The Russell 2000 has been the market's work horse since the election. I have seen many narratives about why this is so. Most take a stance on Donald Trump’s tax policy or trade policy or desire to promote jobs in the US. There is probably something to that. But if you know exactly what those policies are or that they will be passed in short order without any changes, you are a smarter person than I.

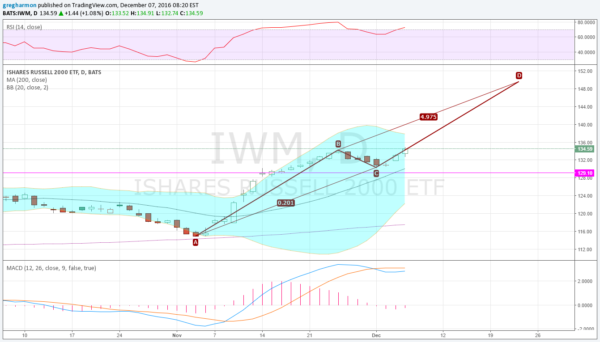

Watching price action is all that it takes. I do not need tax code proposals or incentives to determine where the Russell 2000 is going. So for me, the reason the Russell 2000 is going higher is easy. It's all about the ABCD pattern. The chart below explains.

The AB=CD pattern is a simple one with some interesting information. The initial leg from A to B is measured in both price change and time, and then after looking at the pullback to C, the measures for leg AB are added to C for the CD leg. This gives a price and time target. For the Russell 2000 ETF (NYSE:IWM), the target is 149.60 on December 22.