USD/JPY slides

The various twists and turns in risk appetite over the past 24 hours have left many licking their collective position wounds. US indices have extended yesterday’s firm close with gains of between 0.06% and 0.11%. After falling as much as 0.9% early yesterday, USD/JPY closed 0.7% higher at 106.13 yesterday. The pair has given back a small bit of that advance in slow trading this morning and is currently at 105.70.

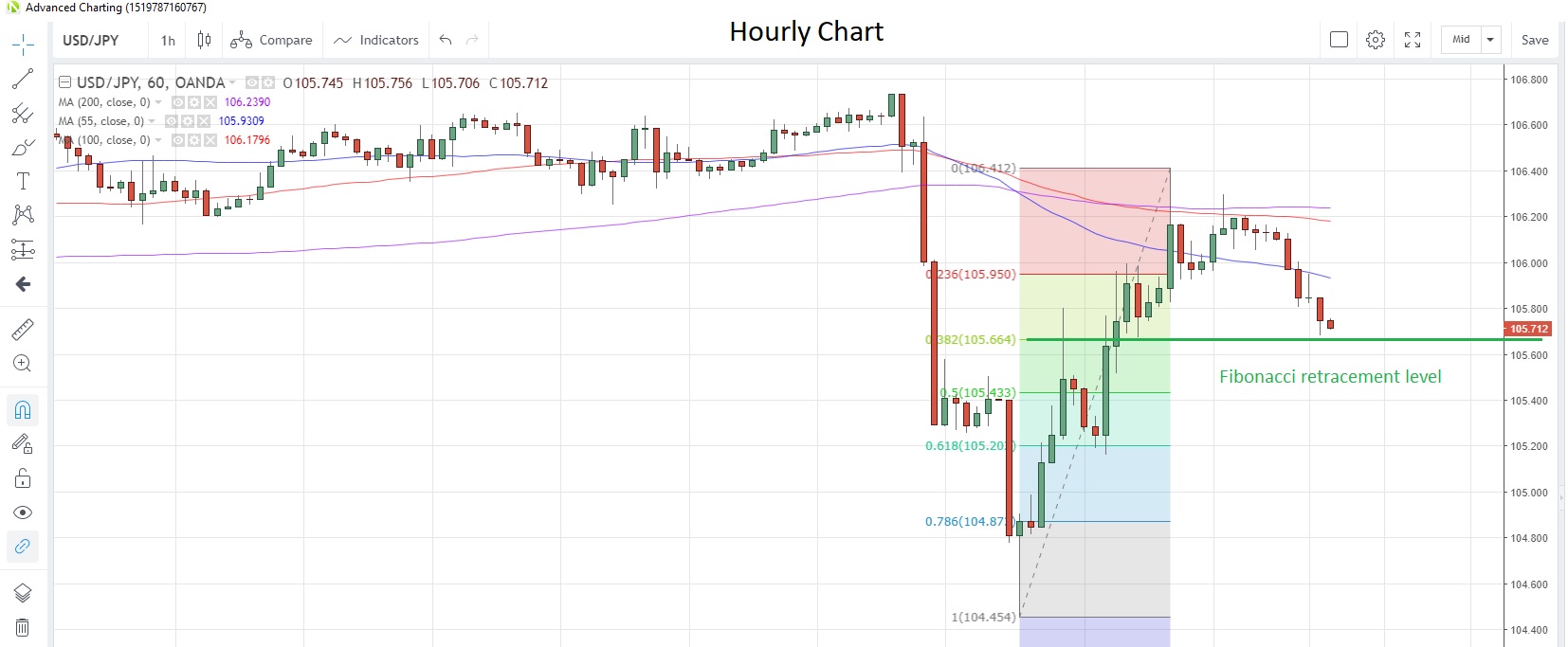

USD/JPY is nearing the 38.2% Fibonacci retracement of yesterday’s range, which is at 105.66 and is currently being capped by the 100- and 200-hour moving averages at 106.18 and 106.23, respectively.

USD/JPY Hourly Chart

USD/CNH Holding near yesterday’s high

After a relatively stable fixing yesterday, the Peoples Bank of China set today’s mid-rate 0.34% higher at 7.0810 yuan per US dollar. That was the highest fix since March 2008 but was still lower than analysts had been forecasting. USD/CNH is now trading at 7.1694 after hitting an intra-day high of 7.1839 yesterday.

German GDP on tap

The first estimate of German growth in the second quarter came in at -0.1% q/q, the first negative print in three quarters, and analysts are not expecting the number to be revised either up or down. Speeches from Bank of England’s Tenreyro and the European Central Bank’s De Guindos complete the European session.

The data slate for the US session contains mostly second-tier data, with S&P/Case-Shiller home prices for June expected to show a 2.4% gain from a year earlier. US consumer confidence is also due along with the Richmond Fed manufacturing index, which is expected to improve to -4 in August from -12.