Seems like many politicos and main stream economists believe the solution (or at least part of the solution) for too many low incomes is to mandate a higher minimum wage. Let me say to start I believe the minimum wage is too low for a primary wage earner.

Follow up:

From the Huffington Post:

The weekly take-home pay for a 40-hour-a-week minimum-wage employee, after Social Security and Medicare taxes. That adds up to $13,926.38 per year, or just over $1,150 per month.

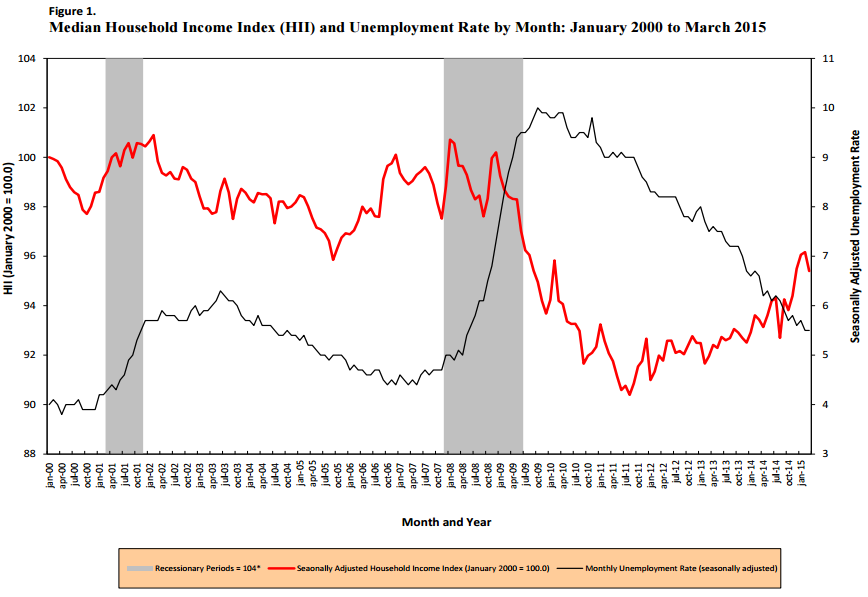

The average Joe is working for less compensation (red line on graph below) then average Joe did in the previous century.

Unless you live with others and ride a bike (instead of owning a car which is impractical for most Americans) - few families can survive on $1,150 each month. Further, it suppresses spending per capita, lowering GDP. Low wages are NOT market friendly. Generally one would think that an economy running on all cylinders would raise wages, but there are other forces at work.

- Many point to free trade agreements being the problem - which allows import of goods made by lower wage workers. In the past, it was likely this was true (there is no proof that trade agreements are good for employment). I doubt in 2015 it is a negative dynamic as the loss of jobs caused by lower wage imports was transitioned years ago.

- The governing dynamic is that the natural worth of labor is now $1 per hour. This is because the average cost of a robot works out to $1 per hour over its operating life. However, the movement to robotics will be slow for a variety of factors (e.g. public acceptance of directly dealing with a robot, working a robot into the operating structure and validating its worth). When labor costs rise, the urgency to use people-replacing robotics increases. Many companies are in the later stages of beta testing - McDonald's (NYSE:MCD) is rolling out its first robotic restaurant.

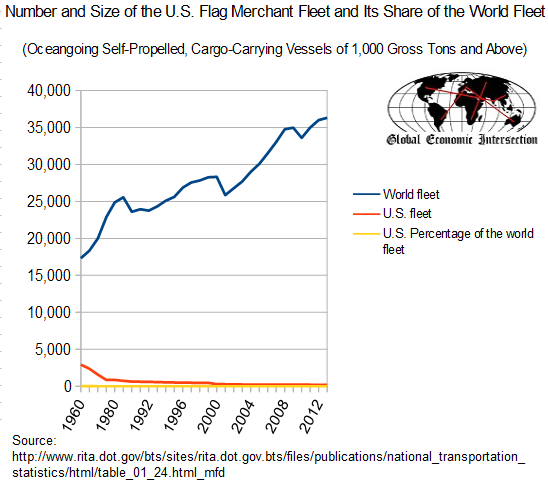

When thinking of mandating minimum wage, consider the effect of the Jones Act on shipping. The purpose of the Jones Act was to protect the Merchant Marine ships and maritime jobs by mandating certain requirements for USA flag ships. It did not save USA flag ships or jobs - it did the opposite. The Jones Act made USA shipping non-competitive. Consumers generally purchase the cheapest item of acceptable quality - and ignore who is providing the product.

It is problematic to regulate economic elements that ultimately are driven by market forces (exceptions are for short periods to smooth out transitory factors). Low wages are a problem. The solution of mandating higher wages only reduces the number of jobs in the long term when market forces can provide remedies for reducing or eliminating the costs of higher wages through elimination of jobs. The problem is distribution of income in a world that has fewer and fewer jobs. Setting a higher minimum wage for a smaller working population has the best of intentions - but the road to hell is paved with good intentions.

Other Economic News this Week:

The Econintersect Economic Index for June 2015 continues to weaken. Most tracked sectors of the economy are relatively soft with most expanding well below rates seen since the end of the Great Recession. When data is this weak, it is not inconceivable that a different methodology could say the data is recessionary. The significant softening of our forecast this month was triggered by marginal declines in many data sets which are dancing closer and closer to zero growth. Please note that most 6 month outlook forecasts are for a marginally improving economy.

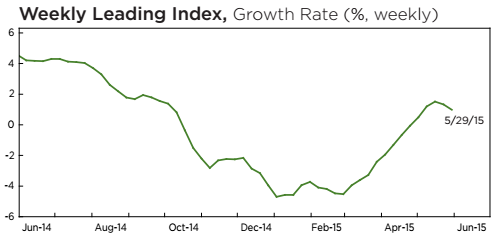

The ECRI WLI growth index is now in positive territory but still indicates the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

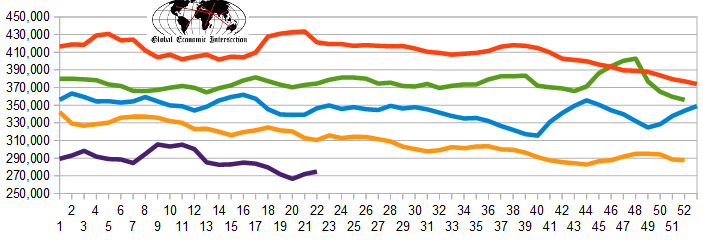

The market was expecting the weekly initial unemployment claims at 270,000 to 300,000 (consensus 276,000) vs the 276,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 272,000 (reported last week as 271,500) to 274,750. The rolling averages have been equal to or under 300,000 for most of the last 7 months.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Cayman Islands-based Saad Investments Company

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: