Based on the market data, The Bank of England has satisfied expectations and didn’t change the interest rate at the level 0.5%, and also held volumes of the asset’s purchase program in the amount of 375 billion dollars.

From protocols of Monetary Policy Committee it has transpired that whole voting on the interest rate the decision was made unanimously. Also all members of MPC were aligned to leave targets unchanged.

Members of the regulator expressed confidence in existence of reductive processes in the British economy, but they announced anxieties, that will cause a further rise of the pound.

According to the opinion of the Bank of England, the driving forces in recovery of economy are consumption and stockpiling. Also the necessary term is growth of investment. Along with this there some signs of the growth consumption slowing. Also “wondering” of MPC members is set by the lack of productivity growth.

Regarding to the forecasts of the Bank of England GDP growth in the fourth quarter will be 0.9%, to the beginning of 2014 inflation can reduce to the target value.

The Pound through the eyes of traders.

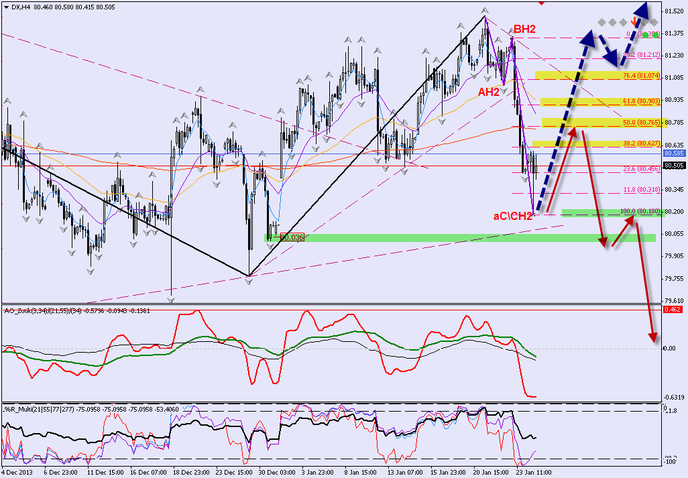

The analysts of the Binary Options Broker Optionova agree that the wave (C)/C level H2 from the reference point 81.350 is over. The actual correction crosstab of this wave (C)/C on Forex market is with borders 81.350 and 80.180. The new reference point on Forex Market can be named level 80.180. Up from this reference point is formed the wave A/B with borders, going through levels 80.180 and 80.580.

By movement down aren’t broken the slopping channel (SC) with figures 79.020/79.650 and pivot 80.036, for which it is possible to form the wave (C).

For movement up it is necessary to form a fractal-zigzag reactance turn (FZT).

Goals up are the next levels:

80.627=38%;

80.765=50% till the level is possible to form the 4th wave;

80.903=62%;

81.074=76% + SC with figures 81.485 and 81.350.

To continue the movement down, it is necessary to form a “dog” of Elder of the new wave (C) down with the breakdown of pivot 80.036 and the next forming of the latent FZT.