Last night there was a major intervention in the S&P Futures that actually started in the late afternoon and continued on through. It gave the S&P a gap up Tuesday morning and a short squeeze before giving back most of it into the bell. A lot of traders are asking, why did it happen last night besides the obvious need to break the downward momentum?

The first chart, the iPath S&P 500 Vix Short Term Fut VXX (VIX Short Term Futures) dictated that it had to happen then. The VXX was due to cross up into its huge red line channel Tuesday morning. By holding the Futures up until a regular session gap up open and keeping the S&P green the entire day, they got the VXX to back away a little from the bottom of that monster channel. We really do not want the VXX to get into that channel. If they can hold the stock market tight where it's at long enough for that red lower channel line to become resistance, they will likely save a lot of 401k holders a great deal of grief. That line has to continue to hold as resistance to the VXX. If it does we might well have a playable bounce here.

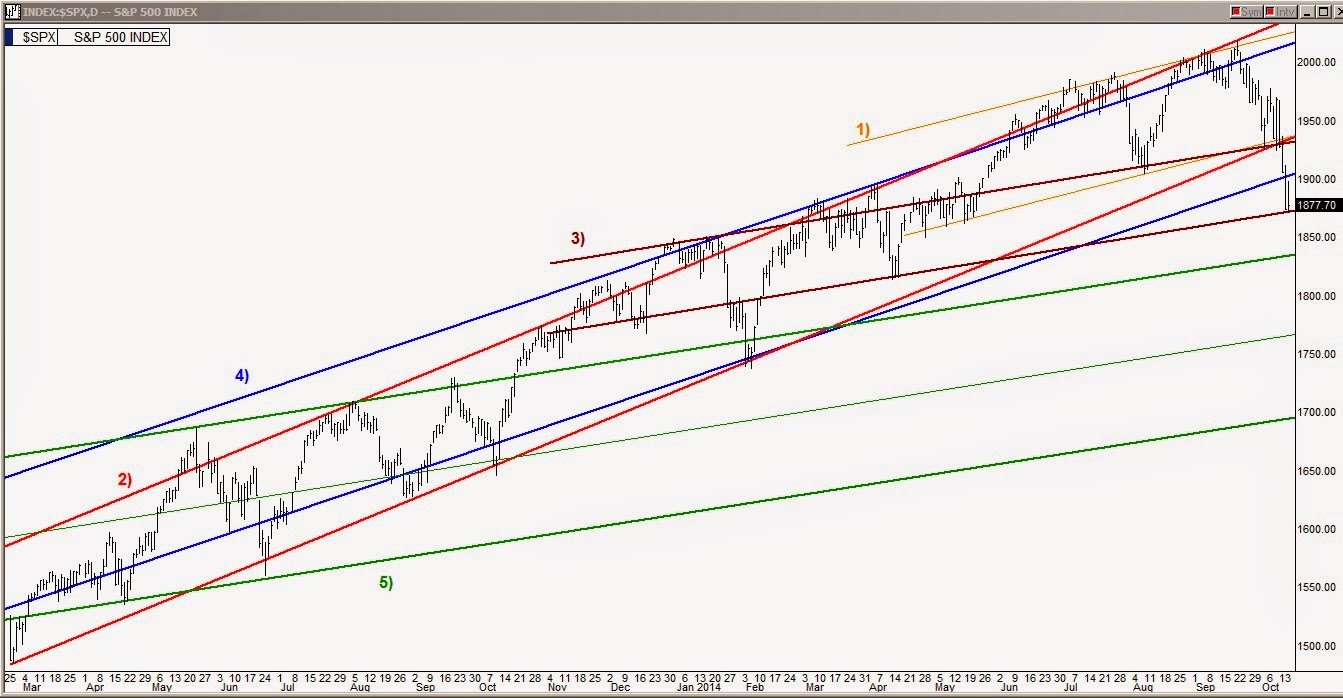

Next let's take a look at what the bulls have to work with now that they have broken the downward momentum. Looking at the second chart, the multiple channels chart of the S&P, we can see that it sat down on the lower line of the brown channel (3). It's too early to say if we will have play in that channel for sure but with the success they had last night and their ability to keep the S&P from going red today was quite impressive. Granted, no one will want to be the first to go into the water but once a few do, the brown channel could be where we spend the rest of this week. Don't bet big either way in this market though, it is so day by day.