It does not take a degree in engineering to understand that crude oil can provide energy. The diagram above shows pretty simply how it can work. There is a clearly defined relationship. But the relationship between crude oil and the Energy Sector ETF is a bit more complicated. The chart below shows the recent history.

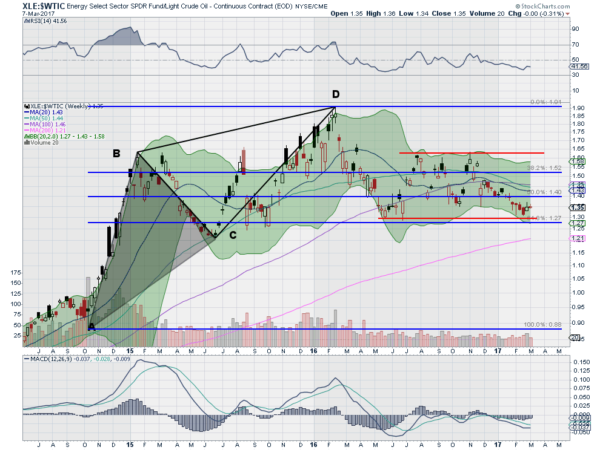

The price of the Energy ETF (NYSE:XLE) against the price of crude oil went through an interesting transition. As oil prices cratered in late 2014 the ratio rose quickly. It retrenched over the first half of 2015 and then rose again to complete an AB=CD pattern at the beginning of 2016. This pattern looks for a reversal to follow and the ratio obliged. It retraced almost 61.8% of the pattern into mid-2016.

But since then it has been stuck in a channel moving sideways. Today it sits at the bottom of the channel with the Bollinger Bands® giving it some room to the down side. That would imply a strengthening of oil prices against the broader energy sector. With oil prices stuck in a rut, also moving side ways for over 3 months, it would seem the easiest path for this to continue would be with the broad sector weakening.

Oil Services are doing just that. Solar and coal not so much. So perhaps another bounce to the top of the range. Perhaps it will be as simple as oil prices breaking their tight range between $51.50 and $54 to move the chart. For now though stagnation.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.