The S&P 500 has moved erratically this week, with an emergence of renewed US economic fears disrupting the previous decline. We were under the assumption that 2014 would be the year that the US makes an economic recovery, while exiting its Quantitative Easing (QE) program. The December QE taper halted the S&P 500’s bullish all time highs from advancing any further.

However, after witnessing the past week’s economic news, it appears that the direction this CFD is heading is not yet solidified.

Friday’s NFP (non-farm payroll) confirmed Wednesday’s ADP employment report that the United States would fail to add the expected number of jobs to their economy this month. This is the second month in a row that NFPs have missed expectations. Right now, the atrocious weather conditions the US has witnessed is being made accountable (perhaps rightly so) for the weaker NFPs, but I wonder how long it will be before the markets lose patience with this justification.

Last week was not been a positive one for the United States. Monday’s Manufacturing ISM’s (Institute of Supply Management) showed the weakest growth levels in eight months. Manufacturing is a high contributor to their employment market, with the US being the world’s largest manufacturer. Personally, I do not think it is any coincidence that manufacturing growth slowed considerably last month and a few days later, we are receiving a weak NFP.

Furthermore, I am looking at Yellen’s speech on monetary policy on Tuesday with a high level of caution. One thing we have found out about the new Federal Reserve leader after her Senate confirmation hearing is that she is a passionate supporter of QE. If on Tuesday, Yellen at all hints that two months of substandard NFPs coincided with a slowdown in manufacturing could delay the Federal Reserve’s plans to end QE this year, then it is very likely the bulls will awake.

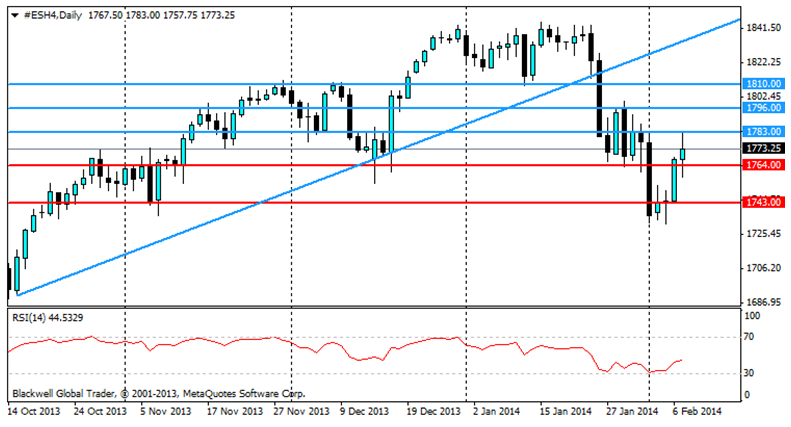

In reference to my technical observations for the S&P 500, the previous bullish trend line was broken in mid-December, the same time of the first US QE taper.

Right now, it appears that the S&P 500 is heading towards the 1783.00 resistance level. If US economic data continues to disappoint, or Yellen hints on Tuesday evening that future QE tapers may need further discussion, bearing in mind the recent US economic news, then 1796.00 and 1810.00 are likely resistance levels.

Conversely, if economic news is positive for the US next week, or Yellen indicates that the Federal Reserve will still end their QE program this year, regardless of recent events, then I expect the previous bearish decline to resume. If looking for support levels, then 1764.00 and 1743.00 can be implemented as targets. Although, according to the RSI, upward movement is in the works.

Overall, after witnessing the S&P 500’s recent movement, I am very much looking forward to hearing what Yellen has to say about the US economy on Tuesday night.

In my opinion, the S&P 500 is my pick to watch over the next few days.