Another week, another rally? The market began the current trading week on a high note once again, and it seems as if this bull just can't be stopped. The S&P 500 has moved higher in 13 out of the last 15 weeks, and the current week looks like it will extend that streak. Yet with that index now firmly ensconced above the 1,400 mark, the bull and bear cases are beginning to sharpen.

The bullish case

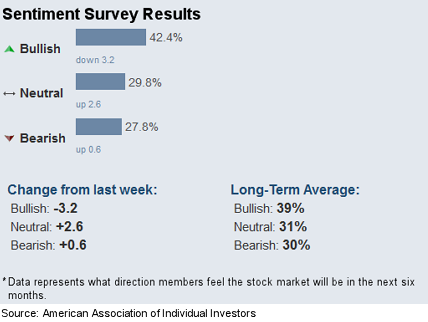

On the bullish side, money is pouring into the market at a fevered clip as formerly bearish hedge funds shift their bias to bullishness. Individual investors are playing their part as well: The weekly sentiment snapshot conducted by the American Association of Individual Investors (AAII) shows bullish investors holding a 13 percentage point lead over bearish investors.

To be sure, stock prices are simply a function of supply and demand, and demand is quite strong right now.

The bearish case

The bearish side also has some merit. Economists express concern that the recent run of positive economic data may have run its course and fear the U.S. economy will cool in coming months. This is precisely the scenario that played out in 2011, as a strong start to the year met with a cooling off period in the spring that led to a market rout in the summer.

Technical analysts also talk of an over-bought market right now, and a number of measures suggest we're due for a pullback.

For now, investor enthusiasm is the overarching theme, though who knows how long that will last? What is known: a certain group of stocks should benefit from a rising market, while also offering much more robust downside protection.

I'm talking about low-beta stocks. Beta measures how a stock moves in relation to the broader market, and those with a beta of less than 1.0 means that they are fairly decoupled from the broader market. [My colleague Tim Begany recently touched on this theme. You can read his take on the best stock to own for a correction here.]

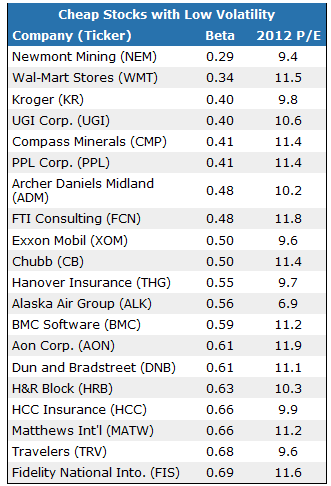

I went searching among stocks in the S&P 500 (large cap stocks) and S&P 400 (mid-cap stocks), and found 38 of them to have a beta below 1.0 and also have a price-to-earnings (P/E) ratio below 12. Even if the economy slows and earnings growth becomes a real challenge, these low-priced stocks won't get penalized for their valuations.

Below is a table of 20 stocks that sport a beta of less than 0.7.

Here's what this list is telling me...

1. Remember Wal-Mart...

A low beta doesn't mean a stock won't budge. Shares of Wal-Mart (NYSE: WMT), which sport a beta of just 0.34, have still managed to rise more than 20% since bottoming out last summer. That's due to slightly better operating trends, especially in the retailer's grocery division.

2. Health care is seemingly safe

A number of drug and medical device companies are in this group. Companies such as Abbott Labs (NYSE: ABT), Watson Pharmaceuticals (NYSE: WPI), Amgen (Nasdaq: AMGN), Gilead Sciences (Nasdaq: GILD) and Baxter International (NYSE: BAX) all have a beta below 0.5, largely due to the fact that they have a high degree of recurring revenue and rarely tend to deliver quarterly results far from the consensus forecasts. They all trade for around 10 times earnings, which is well below the broader market's multiple, which is closer to 15.

3. Steer clear of defense and for-profit education

The list of low-beta stocks also carries a lot of defense sector and for-profit education stocks. Each of these groups faces real headwinds and may see limited (or even negative) sales growth in coming years. In this instance, the low beta tells you that these stocks are likely dead money -- at best.

4. The winners

So what's left? You'll note a handful of insurers on the list, including Chubb (NYSE: CB), Hanover Insurance (NYSE: THG), Aon Corp. (NYSE: AON) and Travelers (NYSE: TRV). These could all prove to have solid upside if the economy gets much better, as pricing becomes less competitive in this business when an economy expands. Their low betas mean these insurers are unlikely to fall much if the economy slips backward, either.

Perhaps my favorite name on this table is Archer Daniels Midland (NYSE: ADM), which may soon come out of a multi-year phase of operational challenges. Many of this agricultural processor's divisions have been caught on the wrong end of the cycle, crushing profit margins in the process. The company's EBITDA margins have fallen 200 basis points in the past six years to just 4.5% in fiscal (June) 2011. Yet analysts at Citigroup think the company "...is in store for sequentially improving profits across the majority of its businesses over the coming quarters, with the exception of ethanol." They see earnings per share rising from $2.60 in fiscal 2012 to $3.25 in fiscal 2013 and $3.50 in fiscal 2014.

Shares of ADM have hovered right around the $30 mark during the past three years, but that earnings strength could finally move the stock up toward the $40 mark.

I also think investors continue to overlook a solid current turnaround that is underway at tax prep firm H&R Block (NYSE: HRB). I am not expecting an overly-robust tax season for the company, but I think the company's long-term strategy should yield solid benefits.

Risks to Consider: A low beta wouldn't necessarily keep these stocks from falling in a down market. If that happens, then you'd likely need to focus on negative beta stocks that move in the opposite direction of the market.

The rising market doesn't mean you should sell your stocks. But replacing high-beta stocks in your portfolio with low-beta stocks should provide a buffer of comfort if the market turns choppy. Any of the stocks I mentioned above are a good place to start looking.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Right Stocks For Today's Market

Published 03/28/2012, 07:09 AM

Updated 07/09/2023, 06:31 AM

The Right Stocks For Today's Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.