In mid-September I wondered if the nascent rebound in value stocks was more than a flash in the pan. A month later, this long-challenged corner of the equity market continues to show encouraging signs that a renaissance is intact, based on analysis of a set of exchange traded funds. It’s still a tentative recovery, but for the moment, at least, it seems that the value factor has a tailwind.

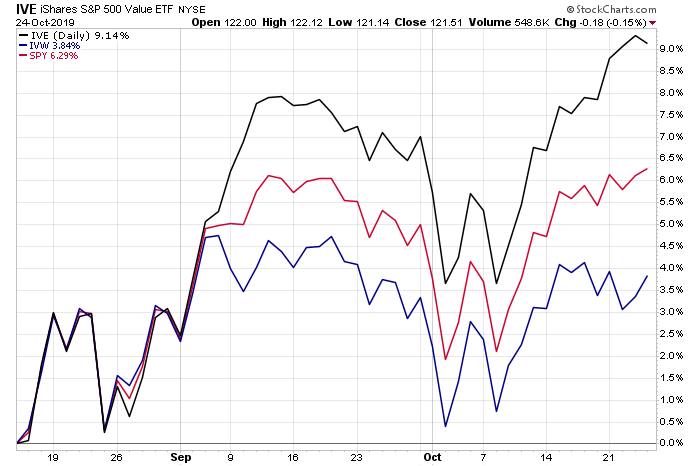

Let’s start by comparing how a set of proxy ETFs stack up. The iShares S&P 500 Value (IVE) – a large-cap value fund – continues to outperform its growth counterpart (IVW) and the broad market (SPY (NYSE:SPY)) by a respectable margin since August 15.

Why use August 15 as a start date? A day or so later Barron’s ran a widely read article that made a case that a revival was in progress for the value factor. Since then, value’s performance edge has widened over growth: IVE is up 9.1% since August 15, more than twice the performance for IVW over that span (through yesterday’s close, Oct. 24). For perspective, US stocks generally are up 6.3% for this period, based on S&P SPDR 500 (SPY (NYSE:SPY)).

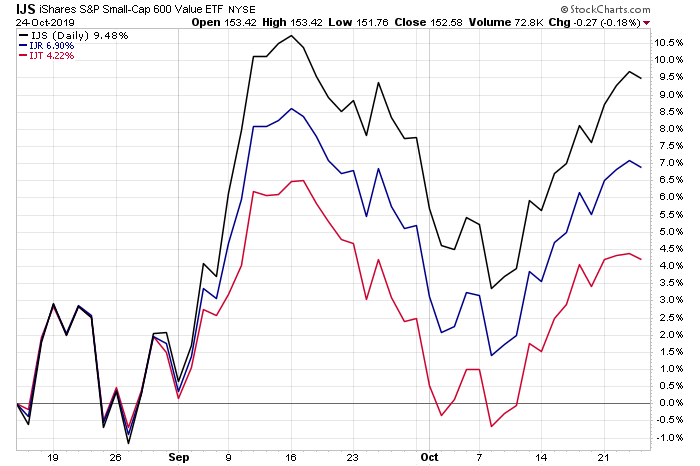

Note that a similar dynamic applies to the small-cap space. Since August 15, iShares S&P Small-Cap 600 Value (IJS) is up 9.5% vs. 4.2% for iShares S&P Small-Cap 600 Growth (IJT) and 6.9% for iShares Core S&P Small-Cap (IJR).

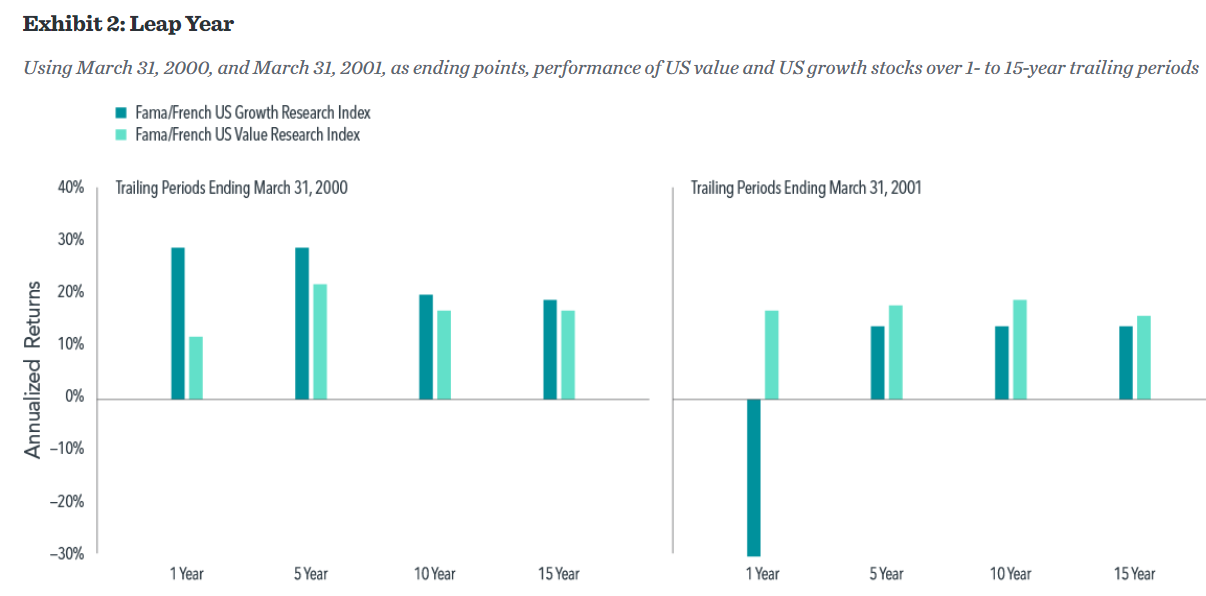

It’s anyone’s guess if value’s recent rally is the start of an extended rebound, but Dimensional Fund Advisors (DFA) notes that “there is precedent for the value premium turning around quickly after periods of sustained underperformance.”

In a recent research note, DFA observes that “some of the weakest periods for value stocks when compared to growth stocks have been followed by some of the strongest,” as illustrated in a chart included the analysis (see below). “On March 31, 2000, growth stocks had outperformed value stocks in the US over the prior year, prior five years, prior 10 years, and prior 15 years. As of March 31, 2001—one year and one market swing later—value stocks had regained the advantage over every one of those periods.”

As for catalysts driving the renewed interest in value, one theory is that heightened concern over slowing economic growth is refocusing the market’s attention on undervalued assets.

“Recession fears seem to have jolted investors into the reality that earnings, dividend payouts, and fair value matters again,” a columnist at Forbes notes.

For the moment, at least, the crowd’s on board with that attitude adjustment.