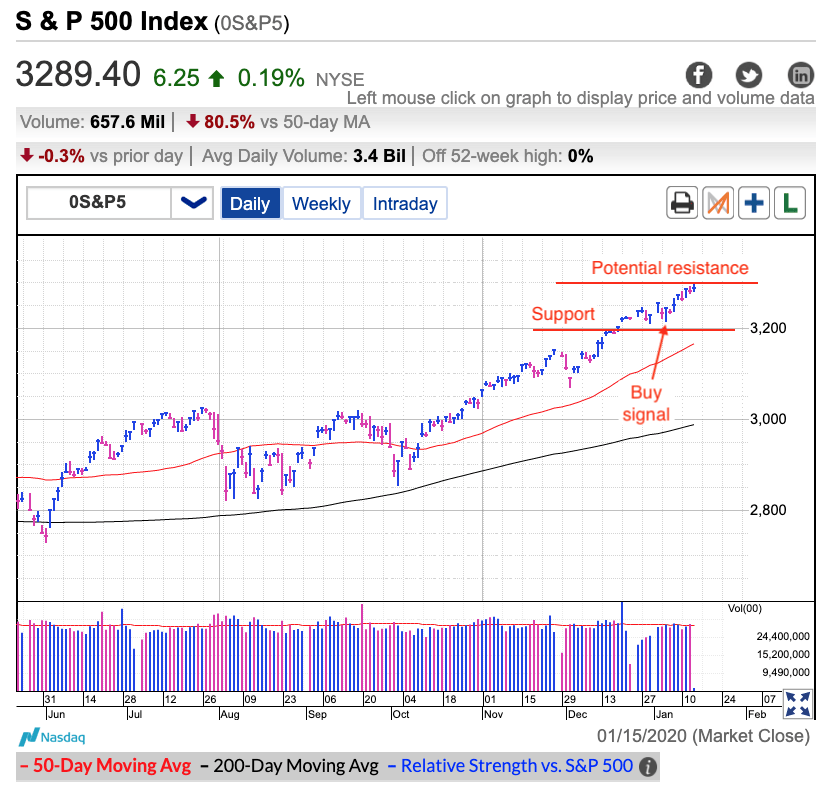

Two weeks ago I wrote the blog post “Why January’s start is so bullish“. The market reflexively dipped after the U.S. killed an Iranian general and that initially put traders on edge. But rather than extend the selling, most owners shrugged off the headlines and snapped up the discounts. That morning’s dip tested 3,200 support and here we are nine days later, challenging 3,300 record highs.

I will be honest, on January 1st I was skeptical the one-way rally since the October lows could continue, but as soon as I saw the way the market reacted to the general’s killing and the subsequent attacks on U.S. airbases, I knew this was a strong market and prices were still headed higher. We don’t need to be able to predict the future if we know what clues to look for.

But that was then and this is now. The easy buy was two weeks ago when the market bounced decisively off 3,200 support and never looked back. But now that we are nearly 100 points higher, the risk/reward looks far different. Without a doubt, buying now would “feel” a lot easier than buying in the face of an escalating military conflict in the Middle East, but doing what feels good in the market rarely works out. In fact, we should be edging in the opposite direction, rather than buying this surge to the highs, we should be looking for opportunities to take profits. Anyone savvy enough to buy last week’s dip should be moving their stops up and even considering taking some profits proactively. If we are in this to make money, the only way to do that is by selling our winners.

As for what comes next, there are two ways the market approaches 3,300. Either the buying accelerates and we race toward a climax top, or the rate of gains stalls and we consolidate recent gains. If a person wants to hold for further upside, make sure you move your stops up when we cross 3,300 so your profits are protected. As for the most balanced approach, it makes sense to take some profits and let some ride. If the market continues higher, it is always easy enough to jump back in.