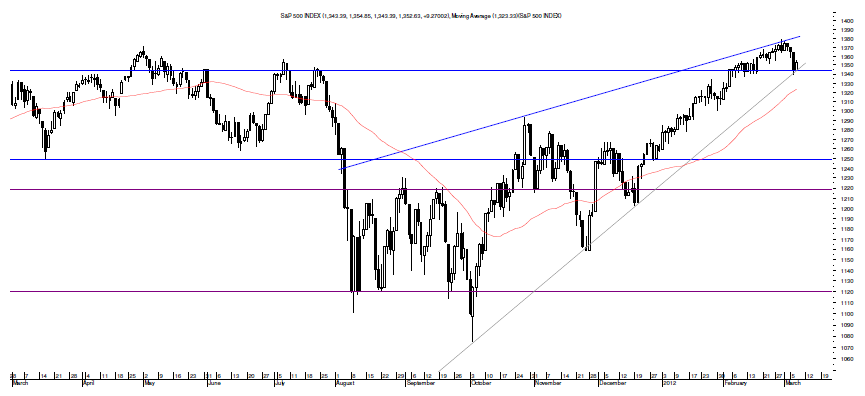

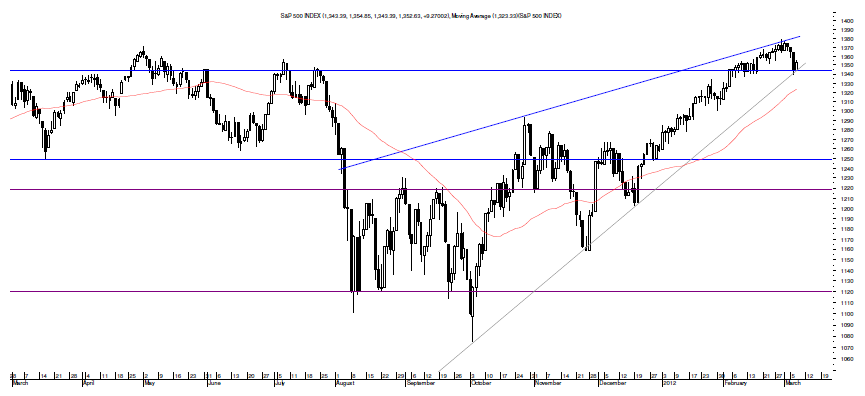

After weeks, months really, of talking about the bearish Rising Wedge pattern that has been stalking the risk rally for that long, it is coming out of hiding to try to confirm in the S&P, Dow and Russell 2000.

As can be seen in the chart of the S&P above, any close in the index’s sideways trend will begin to confirm that pattern while a move below 1300 would probably do so safely and a level between the S&P’s 50 and 200 DMAs with a bearish cross of both seeming quite possible right now and good reason to pay attention to that pattern’s target of 1075.

Turning to the Dow without a lift from AAPL, its bearish Rising Wedge is already beginning to confirm for its target of 10400.

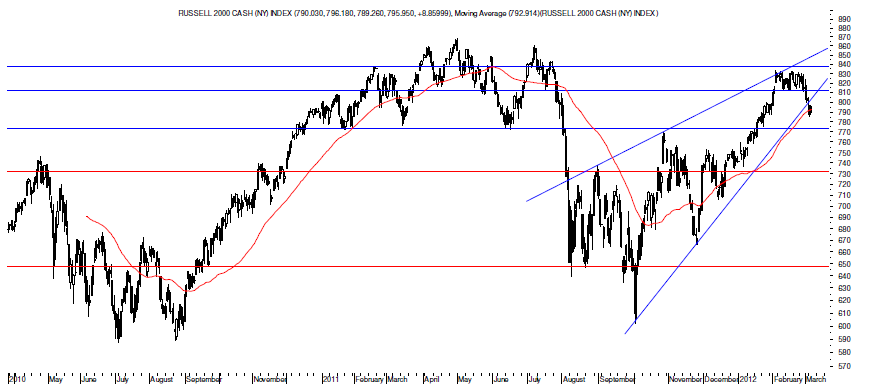

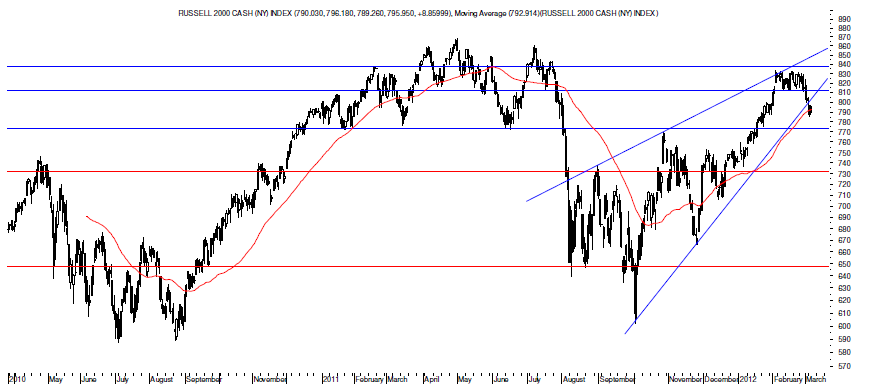

Lastly, let’s look at the Russell 2000 considering that this small cap index appears to have chosen its bearish Rising Wedge over its bullish Inverse Head and Shoulders pattern at this point.

Lastly, let’s look at the Russell 2000 considering that this small cap index appears to have chosen its bearish Rising Wedge over its bullish Inverse Head and Shoulders pattern at this point.

Maybe the Russell 2000 uses its little appendage pattern to bounce just above 800, but this potential bounce is unlikely to take the Russell 2000 above 810 and more likely to take this small cap index below its 200 DMA on a Rounding Top with a target of about 750 while its Rising Wedge carries a target of 602.

It is for this sort of possible drop, then, that it makes sense to point out that the Rising Wedge is back.

As can be seen in the chart of the S&P above, any close in the index’s sideways trend will begin to confirm that pattern while a move below 1300 would probably do so safely and a level between the S&P’s 50 and 200 DMAs with a bearish cross of both seeming quite possible right now and good reason to pay attention to that pattern’s target of 1075.

Turning to the Dow without a lift from AAPL, its bearish Rising Wedge is already beginning to confirm for its target of 10400.

Lastly, let’s look at the Russell 2000 considering that this small cap index appears to have chosen its bearish Rising Wedge over its bullish Inverse Head and Shoulders pattern at this point.

Lastly, let’s look at the Russell 2000 considering that this small cap index appears to have chosen its bearish Rising Wedge over its bullish Inverse Head and Shoulders pattern at this point.

Maybe the Russell 2000 uses its little appendage pattern to bounce just above 800, but this potential bounce is unlikely to take the Russell 2000 above 810 and more likely to take this small cap index below its 200 DMA on a Rounding Top with a target of about 750 while its Rising Wedge carries a target of 602.

It is for this sort of possible drop, then, that it makes sense to point out that the Rising Wedge is back.