"The price has nothing to do with a shortage of oil. There's a lot of oil on the market. It's because of speculation and OPEC cannot control speculation." Quote by OPEC Secretary General Badri.

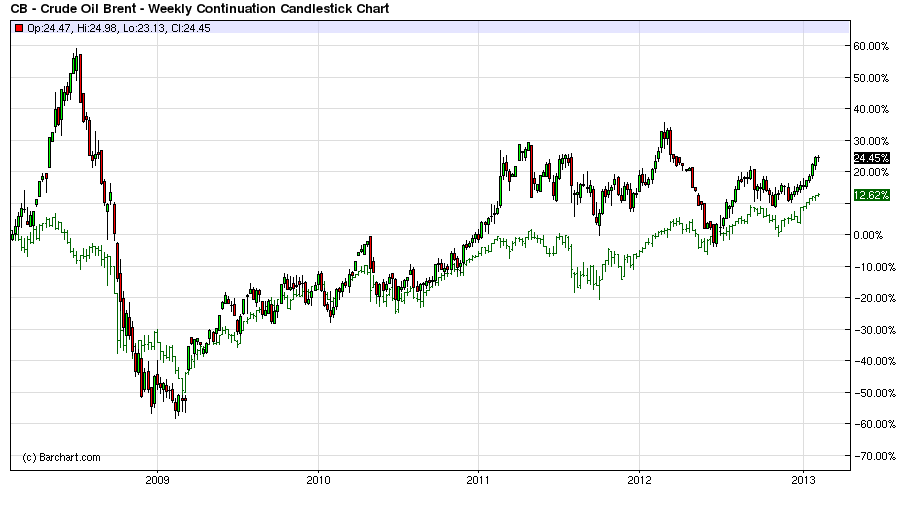

Some people are audible learners, some learn based on touch, some by interaction, for the visual leaners out there I provide the following work of art, which I call the “Risk-On Correlated Asset Motif” from the Dark Period by Jerauld de Speculator.

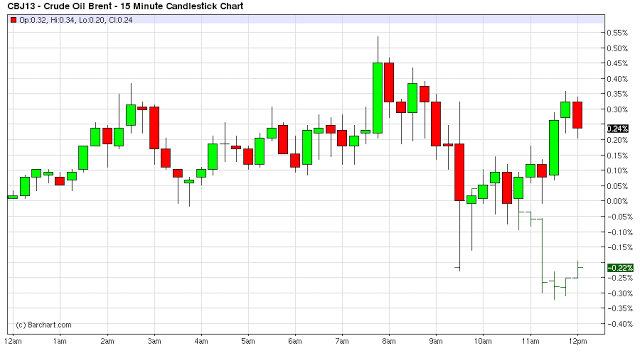

1 – Day S&P 500 & Brent Oil Comparison

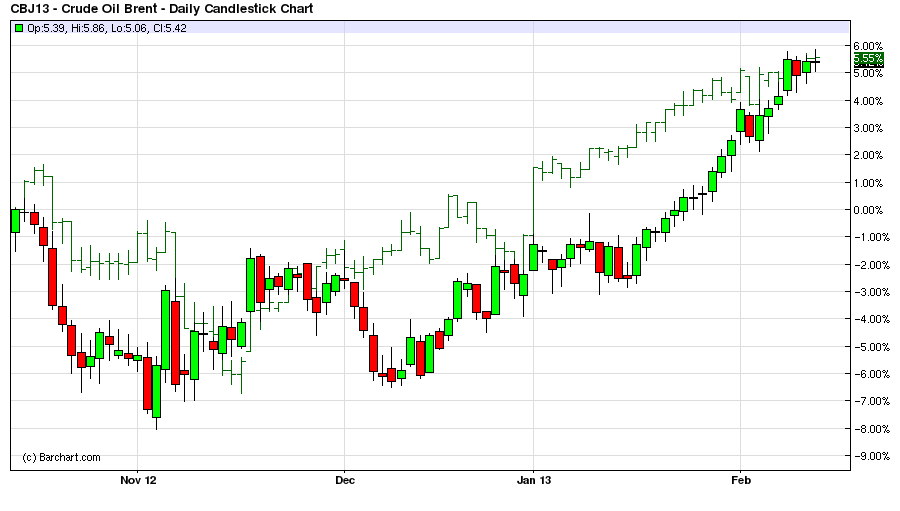

4 – Month S&P 500 & Brent Oil Comparison

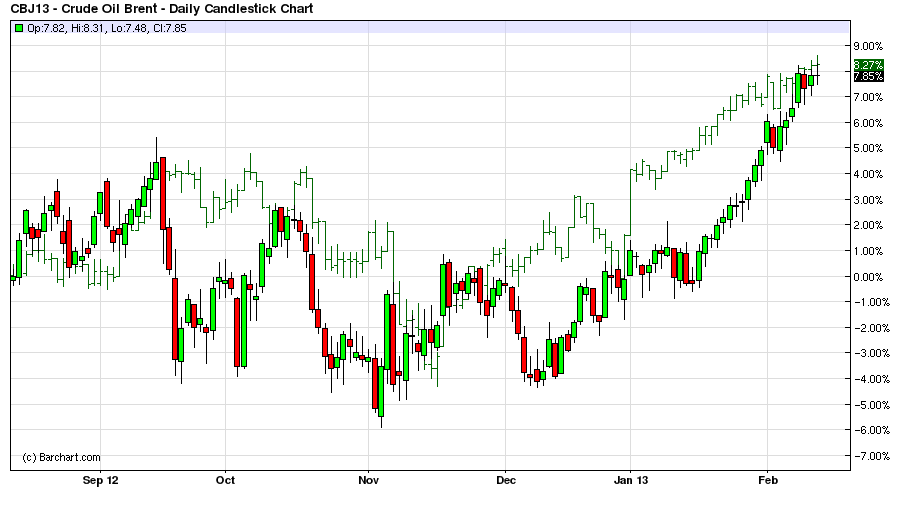

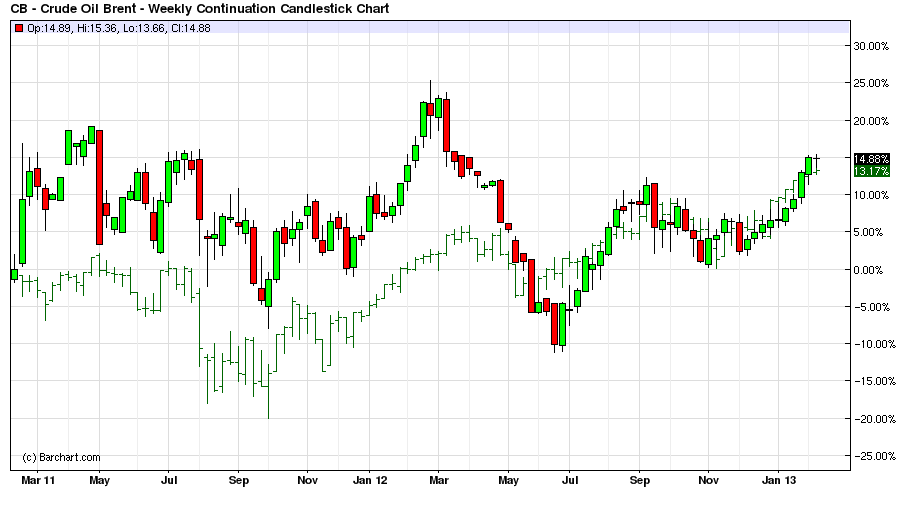

6 – Month S&P 500 & Brent Oil Comparison

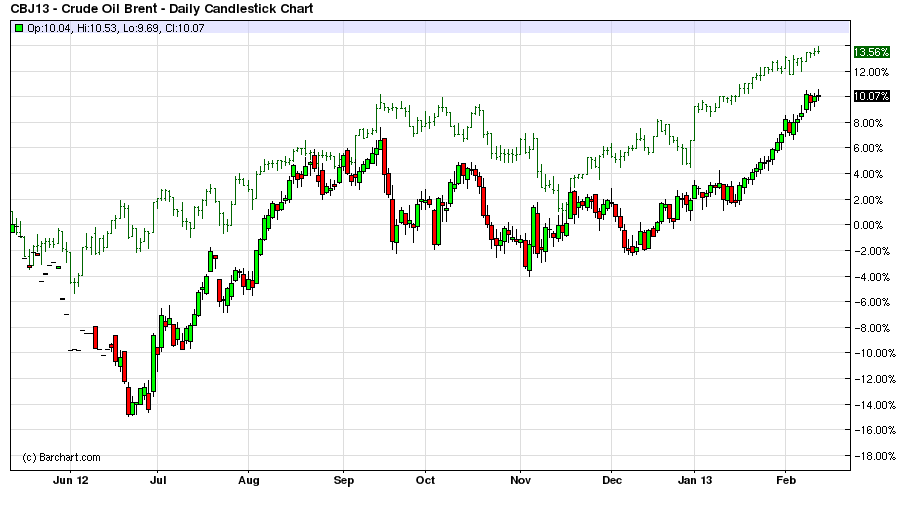

9 – Month S&P 500 & Brent Oil Comparison

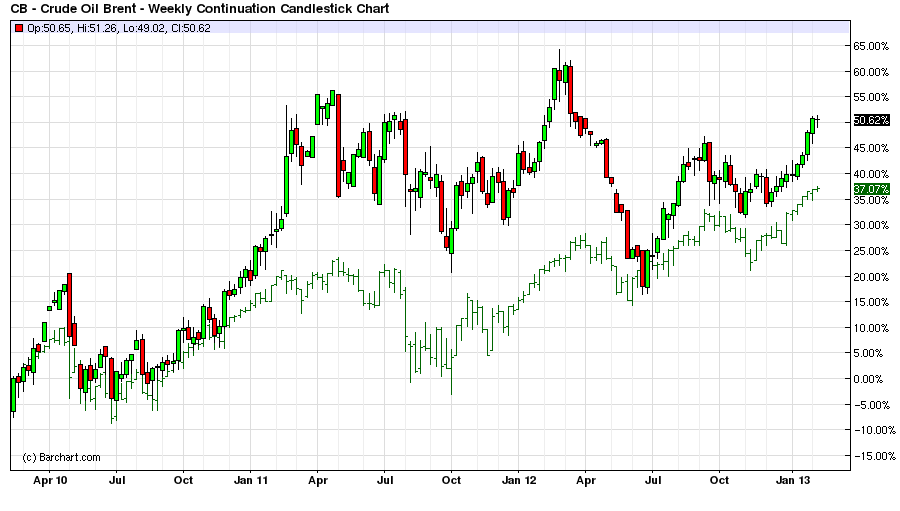

2 – Year S&P 500 & Brent Oil Comparison

3 – Year S&P 500 & Brent Oil Comparison

5 – Year S&P 500 & Brent Oil Comparison

Correlated Global Markets require one thing - A whole lot of juice!

The first thing you have to realize about markets is that they are crooked. If you believe the price of oil has anything to do with the stuff that comes out of the ground, then I have some nice beachfront property in Louisiana for you.

It is all about the juice, whether it is 401k money coming in the beginning of each month, Central Bank injections, share buybacks, increasing leverage ratios, or currency funding the initial money has to be there in what I call the juice for markets, and I mean all markets.

This is why before and during almost any major up move in markets traders go to the EUR/USD and USD/JPY funding crosses for the juice to propel the move. It all starts with the juice, that is what determines price in markets.

This is why the S&P 500 has stalled for a couple days; traders are waiting for the next juice injection into markets. There would have to be some ‘crazy good’ news for firms to extend their leverage ratios at this point, so they wait for the next big fed injection, major currency move, or 401k money for their next major move up in markets.

Finally, those traders who think they are trading oil, you are actually trading the S&P 500, for all intents and purposes, it is the very same liquidity fueled market.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The S&P 500 And Brent Oil Are Basically The Same Market

Published 02/17/2013, 12:36 AM

Updated 07/09/2023, 06:31 AM

The S&P 500 And Brent Oil Are Basically The Same Market

Portraits from the Dark Period

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.