Don’t look now, but the investment world is warming up to Europe.

“There are a few blooms sticking up from the frozen ground,” says Steve Koenig, an analyst at Wedbush Morgan Securities.

Over at BlackRock, Chief Investment Officer Nigel Bolton believes that we’ve reached “a significant turning point for equity investors [in Europe].”

Credit Suisse (CS) is a believer, too. The investment giant recently instructed investors to overweight European banks in their portfolios.

Same goes for JP Morgan (JPM). Equity strategists at the firm now expect Europe to enjoy better growth in the second half of the year.

Talk about fashionably late!

I’ve been banging the contrarian drum on Europe for the better part of the year, recommending the SPDR EURO STOXX 50 Fund (FEZ).

And about a month ago, I urged investors to take advantage of a once-in-a-30-year buying opportunity in European bank stocks via the iShares MSCI Europe Financials ETF (EUFN).

But I’m not here to establish bragging rights. Instead, I’m want to provide a safe way for skittish investors (i.e. – the non-contrarians) to take advantage of the opportunity in Europe before it disappears.

As Thanos Papasavvas at Investec Asset Management notes, “[Europe is] very underinvested from a global-investor perspective.” But that won’t be the case for long. Here’s why…

Follow The Stock Market’s Lead

Make no mistake, we’re witnessing a data-driven – and therefore, legitimate – change of heart on the part of Wall Street analysts when it comes to Europe.

You see, the economy (and currency) – which was once on the brink of complete and utter disaster – is finally on the road to recovery.

Case in point: the latest reading of the euro-zone PMI Composite Output Index. Any reading above 50 indicates expansion. And it just checked in at 50.4 in July – the highest reading in 18 months.

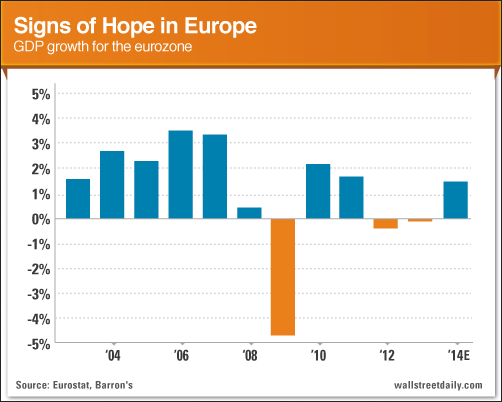

The data underscores the European Commission’s expectation that the euro-zone economies will return to growth in the fourth quarter.

Growth Is Growth

I’ll concede that a GDP growth estimate of 1.4% in 2014 isn’t China-esque. But growth is growth. And it’s a definitive sign that Europe isn’t going to fade to black.

Of course, as I’ve long contested, we only need conditions to transition from “bad” to “less bad” for equity markets to respond. That’s happening. And stocks are responding right on cue…

Twice U.S. Stock Growth

Over the last month, European stocks are up 8.2% – nearly doubling the return of U.S. stocks.

And European bank stocks are performing even better. After hitting a series of higher lows in late June, the iShares MSCI Europe Financials ETF rallied 9.9% in July.

Now, if you’re still too scared to dip your toes in Europe via one of these ETFs, you can still benefit from the imminent turnaround… With a homegrown opportunity, no less.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Safest Way To Bet On Europe's Rebound

Published 08/01/2013, 12:37 PM

Updated 07/09/2023, 06:31 AM

The Safest Way To Bet On Europe's Rebound

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.