Summary- Russian retail sales accelerated to 3.1% in September.

- Bank of Russia rate cutting is finally having an effect.

- The bull market in Russian stocks is just getting started.

Watching the recovery in Russia over the past year has been frustrating. I have been critical of the Bank of Russia’s slow response to it. And while the BoR has finally relented and began lowering interest rates, it is still way behind the curve given the historic lows in inflation the economy is experiencing.

Russia’s CPI is rising at an annualized rate of just 3.0% while the benchmark lending rate is still 8.50%. This very high level of real interest rates has kept a lid on credit expansion and kept the Russian yield curve inverted (and bifurcated) for far longer than it needed to be, in my view.

Retail Joins The Party

Friday’s release of the latest retail sales numbers, however, finally tell a tale of an economy beginning to take full flight. Sales rose 3.1% year over year in September. This mirrors the big rise in GDP growth in Q3 from 0.5% in Q2 to 2.5%.

But more importantly, it shows that the recovery has moved from the productive part of the economy to the consumptive. And, more importantly, it made that move in the right order. Construction and Manufacturing growth led this new expansion, beginning in 2015.

But, you can see that the insanely high interest rates earlier this year were stifling new construction growth. Look at the Q1 and Q2 numbers in the chart above. The Russian economy is highly cyclic, so year-over-year comparisons quarter to quarter tell the real story.

In March, the Bank of Russia finally relented and began tentatively lowering the benchmark lending rate. And as such, we are beginning to see the effects of pulling it down from 10% to the current level of 8.5%.

BoR President Elvira Nabullina still has plenty of room to cut, given 5.5% real interest rates and unemployment bouncing around near 5.0%. I expect she will continue here lowering by 50 basis points at the next meeting and possibly another 50 in Q1. That would bring the rate down to 7.50% while still maintaining strong positive real yields.

Now, we’re beginning to see the next leg of the advance and consumer-oriented stocks should begin to do well. Retail sales are rising right alongside real wage growth. These trends should continue as the BoR cuts rates further.

I do expect Nabullina to keep real interest rates positive for as long as possible and don’t foresee her bringing the benchmark rate down below 7% in 2018. Inflation may pick up as demand does.

Where To Put Your Money

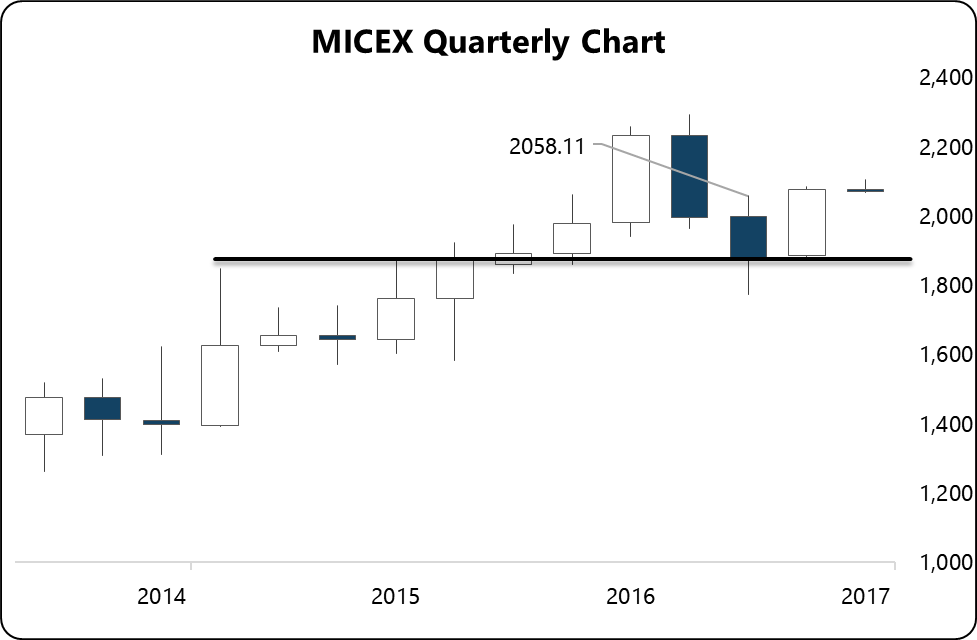

The response from the Russian stock market has been predictable. After a speculative push up above 2200 in January, the MICEX corrected over the first half of 2017 to re-test the long-term breakout level around 1865.

The strong performance in Q3 created back-to-back reversal signals on the quarterly chart. This puts the Russian equity market in the prime position to make new highs in 2018. We’ve had the breakout, the re-test confirming support, now it’s simply a matter of moving to new highs. And with the Russian economy now showing broad growth across both the investment and the consumer sectors, this rally should not only continue in 2018, but beyond that.

I’m already on record as being long the state gas giant Gazprom (MCX:GAZP). I feel Gazprom is one of the most unique opportunities in equity markets today. With the recent major geopolitical wins by Russia with regards to both Saudi Arabia and Syria, which I’ve detailed in posts on my blog here and here, Gazprom is set to further solidify not only its hold over European gas market but begin the expansion from central Russia south towards India as part of China’s Belt and Road Initiative.

The bigger question for investors is how to diversify. There are plenty of good Russian companies that will do well in the new economy. Yandex NV (NASDAQ:YNDX) is one of them. The company is steadily pushing Google (NASDAQ:GOOGL) in every area from search to advertising. But, it’s also trading at valuations that reflect that potential.

I’m more interested in the groundswell that will occur in 2018. Gazprom has been a laggard and it has weighed on the MICEX and the VanEck Vectors Russia (NYSE:RSX) heavily as the market over-discounts the political risk, Russian large caps have performed well and so, right now, Russian small caps should have higher leverage to this economic expansion than large caps as interest rates fall and their cost of capital with it.

The VanEck Vectors Russia Small-Cap (NYSE:RSXJ), for diversification and growth reasons, is the better call than RSX. Having nearly no exposure to the Russian energy sector (just 2.3% of AUM), RSXJ is the perfect complement to Gazprom and other individual Russian large caps that have listed ADRs.

Moreover, after a six-month consolidation between $37 and $42, RSXJ has broken into a new trading range above $43, a solid signal that the rally that began in 2016 is entering its next leg.

You won’t be buying RSXJ for its lagging yield but rather for its future growth. For yield, you have Gazprom’s 6.5%.

With improving economic data, the central bank opening up the market to domestic credit and political risks fading, Russian stocks are one of the better opportunities for long-term investors to add to their holdings.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.