It may seem like a faint memory, but this time last year the S&P 500 was sitting at the bottom of a 9% pullback. At the low of that drawdown, November 15, the S&P 500 hit a closing low of 1353. Exactly one year later, the S&P 500 closed up 32% from that date last Friday.

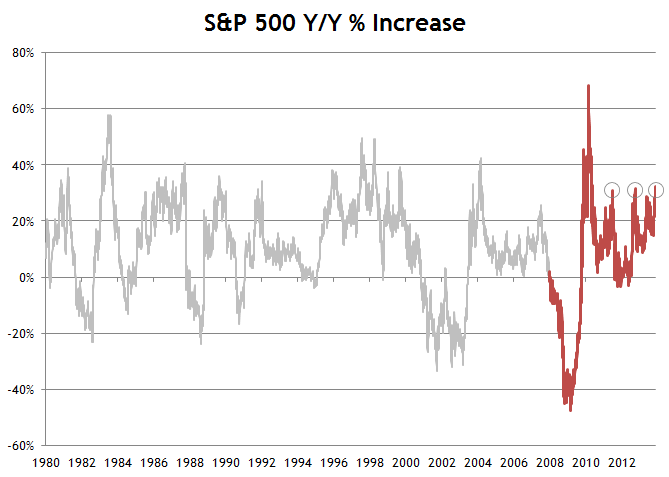

The pace of that 12 month increase has been matched two other times during this bull market. In both October 2012 and July 2011 the index was up more than 30% since the previous year. Each of those dates were followed by drawdowns over the next couple of months. In 2010 the 12 month trailing gain exceeded the current pace by a large margin. After bottoming in March 2009, the S&P 500 was up more than 60% over the next 12 months.

The chart below includes data going back to 1980 for historical perspective. There are plenty of other times that the index was up more than this in a 12 month period, but eyeballing the data, the 12 month increase generally tops out between 20-40%. Given the arithmetic, larger gains tend to come about in a bear market recovery.

The pace of increase is likely to slow from here since there haven’t been many drawdowns to speak of in 2013. The only pullback of any significance this year took place in June. If the index is up 30% from that point in June 2014, it would break the 2000 level.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.