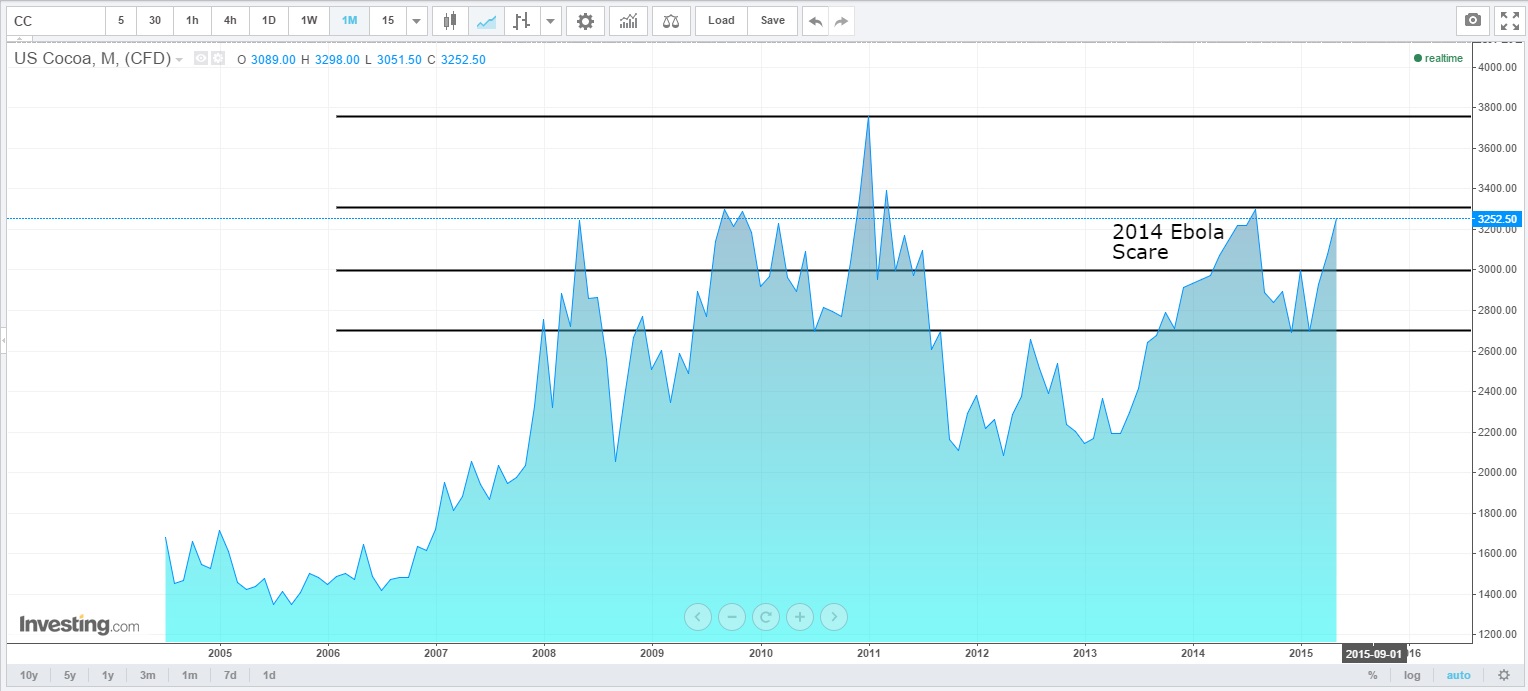

At the end of March 2015, there was a change of trend on American cocoa prices. The price than stood at 2700 $/ton after dropping sharply down from almost 3000 per ton. While some people didn't follow through on 'BUY' recommendations, others entered in on what was one of the best commodities opportunities during the first half of 2015.

Ever since the cocoa price crossed the 3200 line, there is a big question mark regarding where cocoa is heading. I'll start with a quick summery for traders who are not usually focusing on agricultural commodities and will remind them that with investment such as cocoa it's important to remember that the purpose of investing is showing an over-time uptrend on the investment. This is because there's a likelihood of finding other opportunities related to the initial investment.

The main factors effecting cocoa prices are the world consumption of cocoa based products such as chocolate; The planting of cocoa which only bears fruit after two years and of course, plant diseases that are effecting the crops.

Examining each one of the factors by itself we will find a nice strategy to "attack" the market with a profitable trade for the next cocoa contracts.

Following a recent study, published in the Heart medical journal which indicated that chocolate consumption could be related to lower risk of cardiovascular disease and strokes, one can expect the worldwide consumption of chocolate to increase. According to the study the heart health advantages are coming from the polyphenols contained in the cocoa beans used to manufacture the chocolate.

In additional to the chocolate consumption which plays an extensive role within the cocoa industry's current situation, weather conditions, tree diseases, and farming methods are all major price factors as well.

In Ghana for example, the dry weather and the late application of pesticides and fungicides to protect cocoa trees have caused the crop to shrink dramatically, suggesting an option that growers won't be able to meet the requirements of their contracts. Even so, Ghana’s cocoa farms are positive about bouncing back in the next season.

This erratic output identifies a major vulnerability in the cocoa-futures markets; over-reliance on Ivory Coast and Ghana, two countries that are responsible for more than 50% of the world’s cocoa supplies. Last year, when the world’s worst Ebola eruption hit West Africa, cocoa prices climbed to over 3 year highs, feeding fears of trouble in cocoa production. The disease never spread to either the Ivory Coast or Ghana, and prices recoiled nearly 21% within 4 months. The current grief in Ghana pushed cocoa prices back to the high reached during the previous Ebola scare.

While Ghana's production is decreasing, demand remains high. The ICCO (International Cocoa Organization) has lately revised its prediction for consumption to surpass production to 38,000 tons of cocoa beans this year, from a 17,000-ton shortfall in the past. Most traders agree Ghana would probably see a rebound in its cocoa production but some are still worried that the same problem could happen next season again.

Personally I am very confident that fear is much more motivating than hope, leading me to two very strong decisions; the first one is to keep buying Cocoa contracts at least until it reaches 3700 $/ton and the second one is to find comfort with my Hershey's chocolate bar while looking at the market. Soon enough it's going to cost much more than its current price.