The machines are rising up...

To new levels of industrial productivity.

Robotic factories are revitalizing American industry. But for many workers - and vocal politicians - this isn’t the rebirth they hoped for.

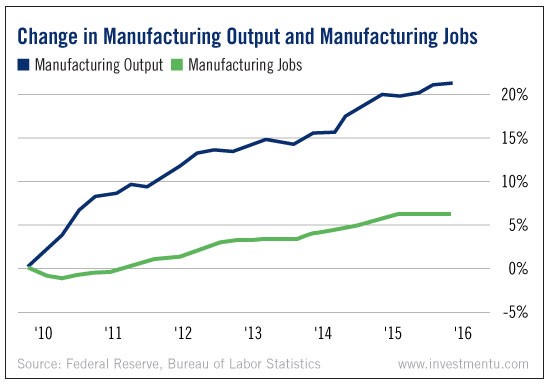

Recent advances in automation have hiked up productivity... but they haven’t done much to bring back blue-collar factory jobs.

As far as what this means for investors...

The rise of robotic factories is cause for bullishness in some markets - and bearishness in others. Below, we’ll examine some of the winners and losers of automation.

The Companies Behind the Machines

It should come as no surprise that factory robot makers have been doing well as of late. Recent technological breakthroughs have helped spawn a new generation of multitasking robots. They’re boosting efficiency while reducing overhead costs. And heavy industry is shelling out for them like crazy.

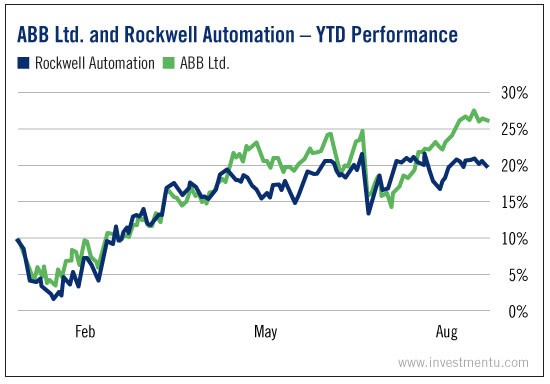

Two companies profiting majorly from this demand are ABB Ltd (NYSE:ABB) and Rockwell Automation (NYSE:ROK).

ABB is a Swiss-Swedish industrial firm with a large presence in the United States. The company is a market leader in robotic multitaskers. It’s also well-diversified within the high-tech space. Other ABB divisions provide wireless network support and power generation services.

Rockwell is the world’s largest industrial automation company. Recently, it has been making waves with its foray into Internet of Things-connected equipment.

These two firms have pioneered the development of robotic factories. It’s no wonder they’re both up by more than 15% this year.

A Bad Time to Sell Workman's Comp

The recent productivity boom from robotic factories has been harder on insurers. Worker’s compensation is (or at least was) one of the most important products they sold.

The problem is... robots don’t need it.

According to a report by Fitch Ratings, insurance companies have sustained yearly losses for most of the 2010s as a result.

That’s bad news for insurers who rely heavily on workman’s comp revenue. Two of the biggest sellers are American International Group Inc (NYSE:AIG) and The Hartford Financial Services Group (NYSE:HIG). Both stocks have had negative returns this year.

Long term, the impact of robotic factories and automation will be so far-reaching that it’s impossible to summarize in just one piece. We’ll be following up on this trend as new aspects emerge.